Sabah’s Nature Conservation Agreement: A two million hectare carbon deal involving a fake director, an inequitable agreement, a history of destructive logging, and massive corruption

As well as a series of offshore companies, and a sprinkling of neocolonial racism

On 28 October 2021, the Sabah State Government signed a 100-year Nature Conservation Agreement with a company called Hoch Standard Pte Ltd, based in Singapore. The Agreement sets up a carbon trading deal over an area of more than 2,000,000 hectares for at least 100 years. Communities living in Sabah knew nothing about the deal – until John C. Cannon wrote about the carbon deal for Mongabay.

Cannon interviewed Peter Burgess, who runs Tierra Australia, an Australian company that brokered the agreement. It’s an extraordinary interview that clearly illustrates the neo-colonial and racist views behind this project.

Burgess told Mongabay that community members “actually don’t know that their jungles have been conserved, have been signed up and are going to be conserved for 200 years”.

And Burgess argues that a process of free, prior and informed consent simply wasn’t possible. “If we had to go and sit around every campfire, it would never happen,” Burgess said. “It’s going to uplift these people out of poverty and bring them back into normal society.”

Meanwhile, Sabah’s Deputy Chief Minister, Jeffrey Kitingan, told the Malay Mail that “I can assure you it will not affect the Indigenous people. It is a protected forest anyway, but we want them to benefit directly from carbon trading also; from their kebun [garden], they can produce oxygen.”

There is no mention in the Nature Conservation Agreement about how additionality will be calculated. In any case, as REDD-Monitor has pointed out several times, additionality is impossible to prove, as it’s based on a counterfactual baseline:

Sabah’s two million hectare carbon deal: The Nature Conservation Agreement

The Nature Conservation Agreement has not been made public. However, an anonymous infographic highlights 11 unusual aspects to the agreement (click on the image for a larger version).

Among the problems are the following:

The NCA is governed by the laws of Singapore and Sabah;

It lasts 100 years, more than three times as long as most REDD projects;

The Sabah government (or a future Sabah government) cannot cancel the agreement;

The company can sell the rights covered in the NCA without the consent of the Sabah government;

The companies involved are new, small, and have no established record of running carbon trading projects;

The rights covered by the NCA are extensive and vague, and not limited to carbon;

No process of free, prior and informed consent was carried out with the Indigenous Peoples living in Sabah;

The NCA includes no requiremnet for a performance bond;

The companies are only required to pay the Sabah government within one year;

The companies take 30% of gross revenue from the project;

The NCA requires Sabah to bear the costs of REDD compliance.

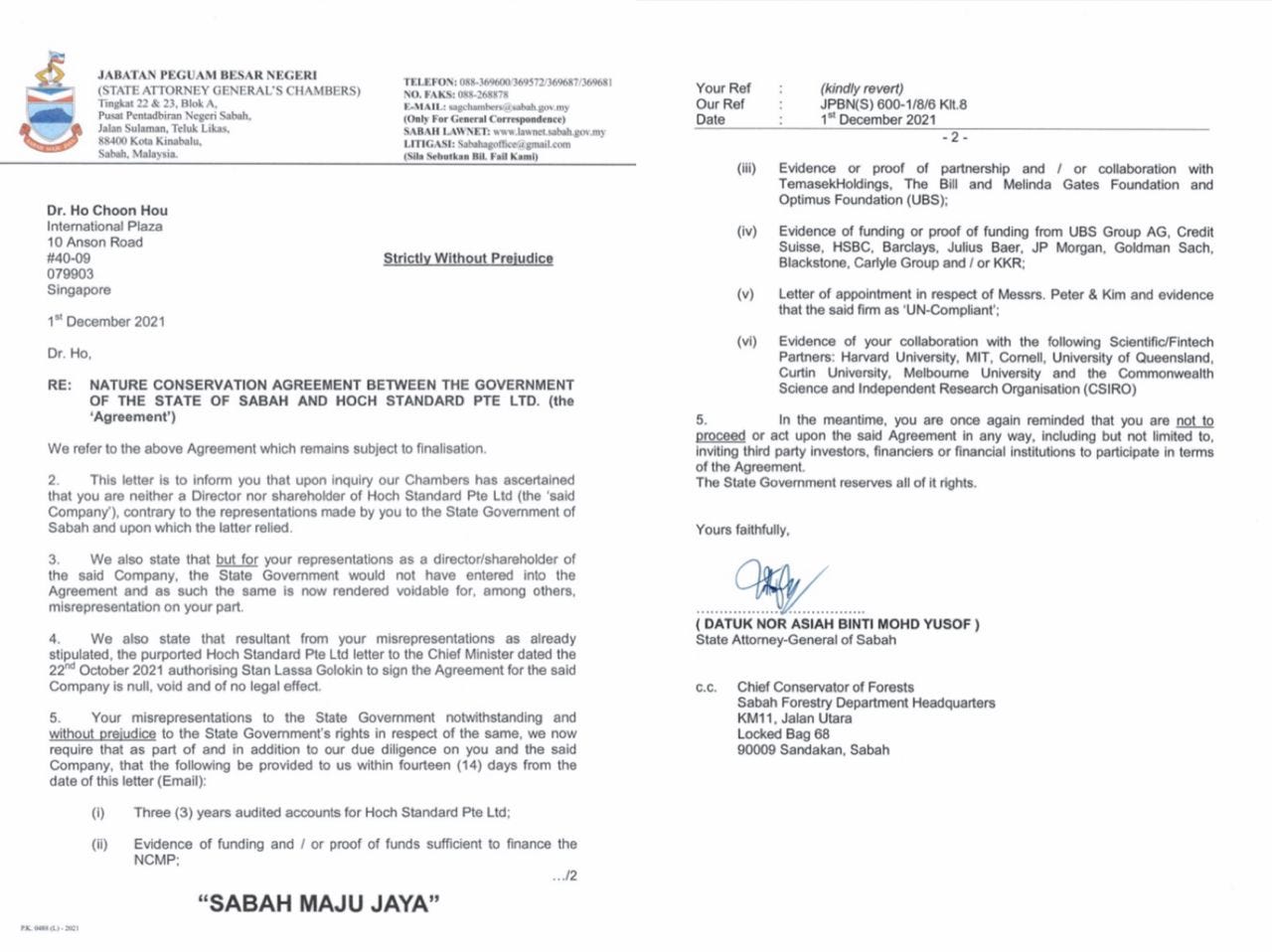

State Attorney-General letter to Hoch Standard

On 1 December 2021, the State Attorney-General of Sabah, Datuk Nor Asiah Yusof wrote to Ho Choon Hou of Hoch Standard Pte Ltd. The letter states that Hou is “neither a Director nor shareholder of Hoch Standard Pte Ltd”.

The Attorney-General has confirmed to REDD-Monitor that the letter is genuine, and the Malaysian newspaper the Daily Express reports she has ordered an investigation into the leak.

The letter states that,

but for your representations as a director/shareholder of the said Company, the State Government would not have entered into the Agreement and as such the same is now rendered voidable for, among others, misrepresentation on your part.

And adds,

We also state that resultant from your misrepresentations as already stipulated, the purported Hoch Standard Pte Ltd letter to the Chief Minister dated the 22nd of October 2021 authorising Stan Lassa Golokin to sign the Agreement for the said Company is null, void and of no legal effect.

The letter gives Hoch Standard two weeks to provide the following information:

Three years audited accounts for Hoch Standard Pte Ltd;

Evidence of funding and / or proof of funds sufficient to finance the Nature Conservation Management Plan;

Evidence or proof of partnership and / or collaboration with Temasek Holdings, The Bill and Melinda Gates Foundation, and Optimus Foundation (UBS);

Evidence of funding or proof of funding from UBS Group AG, Credit Suisse, HSBC, Barclays, Julius Baer, JP Morgan, Goldman Sach, Blackstone, Carlyle Group and / or KKR;

Letter of appointment in respect of Messrs. Peter & Kim and evidence that Hoch Standard is ‘UN-Compliant’; and

Evidence of collaboration with the following Scientific/Fintech Partners: Harvard University, MIT, Cornell, University of Queensland, Curtin University, Melbourne University and the Commonwealth Science and Independent Research Organisation (CSIRO).

Several companies appear to be involved in the Nature Conservation Agreement: Hoch Standard Pte Ltd (Singapore), Tierra Australia, Global Nature Capital Ptd Ltd (Singapore), Global Nature Capital Sdn Bhd (Malaysia), Global Nature Capital (Australia), and Kinabal Coin (Australia).

More information about these companies and their involvement in the Agreement is available in an anonymous document that was uploaded to Reddit as a series of images (by “phoenixed123”).

This post focusses on Hoch Standard because of the key role it appears to play in the Nature Conservation Agreement.

Hoch Standard

Jeffrey Kitingan, Sabah’s Deputy Chief Minister, is one of the key promoters of the Nature Conservation Agreement.

According to Kitingan, “Hoch Standard is a global player, involved in private equity funding all over the world.” He said, “Don’t worry, we have done our due diligence,” and added that “the company is not an issue. We are confident in their background. It is backed by several multi-billion private equity funding institutions.”

The reality is that Hoch Standard was registered in Singapore on 11 September 2019. The company has two officers, and paid up capital of only US$1,000.

A Tierra Australia corporate presentation claims that Dr Ho Choon Hou,

initiated and established, Hoch Standard Pte Ltd, a Singapore incorporated company to undertake global environmental related projects under the framework of the Carbon Impact Exchange (CIX) in Singapore.

He is currently accessing, via Hoch Standard, a portion of the Singapore Governments initiated Global Climate Change Initiative of USD$100bil to undertake and implement CLIMATE CHANGE (CC) global projects and risk mitigation measures

Dr Ho is a managing director of Southern Capital Group. He is Vice-Chairman of Cordlife Group. He is Singapore’s non-resident ambassador to Mexico.

However, neither his LinkedIn nor his Bloomberg profile make any mention of Hoch Standard.

Dr Ho is not mentioned in Singapore’s Accounting and Corporate Regulatory Authority documents about Hoch Standard. Instead, ACRA lists Ng Wie Cheun Benjamin as Hoch Standard’s director. Hoch Standard’s secretary is recorded as Chen Ning.

Shares in Hoch Standard are owned entirely by a company called Lionsgate Ltd, which incorporated in Singapore as an “unregistered foreign entity” on 3 September 2019.

Lionsgate’s address is given as Vistra Corporate Services Centre, Wickhams Cay II Road Town, Tortola VG 1110, British Virgin Islands.

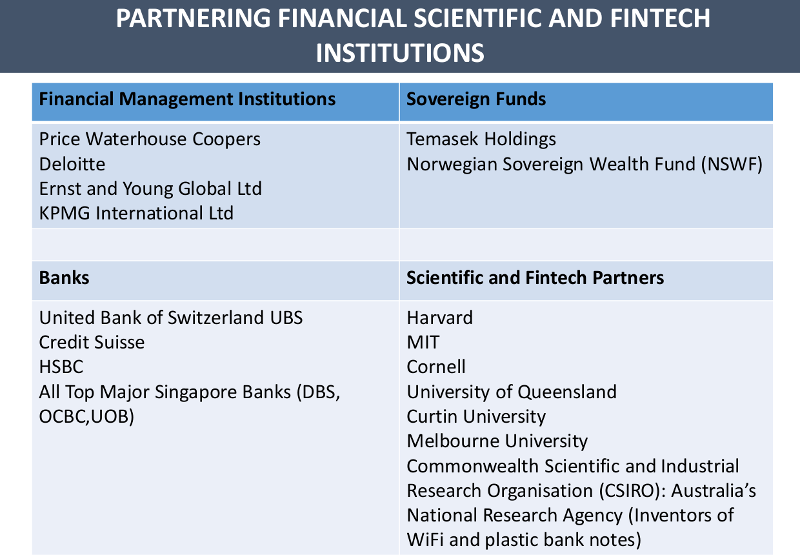

Tierra Australia’s corporate presentation claims links with the following:

Hence the Sabah Attorney-General’s questions to Hoch Standard about evidence of collaboration with these organisations.

Jeffrey Kitingan and Stan Lassa Golokin

Yet another anonymous document explores the connections between Sabah’s Deputy Chief Minister, Jeffrey Kitingan, and Stan Lassa Golokin, who signed the Nature Conservation Agreement for Hoch Standard. Jeffrey Kitingan was witness to the signing of the Nature Conservation Agreement.

Kitingan and Golokin were both involved in the Sabah Foundation (Yayasan Sabah). In 1985, Kitingan was appointed director of the Sabah Foundation. By 1990, Golokin was Group General Manager of Innoprise Corporation Sdn Bhd, a holding company for the Sabah Foundation’s commercial assets.

The Sabah Foundation had a 100 year lease on more than one million hectares of forest, which is was supposed to manage on a “sustained yield basis”.

Instead, the Sabah Foundation oversaw the plundering of Sabah’s forests with the money going to serve “the political and financial interests of state-level politicians and cronies”, as professor of political science William Ascher wrote in his 1999 book, “Why Governments Waste Natural Resources”.

A US researcher, David Brown, carried out his PhD research on the timber industries in Indonesia, Sarawak, and Sabah between 1970 and 1999. His dissertation, “Why Governments Fail to Capture Economic Rent: The Unofficial Appropriation of Rain Forest Rent by Rulers in Insular Southeast Asia Between 1970 and 1999”, documents how US$9.5 billion in timber revenues was “lost” in Sabah over the 20-year period.

Brown writes that,

From the late 1980s to the mid-1990s, Jeffrey Kitingan was repeatedly incarcerated, or held under house arrest, by the national government, and was investigated for 19 counts of corruption related to his position at the head of the Sabah Foundation.

Brown interviewed a friend of Kitingan who estimated that Kitingan’s personal wealth from his nine years as director of the Sabah Foundation amounted to US$1 billion.

In 1994, Price Waterhouse carried out a study at the request of Malaysia’s Prime Minister. Price Waterhouse found that US$1.6 billion in timber rent had disappeared from the Sabah Foundation while Kitingan was director.

Jeffrey Kitingan’s brother, Pairin Kitingan was Chief Minister of Sabah from 1985 to 1994, the same period that Jeffrey Kitingan was director of the Sabah Foundation. Brown concludes that,

Although the Kitingan brothers rode to power under the banner of reform, their nine year administration turned out to be as strongly characterized by the unofficial appropriation of timber rent as their predecessors, if not more so. Not only did they have personal ties to private timber concessions, but perhaps more than the two governments before them, the Kitingans secretly emptied the Sabah Foundation of rent in myriad ways. Jeffrey Kitingan’s collecting bribes from both the existing and the prospective shipping monopolies is an example of the kleptocratic extremes to which the Kitingans went.

Not a great deal of information in publicly available about Stan Lassa Golokin’s career since Innoprise Corporation until he popped up as corporate adviser for Hoch Standard to sign the Nature Conservation Agreement.

However, Golokin appears in the Panama Papers and the Offshore Leaks Database. Golokin is linked with a series of companies registered in the tax haven of the British Virgin Islands:

Westfield Ventures Co. Ltd (registered in the British Virgin Islands in November 2004 – Active);

Orient Investment Management Limited (registered in the British Virgin Islands in January 2009 – Active);

Mabrouk Holdings Limited (registered in the British Virgin Islands in March 2004 – Active);

Flaming Sunset Assets Ltd (registered in the British Virgin Islands in July 2008 – Active);

Neubridge Kapitals Ltd (registered in the British Virgin Islands in September 2006 – Struck / Defunct / Deregistered);

Crosshaven Development Ltd (registered in the British Virgin Islands in July 2002 – Struck / Defunct / Deregistered);

Ferrington Investments Group Inc. (registered in the British Virgin Islands in September 2002 – Struck / Defunct / Deregistered);

Innovation Success Ltd (registered in the British Virgin Islands in October 2003 – Struck / Defunct / Deregistered);

Shine Channel Offshore Group Limited (registered in the British Virgin Islands in May 2005 – Struck / Defunct / Deregistered);

Aspiring Heights Limited (registered in the British Virgin Islands in October 2004 – Struck / Defunct / Deregistered);

Winning Dream Limited (registered in the British Virgin Islands in July 2004 – Struck / Defunct / Deregistered).