BluForest Inc: “Creating a sustainable, profitable business that protects the world’s irreplaceable rainforests.” Really?

BluForest describes itself as “a publicly traded carbon offsets marketing company that is setting a new standard for sustainable business in carbon offset credit trading.” BluForest owns 135,000 hectares of forest in Ecuador, “from which it will generate tradable carbon credits”.

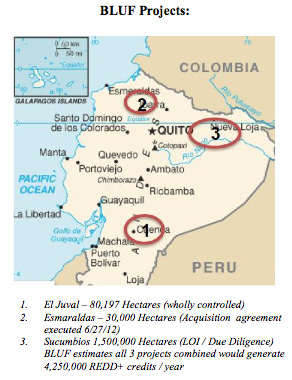

In July 2012, BluForest announced that it had signed a letter of intent with the Commonwealth of Northern Ecuador granting BluForest the rights to carbon credits from 1.5 million hectares of land in Ecuador.

In 2012, colleagues in Ecuador contacted REDD-Monitor to ask about BluForest and its REDD plans in Ecuador. I knew little about the company, and nothing about its operations in Ecuador, beyond the company’s press releases. Then, this week, I read this article, “BluForest Inc: See the forest for the trees”. The article, by Christopher Drose on the website Seeking Alpha, suggests that there are serious causes for concern about BluForest.

BluForest is a company with a background in mining, oil and gas. The company has few staff and no previous experience of either forest conservation or carbon trading. It also has a background of alleged pump and dump share scams.

BluForest used to be called Greenwood Gold Resources Inc. The website has gone, but in the bits that remain on archive.org, Greenwood Gold Resources claimed that it was in the business of buying and developing mining resources in Canada and the USA. On 27 June 2011, Greenwood Gold Resources bought the Summer Mining Property in British Columbia from a company called Candorado. Greenwood Gold Resources then sent out a series of press releases and promotional emails about the property, encouraging people to buy shares in the company.

Pumpsanddumps.com describes the Summer Mining Property as “worthless”. Candorado bought the land for $8,000 in 2007. Candorado explored the land, and sold it to Greenwood Gold Resources. The day before the sale, Candorado had a total market cap of about $2.5 million. After the sale, Greenwood Gold Resources “had a market cap of about $30 million with no cash in the bank and the Summer property as its only asset”.

Pumpsanddumps.com describes Greenwood Gold Resources as “one of the bigger Pump & Dump scams of 2011, estimated to have cost investors in excess of $10 million”.

At this stage, things get complicated.

In February 2012, a reverse take over of Greenwood Gold Resources took place, involving a Canadian company called Oceanview Real Estate Company. (Oceanview has a website, but the company’s registration details don’t show up in a search on Open Corporates.)

Under the deal, Greenwood Gold Resources bought all the rights to Oceanview’s 80,197 hectares of land in Ecuador, including rights to oil, gas, other minerals and carbon credits.

Charles Miller, the director of Oceanview, became director of Greenwood Gold Resources, replacing Branislav Jovanovic. In June 2012, Jovanovic took out a lawsuit against BluForest for allegedly failing to pay debts. Bluforest sued back a month later. Jovanovic sued again in October 2012. In January 2013, the judge dismissed the case.

The Oceanview deal involved a reverse stock split of one for five hundred shares of Greenwood Gold Resources stock and the issue of 75 million new shares to Oceanview. According to pumpsanddumps.com, these shares were transferred to Global Environmental Investments Limited, a company based in Belize City and controlled by Jim Can (more on him and his alleged role in Greenwood, BluForest and other companies, here).

On 16 March 2012, Global Environmental Investments (GEIL) entered into an Aquisition Agreement with Fundacion Nelson Velasco Aguirre, an Ecuadorian Foundation. Under the agreement, control of 105,000 hectares of land, “El Juval”, would be transferred to GEIL. Two weeks later, Greenwood Gold Resources entered into a purchase of acquisition agreement with GEIL over the land. In May 2012, the company changed its name to BluForest. This is all documented in BluForest’s most recent filing with the US Securities and Exchange Commission.

George Sharp was one of the people who was taken in by the flurry of promotional emails in 2011 about Greenwood Gold Resources. Last month, he filed a civil action against BluForest for alleged fraud, negligent misrepresentation, deceit, false advertising and various breaches of California business codes.

On 5 August 2013, Sharp put out a press release, which states:

Mr. Sharp expressed concerns for investors in BluForest, Inc., currently undergoing a heavy promotion. Mr. Sharp fears that investors will experience the same kind of harsh losses that wiped out previous investors during the Greenwood Gold Pump & Dump campaign. Mr. Sharp cautions investors not to invest in stocks promoted through email or internet advertisements, such as those disseminated by “Best Damn Penny Stocks” and “Research Driven Investor”, as these are almost exclusively attempts to abscond with investors’ funds, by selling worthless or near-worthless stock at heavily over-inflated prices. Stocks promoted by these newsletters, always ends up with share price that evaporate and significant losses by the public.

In his article, Christopher Drone looks at four of the the reports promoting BluForest and found that the companies that produced the reports were paid to do so. Goldman Small Cap Research received $5,000, Murphy Analytics received $6,500, Bull Exchange expects to receive $200,000 for “two months of coverage”, and Try Penny Stocks expects to receive “fifteen thousand dollars cash from a non-controlling third party for BLUF advertising service”.

Drone describes BluForest as “Fundamentally Worthless”. As of 15 March 2013, the company had US$43 in cash and a grand total of US$$17,210 in current assets. Yet the company claims to have almost US$700 million in total assets. BluForest claims to have US$698,875,000 in “property for developing carbon assets.” This is based on the 135,000 hectares in Ecuador that BluForest controls (numbers 1 and 2 on the map below):

BluForest explains how it plans to profit from Ecuador’s rainforest in its filing with the SEC:

Initially, we intend to sell carbon offsets through our website to voluntary markets where no verification is required. . . .

Once we are able to complete the verification process, we will sell verified carbon offsets through other markets. We intend to market and sell Verified Emission Reduction (VER) and Reduced Emissions from Deforestation and Degradation (REDD) carbon offsets through global restoration projects. The offsets will be validated and verified for sale to companies, foundations, and other entities that, for branding, policy and corporate social responsibility reasons, wish to offset their carbon footprints to support climate change mitigation efforts.

On its website, BluForest explains that about 90% of the area of “El Juval” is inside the Sangay National Park. In its SEC filing, BluForest gives a figure of 70% as inside Sangay, adding that this makes it “a suitable location for carbon offsets marketing”. Which suggests that BluForest has little idea of the concept of additionality.

BluForest expects that “by the second quarter of the next fiscal year we will commence generating revenues from our projects”. But it currently doesn’t have permission for any REDD projects from the Ecuadorian authorities, and hasn’t even hired consultants to design the projects and calculate the number of carbon credits that the projects might generate.

Nevertheless, according to BluForest’s SEC filing, the company has started pre-selling carbon credits. In November 2012, a company called Global Resource Energy Inc pre-purchased 66,000 certified emissions reductions from BluForest. Global Resource Energy paid for the deal with 3 million shares. Pumpsanddumps.com describes these shares as “intrinsically worthless”. In December 2012, a company called Mainland Investments Ltd pre-purchased 8,300 and wiped off US$83,000 off the debt that BluForest owes it. (The reverse take-over of Greenwood Gold Resources, included an agreement that Greenwoood would compensate Mainland with three million stock options and US$1 million a year for three years for “financial, advisory, marketing and investor relations services”.)

In the SEC filing, BluForest explains that the company has “negative working capital”, and has “incurred substantial losses since inception” (around US$300 million), and has “not yet generated revenues”.

Christopher Drose leaves no doubts in his conclusion:

BluForest is a company that investors should avoid, as the market cap of this company has been massively inflated by the stock promotion. I urge any owners of the stock sell his or her shares immediately and any potential investors to stay as far away from this company as possible.

Comments following the original post on REDD-Monitor.org are archived here: https://archive.ph/24SAa#selection-931.4-931.14