Blackmore Bond collapse: Financial Conduct Authority is “responsible for every penny lost”

Three weeks ago, Blackmore Bond’s mini-bond investment scheme collapsed into administration. The Financial Conduct Authority was warned three years ago about one of the boiler room operations that was cold calling pensioners to persuade them to invest in Blackmore Bond. But the FCA took no action.

Paul Carlier is a former foreign exchange trader who worked for 30 years for some of the world’s largest banks. In 2017, he was working in a WeWork shared workspace in London. Next door was a company called Amyma.

Amyma: “In a nutshell Boiler Room”

With only a glass partition separating the two offices, he could hear everything Amyma did. “In a nutshell Boiler Room,” he wrote in an email alerting the Financial Conduct Authority about Amyma’s operations.

One of the “investments” that Amyma was pushing was in Blackmore Group, a company that offered mini-bonds to retail investors. Blackmore Group and its subsidiaries invested the money raised in a series of property development projects.

Carlier told the FCA that Amyma was “pushing all manner of these bonds to pensioners,” and Amyma’s sales team claimed that the mini-bonds were “guaranteed by one of the world’s biggest banks”.

Amyma’s boiler room staff told the people they cold called that the company’s application for FCA authorisation was being processed. “They are not FCA authorised and laugh between each other when anyone uses that line on a call,” Carlier told the FCA.

Carlier received a reply from John Dodd, the Team Leader of the FCA’s Whistleblowing Team. Dodd told him he would pass the information “to the relevant areas to consider”.

Carlier urged the FCA to take action because “pensioners are clearly being targetted”.

A few days later, Carlier wrote again to Dodd at the FCA telling him Amyma was still pushing Blackmore Group’s mini-bonds.

“Just overheard the pitch again,” he wrote. “9.9% yield, interest paid quarerly. £75,000 maximum investment. All guaranteed.”

In August 2018, Carlier wrote again to Dodd. This time he copied his email to Andrew Bailey, then-Chief Executive of the FCA, Mark Steward, Director of Enforcement and Market Oversight at the FCA, and Jane Attwood, Head of Intelligence at the FCA. Bailey is now the governor of the Bank of England.

Carlier wrote that he’d seen an online advert for a Crossrail Property Bond offering 9.25% fixed returns. Clicking the link he found it was “a trading name of these Amyma cowboys who are still in business”.

He pointed out that Amyma was pushing these investments to non-sophisticated investors. “They were clearly targetting pensioners and their pensions,” he wrote.

Carlier raised his concern that the FCA had not contacted him either him or his colleagues who had “witnessed this firm in action first hand”.

Three weeks later, Steward replied. Here’s his response in full:

We have received reports about Amyma’s activities, and are making enquiries. In line with normal policy, we do not comment on operational matters, save in exceptional circumstances. I am sorry we cannot provide any further information at this stage.

In August 2019, Carlier wrote to Bailey, Steward, and Attwood again. He noted that Amyma’s website was back up, after having been offline. Amyma was “still marketing the same fixed return bonds,” Carlier wrote. “How is that possible given the information I gave you back in March 2017 and again in August 2018, when it was clear that you had ignored the first report I made?”

Carlier pointed out that “There are no circumstances under which this firm should be permitted to continue operating.” And he asked the FCA to explain why it had taken no action in response to his previous emails.

Here’s Steward’s response, again in full:

We are aware of these matters which are the subject on ongoing work on our part. Consistently with practice and policy, we do not provide details of our operational matters.

Amyma carried on its boiler room operations, pushing ever more pensioners into Blackmore’s mini-bonds. Amyma even took out an advert in the Police Federation’s October-November 2018 magazine:

Amyma and Sami Raja

In January 2019, Amyma had a passing mention on REDD-Monitor. Amyma was listed on Sami Raja Consultancy’s website as one of Raja’s “clients” (along with Heron Global Partners, Bar Works, and various other dodgy looking companies).

The focus of the REDD-Monitor post was Sami Raja, who on 18 January 2019 was found guilty of conspiracy to defraud and money laundering in Southwark Crown Court. He was sentenced to eight years in prison, for miss-selling carbon credits to retail investors via two companies, Harman Royce and Kendrick Zale. The scam took place between January 2012 and August 2013.

Raja was not in court to hear his sentence. He fled to Dubai, and in May 2019 appealed his sentence and conviction.

A May 2018 discussion on MoneySavingExpert reveals that Amyma was advertising (via unsolicited emails) projects with returns of 500-800% with interest rates of 6-12%. Amyma stated that its clients were “under the rules of the FCA”.

Blackmore Bond collapses into administration

Blackmore Bond raised a total of £45 million from about 2,500 investors.

In October 2019, Blackmore Bond postponed interest payments to investors. One month later, it delayed again, with excuses about properties being “not yet completed”, but the company claimed that “contracts have been exchanged and completion dates are now agreed, so we expect to be able to be in a position to pay interest by the end of December”.

By March 2020, Blackmore Bond was using the coronavirus as an excuse for failing to give out interest payments due in October 2019, and in January 2020.

On 22 April 2020, Blackmore Bond went into administration.

Between July 2016 and December 2017, Blackmore paid £5.1 million to a Brighton-based marketing firm called Surge Group. That’s the same company that made tens of millions of pounds in fees from marketing London Capital & Finance’s mini-bonds. London Capital & Finance collapsed last year. More than 11,000 people invested £236 million in London Capital & Finance and many also invested in Blackmore Bond.

100% avoidable

Of course, had the FCA followed up on Paul Carlier’s email in March 2017, at least one of the boiler room operations selling Blackmore Group’s mini-bonds would have been shut down.

Carlier comments that “In two years of reporting this firm and marketing of this product and submitting multiple reports, I was never engaged with and never provided with any update in respect to these reports.”

And had the FCA bothered to check the product that Amyma was selling, maybe, just maybe, they would have closed down Blackmore Bond as well. Carlier is convinced that’s precisely what the FCA should have done.

It was “100% avoidable”, Carlier writes on Twitter. “The FCA is responsible for every penny lost on the Blackmore Bond.”

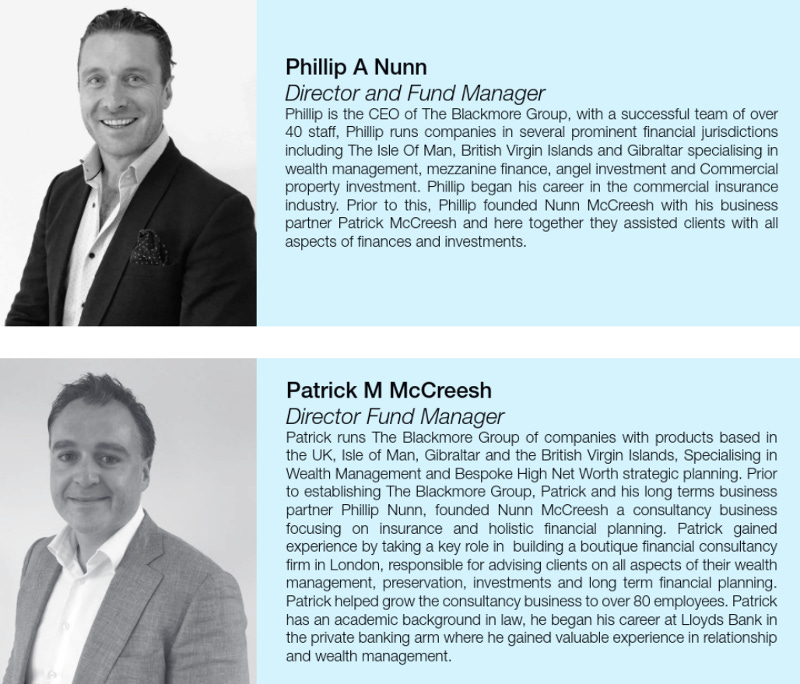

Patrick McCreesh and Phillip Nunn

Blackmore Bond PLC was registered in the UK in July 2016. Patrick McCreesh and Phillip Nunn are the company’s directors. Blackmore Bond is controlled by Blackmore Group Ltd, set up by McCreesh and Nunn in February 2016. Blackmore Bond’s website currently states that Blackmore Bond is in administration, but, “Bondholders should note that the Administration only impacts the Company and the other entities within the Blackmore Group are currently unaffected.”

There are several companies carrying the Blackmore name, all with links to Blackmore Group Ltd. As a Frequently Asked Questions document on the Administrator’s website explains, Blackmore Bond and its subsidiaries bought several plots of land and buildings. Blackmore Bond set up 16 special purpose vehicles to buy the properties (Blackmore SPV 1 Ltd to Blackmore SPV 16 Ltd).

In some cases the SPV entered into joint ventures to buy the properties. Writing in the Evening Standard, Jim Armitage explains that, “Many of the developments have been mortgaged to other lenders, making it even less clear how much money will be left for bondholders.”

In addition to the Blackmore SPV companies, here are some of the other Blackmore companies (none of which have so far gone into administration):

Blackmore Estates Ltd (incorporated on 10 April 2015, McCreesh and Nunn are directors, company controlled by Blackmore Bond PLC).

Blackmore Private Client Ltd (incorporated on 29 October 2015, McCreesh and Nunn are directors, company controlled by Blackmore Group Ltd).

Blackmore Estates Eco Limited (incorporated on 25 February 2016, McCreesh and Nunn are directors, company controlled by Blackmore Group Ltd).

Blackmore Group Services Ltd (incorporated on 17 February 2016, McCreesh and Nunn are directors, company controlled by McCreesh and Nunn).

Blackmore Longridge Limited (incorporated on 12 December 2016, McCreesh and Nunn are directors, company controlled by Blackmore Group Ltd).

Blackmore Asset Management Ltd (incorporated on 29 March 2018, McCreesh and Nun are directors, company controlled by Blackmore Group Ltd).

Fortitudo (Staines) Limited (incorporated on 3 May 2018, McCreesh and Nunn are directors, company controlled by Blackmore SPV 15 Ltd).

Blackmore (Weybridge) Ltd (incorporated on 19 July 2018, McCreesh and Nunn are directors, company controlled by Blackmore Group Ltd).

Blackmore Real Estate Securities Limited (incorporated on 13 September 2018, McCreesh and Nunn are directors, company controlled by Blackmore Group Ltd).

Blackmore Capital Limited (incorporated on 7 March 2019, McCreesh and Nunn are directors, company controlled by Blackmore Group Ltd).

Blackmore International Limited (incorporated on 20 March 2019, McCreesh and Nunn are directors, company controlled by Blackmore Group Ltd).

Blackmore International (Korea) Limited (incorporated on 1 May 2019, McCreesh and Nunn are directors, company controlled by Blackmore Group Ltd).

Blackmore Briercliffe Limited (incorporated 27 September 2019, McCreesh and Nunn are directors, company controlled by Blackmore Group Ltd).

A Blackmore Estates corporate brochure describes the investment as follows:

In simple terms, investors subscribe to Loan Notes which provide Blackmore Estates with funding to facilitate residential and commercial property development projects. In return investors receive:

A fixed return of 6.5% annually

Flexible investment terms of 2 and 5 years

5% Bonus paid on 5 years deferred

Asset backed security, you have a charge over the real estate assets of the company

Minimum investment £5,000

The brochure states that, “If you are a UK resident, over the age of 18, we can accept your aplication [sic] for the Blackmore Estates Property Bond.” And the brochure includes three examples of people who are supposed to have invested in Blackmore Estates. Here’s one:

It may sound convincing, but it’s fake. As a Press Association article points out,

However, the picture next to Mr Donalan’s story is a stock image, with photos of the same man having been used to advertise a wigmaker in Sweden, a bakery in the United Arab Emirates, and a Belfast-based company producing memorial items for dead relatives, among dozens of others.

The brochure also names Katherine Barnard, 36, and Sheila Onslow, 46, in a similar way to Mr Donalan. Both images used for the two women are also stock photos.

Curzon Capital

Blackmore Estates’ brochure lists a company called Curzon Capital as its “Regulation compliance partner”:

Curzon Capital, 34 Clarges Street, London, W!J 7EJ. Curzon is authorized by the Financial Conduct Authority to conduct investment business (FRN: 191520). They supply Blackmore Estates with regulatory compliance advisory services and act as an independent collection agent for investor funds.

Curzon Capital is an interesting choice of company as a compliance partner. Curzon Capital is a Mayfair-based investment company, incorporated in the UK in June 1999. Christopher Derricott is the company’s Chief Executive Officer. The most recent Financial Statement for the company (year ended 30 June 2018) states that, “The main source of income for the company during the year was derived from small corporate debt securities ‘minibonds’ where it provided compliance services which involved the issue of debt securities”.

On 4 November 2018, Curzon Capital lost its FCA authorisation. Unfortunately, the FCA website doesn’t give any further details.

In 2013, Curzon Capital was the subject of a 2013 investigative report by Ben Laurance in The Sunday Times. Laurence wrote that Curzon Capital co-ordinated an “elaborate plan” to “conceal the true ownership of a huge shareholding in London-listed Regal Petroleum”. Laurence traced the ownership back to Ukrainian oligarch Victor Pinchuk.

Curzon Alternative Investments is a 100%-owned subsidiary of Curzon Capital, incorporated in Bermuda. In 2011, Curzon Alternative Investments set up a CIS Natural Resources Fund, also in Bermuda. This fund bought shares in Regal Petroleum.

CIS Natural Resources Fund had only one subscriber – Daletona Global, registered in the British Virgin Islands. The director of CIS Natural Resources Fund, Androulla Christofi, explained in September 2011 that, “The beneficiaries of the discretionary trusts, which indirectly control Daletona Global Limited, are Mr Victor Pinchuk, Elena Pinchuk and their family members.”

In 2017, journalist Nick Kochan asked the FCA about Curzon. The FCA replied, “concerning Curzon, we are not able to confirm or deny whether an investigation has taken place”. The FCA is at least predictable.

Nunn McCreesh LLP, Jackson Francis Ltd, Capita Oak Pension Scheme, Store First Limited

Blackmore Estate’s brochure includes some information about Nunn and McCreesh:

Both men specialise in funds based in tax havens: Isle of Man, British Virgin Islands, Gibraltar. The two founded a company called Nunn McCreesh LLP in August 2012. The company was dissolved in October 2015. According to the FCA’s website, the company became an agent of an FCA authorised firm (Sage Financial Services Limited) in January 2009, and lost its appointed representative status in October 2017.

The Telegraph reports that Nunn and McCreesh’s “early work included drumming up leads for Jackson Francis Ltd, an introducer for the Capita Oak Pension Scheme.” The Serious Fraud Office is now investigating Capita Oak as part of a major investment fraud investigation. Investors lost £120 million in Capita Oak’s pension fund.

And the Independent reports that an investigation by the Insolvency Service found that Nun McCreesh LLP received almost £900,000 in commissions beteen March 2012 and May 2014 for generating leads for Capita Oak.

Jackson Francis and other boiler room operations cold called people about their pensions, and convinced more than 1,000 people to transfer their pensions. The money went to Capita Oak and Henley Retirement Benefit schemes and was then invested in a company called Store First Limited.

Store First has appeared in several posts on REDD-Monitor.

In December 2015, BBC Radio 4’s “You and Yours” put out an excellent programme based on investigative reporting by Shari Vahl about Store First, including the role of the Jackson Francis boiler room in promoting Store First as a pension investment. Store First claims to have 5,000 investors who have handed over a total of £250 million.

Aspinal Chase and Blackmore Global

Nunn and McCreesh were also directors of a company registered in Gibraltar called Aspinal Chase. The company operated out of Manchester and cold called pensioners and advised them to transfer their pensions to an unregulated offshore fund called Blackmore Global. Nunn and McCreesh were also directors of Blackmore Global. (Needless to say, Nunn and McCreesh deny any wrongdoing at any stage of their careers.)

Aspinal Chase worked with an unregulated Czech financial advisory firm called Aktiva Wealth Management (renamed as Square Mile International, then Michalska Holding, and now Planet Pensions).

Aktiva Wealth’s job was to provide “financial advice” to convince pensioners to transfer their savings to Blackmore Global.

In January 2018, a You and Yours programme interviewed people whose pension was transferred to Blackmore Global. One them, Stephen Sefton transferred a £415,000 pension to a fund in Malta and to Blackmore Global, on the advice of David Vilka at Square Mile International. When he contacted the FCA, they told him that Square Mile International was not registered to give financial advice.

Square Mile International was listed as an authorised company on the FCA Registry, but it is only regulated for insurance mediation, not for giving advice about transferring pensions.

The fund in Malta is a professional investor fund, not intended for retail investors like Sefton.

Most of Sefton’s money went to Blackmore Global. In the You and Yours programme, BBC presenter John Douglas explains that,

Then there’s that other fund, Blackmore Global, where most of his money went. We know the managers of a pension scheme on the Isle of Man were worried about that; they sent a letter to their clients who’d already invested in Blackmore Global saying they’d concluded it posed an unacceptably high level of risk.

The letter from the Isle of Man pension fund stated that “they’d become increasingly concerned at the lack of financial and accounting information that was available for Blackmore Global, so they’d removed it from their list of approved investments,” Douglas says.

You and Yours spoke to “Paul” who had invested £100,000 in Blackmore Global after being cold called by Aspinal Chase, offering him a free pension review. When he got the letter from the Isle of Man pension fund, Paul phoned Aspinal Chase, who sent him a reassuring letter, explaining that Blackmore Global was performing well and that the advice from his financial advisers was that fund fits his circumstances perfectly. Aspinal Chase listed Paul’s financial advisers as Square Mile International. Based on Aspinal Chase’s letter, Paul left his money with Blackmore Global.

Of course, Paul didn’t know that Nunn and McCreesh were directors of both Aspinal Chase and Blackmore Global. In an email dated 5 August 2015, Square Mile International’s John Ferguson wrote that,

We offer a service to the Manish’s / Aspinal Chase’s of the world and our IFA’s will sign off the business, provide the advice, deal with the pension and invest a proportion of the fund into the investments these introducers are trying to raise subscriptions on.

Yet Nunn and McCreesh told the BBC they had no financial relationship with Square Mile International. They also said that Aspinal Chase never cold called.

The email was copied to Charlie Goldsmith at Curzon Capital.

Blackmore Global’s website gives an address in the Isle of Man. That company is Blackmore Global PCC Limited, but thanks to the Panama Papers, we know that in December 2014, a company called Blackmore Global Finance Limited was incorporated in the British Virgin Islands. Blackmore Global Finance’s address is in Morocco, care of an intermediary called Basileus Holdings Offshore.

Another related company, BG Finance Holdings Ltd was also registered in the British Virgin Islands. Every year, Blackmore Global paid a management fee to BG Finance Holdings amounting to 2.5% of assets under management. Blackmore Global paid 25% of net returns on the investment to BG Finance Holdings.

Stephen Sefton actually managed to get his money out of the Blackmore Global fund, but only after 18 months of repeatedly emailing and complaining. Square Mile International subsequently offered him £6,000 if he signed a confidentiality agreement. Sefton told the BBC,

“I actually believed I had a right to restitution with no conditions, no strings attached, no signing anything that says you’re going to shut up and not talk to anyone. So no, I didn’t sign it. I told them in no uncertain terms what they could do with it.”

Sefton reported his concerns to Action Fraud, but Action Fraud wrote to him saying it had not identified any leads to follow up.

Comments on this post up to August 2020 are available here: https://archive.ph/wyavp#selection-1297.4-1297.15