Advanced Global Trading: Another boiler room scam? Or a Ponzi scheme? Or both?

Advanced Global Trading sells voluntary carbon credits to members of the public as an investment. The company’s brokers cold call people and attempt to persuade them to invest. “For a minimum investment of $25K you too can invest in Carbon and make a difference,” the company states on its website.

AGT also sends out SMS messages to potential clients, like this one: “Invest in carbon credits and earn up to 30% per annum.” David Armstrong, is a senior broker at AGT. On his LinkedIn page Armstrong explains that his clients, who are “medium/high net worth individuals in the Middle East”, have made “an average of 24% ROI year on year for the last 3 years”.

UPDATE – 21 May 2013: Ian Hainey, AGT’s PR Director responded to this post, here.

Advanced Global Trading was established in 2010. The company’s headquarters is in Dubai. AGT claims to employ 100 people and “is on track to achieve its goal of 14 offices worldwide by the end of 2015”. In addition to selling voluntary carbon credits, the company is the Lotus Formula 1 Team CO₂ neutral partner.

The company’s director is Charles Stephenson. In an interview in September 2011, Stephenson explained why he likes to invest in carbon credits:

“The potential to make money in this commodity is huge and I practise what I preach. It’s a commodity that never goes down and the market is set to double or even quadruple. It’s also an added bonus that I know investing in carbon credits goes some way to help the environment along the way.”

Later in the interview Stephenson said, “I’m currently looking at buying a new Ferrari that I’ve had my eye on for a while.”

Advanced Global Trading has its roots in the UK. In the September 2011 interview, Stephenson said that AGT opened a London office in July 2010. It then expanded to “three offices in the UK, a Dubai office, an office in Zurich and more opening in America”.

Several companies are registered in the UK under the name Advance Global Trading, or variations of it. Advanced Global Trading, was founded July 2010. Its registered office was 33 St James’ Square and its director was Fred Cartwright. The company is now dissolved.

Another company, Advanced Global Trading (UK & Ireland) was established in October 2011 with a registered office in Manchester. The company is now dissolved.

AGT is one of the companies on Gemmax Solutions’ list of companies for which Gemmax provides clearing and settlement services. These services were previously offered by Carbon Neutral Investments (which was previously called AGT Investments Ltd and in April 2013 changed its name yet again, to Opus Capital). Another company, CNI Clearing Ltd was previously called Advanced Global Trading Clearing Ltd. Paul Seakens is director of Opus Capital (previously called Carbon Neutral Investments) and CNI Clearing Ltd. Both companies share the same address.

AGT calls its voluntary carbon credits ETPs, or “Emmissions Trading Permits”. Here‘s how AGT explains what an ETP is:

These certificates are given to organisations around the world that either create projects to clean up the environment – measured by the amount of carbon dioxide (CO2) they reduce in the atmosphere – or clean up their own organisation, reducing their greenhouse gas emissions. For each tonne of carbon dioxide (the major GHG) emission, the entity receives a emission trading permit (ETP), which they can sell either immediately or through a futures market, just like any other commodity.

AGT describes two ETP markets: compliance and verified. In fact, AGT only sells VERs – voluntary carbon credits. Of course, AGT claims that people who have invested in voluntary carbon credits through AGT are delighted with the results:

And investors who have purchased ETPs over the past few years have certainly been smiling about their returns, with a recent report from the World Bank showing the market is up 11 per cent already on 2012. Holders of ETPs last year saw their investment increase in value by 30.2 per cent in 2011, with 2010’s investors making over 22 per cent; and with companies and governments continuing to turn to emissions trading as a tool for fighting climate change, demand continues to outstrip demand.

Demand outstrips demand, eh? OK, that’s probably a typo. But there’s no link to the World Bank report. Or any evidence for the claims that buyers of voluntary carbon credits saw their “investment” increase in value by 30.2% in 2011.

Last year, AGT argued that carbon was a better investment than gold. Franklin Connellan, head of investments at AGT, said,

“Gold as a commodity is very, very similar to carbon as a commodity. They are also both tradable commodities, which is important to know. The only real difference is that gold itself is exchange traded, so it’s affected by economies of the world, natural disasters, wars, for example. The beauty of the carbon market is that it is only driven by supply and demand. OK? And this is why the market has risen 960,000% since its inception in 2005. The World Bank puts that a record level of US$176 billion. And this is why carbon is now known as the new safe haven…. Over the last 12 months, carbon has seen a return of over 22%. Over the last 18 months a phenomenal 41%. We can comfortably predict that the price will increase by a further 15 to 20% by the end of the year.”

What price do AGT’s brokers charge for their voluntary carbon credits? In January 2013, Pete Barnes commented on REDD-monitor that “Advanced Global Trading are charging US$14.97 per credit.” In March 2013, Julius Cobbett, a South African journalist, reported that AGT offered him voluntary carbon credits at US$15.47 per ton.

These prices are pretty high. Ecosystem Marketplace and Bloomberg New Energy Finance reported in their State of the Voluntary Carbon Markets 2012 that the average price for VERs in 2011 was US$6.2/tCO2e, up from US$6/tCO2e in 2010. The range of prices was “from less than $.1/tCO2e to over $100/tCO2e in 2011”. Cobbett points out that AGT doesn’t usually let clients choose the specific projects that their VERs come from (meaning that clients don’t know beforehand whether AGT is selling VERs from large projects in China or India that are worth very little).

But unlike many companies that sell voluntary carbon credits as investments, AGT also offers a way of selling them, via its “Trading Platform”. Using this, AGT’s clients can see AGT’s current price and can buy and sell voluntary carbon credits 24 hours a day. AGT even offers an iPhone APP:

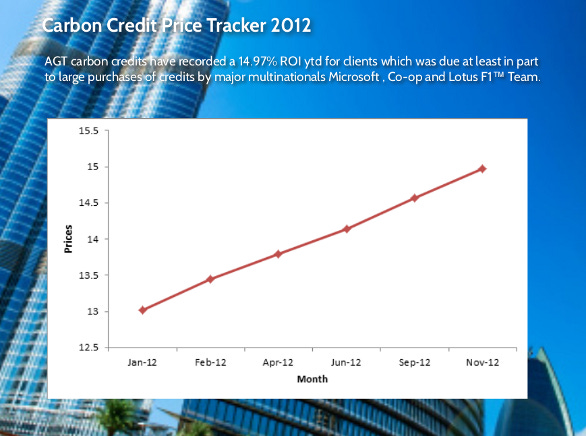

How can AGT offer this service? Simple. The carbon price on AGT’s Trading Platform is not based on the price that other companies sell VERs. It is based on the price that AGT’s brokers can sell VERs to new customers. And that price keeps going up, as shown by this graph in an AGT publication dated November 2012 (page 58):

Let’s ignore the fact that there are no units on the Y axis, the price. That doesn’t really matter, as long as the price keeps increasing. As long as AGT brokers can sell VERs at ever increasing prices to new clients, AGT stays in business. As long as all their clients don’t want to sell their VERs at the same time.

The US Securities and Exchange Commission describes a Ponzi scheme as follows:

A Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors. Ponzi scheme organizers often solicit new investors by promising to invest funds in opportunities claimed to generate high returns with little or no risk. In many Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier-stage investors and to use for personal expenses, instead of engaging in any legitimate investment activity.

Comments following the original post on REDD-Monitor.org are archived here: https://archive.ph/C8goD#selection-693.4-693.16