Bolivia’s US$1.2 billion forest carbon deal is a false solution

The deal is being set up by a company with zero experience in forest carbon in a country where wildfires tore through 10 million hectares in 2024.

On 14 November 2024, the Bolivian government announced that it planned to sell US$5 billion worth of “sovereign carbon credits”. The government said that this is part of its plan to stop deforestation in the country by 2030.

That plan is not going well.

In 2024, wildfires burned an area of more than 10 million hectares in Bolivia, setting a new record for the country. Reuters reports Juan Pablo Chumacero, of Bolivian NGO Tierra Foundation, as saying that,

“This catastrophe is affecting the lives of thousands of households, farmers and people, many of whom have been displaced due to the loss of their homes, crops and livelihoods, as well as contamination of air and water sources."

The fires were exacerbated by drought and expanding cattle ranching and grain production.

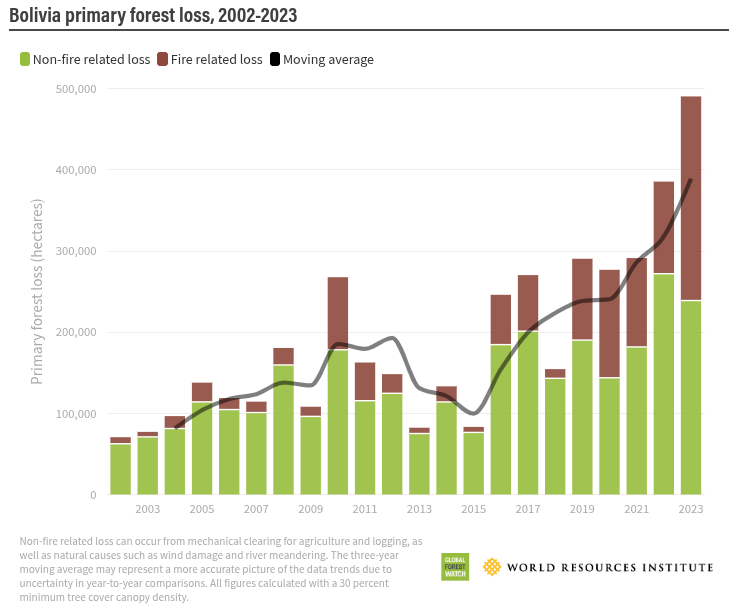

In 2023, for the third year in a row Bolivia lost a record area of primary forest. In 2023, Bolivia lost 490,000 hectares of primary forest, the third-highest area of primary forest lost in any tropical country.

Bolivia is also facing an economic crisis, in part because of declining gas exports — the country’s main source of foreign income. In 2022, Bolivia became a net importer of fossil fuels.

At the press conference in November 2024 announcing the carbon deal, Marcelo Montenegro, Bolivia’s Minister of Economy and Finance, said, “The intention is to conserve, plant and reforest. And it’s a way to generate value in this country.”

“You all know how much we’ve spent in putting out fires trying to control them,” he added, “and we should have resources to prevent, mitigate and get ahead of it.”

Laconic Infrastructure Partners

A company called Laconic Infrastructure Partners Inc. is “assisting with the sale”, Reuters reports.

According to Laconic, the carbon credits generated under the deal will comply with Article 6 rules under the Paris Agreement.

Andrew Gilmour, Laconic’s CEO and founder, told Reuters that potential buyers of the credits include large corporations and other governments. “At COP29, there are interested parties at the table,” he said.

250 million carbon offsets will be sold as securities rather than credits. Reuters reports Gilmour as saying that, “all the proceeds must be used to protect forests”.

Reuters reports that,

Laconic's platform manages the data to ensure the products are compliant with the Paris Agreement and represent genuine emission cuts. It will also monitor progress every six months, with Bolivia liable for default payments if targets are not achieved.

Laconic Infrastructure Partners Inc. was incorporated in the tax haven of Delaware on 8 December 2021.

The deal with Bolivia is the company’s first. That doesn’t stop Gilmour describing himself as a “visionary in carbon securitization” and a “global leader in carbon markets”.

Before setting up Laconic, Gilmour’s background was in prisons and security firms. He spent nearly nine years working at G2 Security LLC, a company that focused on “the development of innovative justice facilities” using public-private partnership ownership models. His first job was with a company called StunFence, Inc. which sold non-lethal electric fencing to prisons.

“US$25 trillion of carbon credits”

On its website, Laconic states that, “Securitized Sovereign Carbon is a new class of financial asset poised to generate $1 trillion in annual carbon trading, making significant strides toward global NetZero goals.”

In October 2024, Gilmour gave a TEDx talk in which he explains this figure:

In order to achieve net zero we have to remove more than 500 gigatons, that’s 500 billion tons of carbon dioxide from the atmosphere in the next 25 years. Put in economic terms that means we have to create more than US$25 trillion of carbon credits, more than US$1 trillion each and every year. And therein lies the problem. Because in 2023, we created only US$3 billion of nature-based carbon credits.

Gilmour appears oblivious to the long list of problems with carbon credits. The most obvious problem is that we need to reduce emissions from burning fossil fuels to address the climate crisis.

Gilmour is talking about trading 20 billion carbon credits every year up to 2050.

However, he does not seem to have considered the fact that there are two sides to every carbon credit sale: there’s the seller who (hopefully) reduces (or maybe avoids) carbon emissions; and then there’s the buyer who uses the carbon credits (definitely, without any shadow of doubt) to continue burning fossil fuels.

That means (in the best case scenario) there is no overall reduction in emissions. In the worst case scenario the seller’s forests go up in smoke releasing the CO₂ back to the atmosphere.

Then there’s the problem that the CO₂ from burning fossil fuels will stay in the atmosphere for a very long time. A recent paper in Nature found that, “A CO₂ storage period of less than 1,000 years is insufficient for neutralising remaining fossil CO₂ emissions.”

Obviously, Gilmour makes no mention in his TEDx talk of how he proposes to ensure that Bolivia stores carbon in its forests for the next 1,000 years.

False solution

This week, Nicholas Kusnetz a journalist with Inside Climate News reported on Laconic’s carbon deal in Bolivia. Sometime next month, the largest single sale of carbon credits ever is set to take place — US$1.2 billion, Kusnetz writes.

So the deal has shrunk from US$5 billion down to US$1.2 billion since November 2024. And the number of securities has fallen from 250 million to 40 million. And the price has gone up from US$20 to US$30 for each securitised carbon credit.

Inside Climate News asks whether the deal is a “climate boon” or a “false solution”?

Obviously, it’s the latter.

Gilmour told Inside Climate News to think of Laconic’s sovereign carbon securities as “being able to buy carbon like you’re buying a share of Google”.

But that’s nonsense. Google is a massive multinational corporation with a huge range of products. Its stock price has increased (with a few wobbles) since the company went public in 2004.

Laconic’s sovereign carbon securities are based on the carbon stored in Bolivia’s forests, large areas of which are at serious risk of going up in smoke.

Entoro Capital, LLC

In December 2024, Quantum Commodity Intelligence reported that Laconic was “currently in talks with 11 countries following an agreement with Bolivia earlier this year”. Gilmour told Inside Climate News that Laconic is working on deals with seven governments.

An investment bank called Entoro Capital, LLC is the placement agent in the sale. James C. Row, managing partner at Entoro told Inside Climate News that, “There’s approximately $30 billion worth of paper that’s going to be issued in the next year and a half that we know of.”

Entoro Capital was incorporated in the tax haven of Delaware in May 2008. It is part of a network of companies under Entoro, LLC which include Entoro Securities, LLC which is a broker selling oil and gas interests.

Laconic told Inside Climate News that Bolivia “retains flexibility” to direct funds from the sale of sovereign carbon securities as needed to protect forests.

Laconic will use satellite imagery to monitor deforestation across Bolivia. On 2 December 2024, Planet Labs, a satellite data company, announced that it had signed a “multi-year, seven-figure deal with Laconic”.

Laconic will hold the money from the sale of the 40 million sovereign carbon securities in a special purpose vehicle in the offshore tax and secrecy haven of the Cayman Islands. Laconic will only release the money if deforestation is reduced, compared to a business-as-usual baseline.

Inside Climate News reports that,

This will play out over a five-year period that corresponds with Bolivia’s climate pledge, or Nationally Determined Contribution, under the Paris Agreement. The securities will effectively finance Bolivia to increase the ambition of that pledge, reducing its climate pollution more than it would have otherwise.

Bolivia’s Nationally Determined Contribution

So, let’s take a quick look at Bolivia’s most recent update of its Nationally Determined Contribution (2021-2030).

The NDC, which was submitted on 15 April 2022, proposes,

to reduce deforestation, carry out afforestation and reforestation actions, increase the areas with integrated and sustainable forest management, implement adaptive measures inside and outside protected areas, promote greater control of forest fires, among others, with a strong role and participation of indigenous peoples and local communities, intercultural communities and Afro-Bolivian people.

The NDC includes several goals relating to forests by 2030:

Reducing deforestation “to 80% compared to the baseline”. The 2020 baseline is the average from 2016 to 2020, or 262,178 hectares per year.

Stop deforestation in protected areas.

Reducing the area of forest fires by 60% compared to the baseline. The baseline is the average from 2019 to 2021, or just under 1.5 million hectares per year.

Double the area under sustainable forest management.

Increase “forest cover gain” by 1 million hectares.

Double timber production.

Double production of non-timber products.

This looks a lot like a wish-list, much of which is conditional on international financing.

Bolivia has long been a staunch opponent of carbon trading. The NDC makes this opposition clear:

Bolivia considers that the financing schemes provided by the carbon markets do not represent an option to make ambitious national policies viable in the country, and opposes any form of commodification of the environmental functions of nature; on the contrary, it assumes the effective implementation of Article 6.8 of the Paris Agreement of the framework of non-marketbased approaches, which will allow for the scaling up and acceleration of the goals identified in the present NDC of Bolivia.

In October 2012, Bolivia enacted Law 300, the Framework Law of Mother Earth and Integral Development for Living Well. Article 32.5 specifically excludes “financing mechanisms associated with carbon markets”.

But in August 2024, Bolivia’s Constitutional Court declared article 32.5 unconstitutional.

On 30 October 2024, Bolivia issued Supreme Decree 5264 which establishes guidelines for climate finance, including the registration of carbon credits. The Decree was issued just two weeks before Bolivia announced the US$5 billion carbon deal with Laconic.

The day before the Laconic deal was announced, Bolivia issued Supreme Decree 5270, which amends Decree 5264, making the Ministry of Economy and Finance responsible for preparing actions for reducing emissions, including hiring necessary services.

Article 6.2: “The Wild West”

On its website, Laconic states that its sovereign carbon securities are “Paris Compliant”:

Sovereign Carbon is netted against the NDC obligations of all Paris signatories — regardless of how many times it changes hands — Sovereign Carbon is the only product in the world with this feature — everything else is non-compliant — full stop.

Inside Climate News writes that Laconic’s securities will fall under Article 6.2 of the Paris Agreement. “Laconic said it will deliver a high quality product by relying on these United Nations-approved standards,” Kusnetz writes.

That’s not reassuring.

“It’s kind of the Wild West of carbon trading internationally, because it’s kind of an anything goes approach,” Isa Mulder of Carbon Market Watch told Inside Carbon News.

Under Article 6.2, a government has to approve the carbon trading plan. It has to submit an initial plan to the UNFCCC for review. It has to follow a technical requirement to prevent double-counting.

And, er, that’s it.

“There are no requirements,” Danny Cullenward, a climate economist and lawyer, told Inside Climate News. “A host country can do whatever it wants.”

So far, Bolivia has not submitted any documents to the UNFCCC about its deal with Laconic.

“Not credible”

The Laconic carbon deal is supposed to avoid 100 million tons of CO₂ emissions over a five-year period. Of this total, 40 million tons will become sovereign carbon securities. The rest is a buffer — in case Bolivia’s forests continue going up in smoke.

Oswaldo Maillard of the Foundation for the Conservation of the Chiquitano Forest is in favour of carbon markets. In January 2025, he co-authored a letter to Science arguing that carbon markets could provide economic benefits to local communities, Indigenous peoples, and private landowners “in exchange for conserving and restoring their forests”. Meanwhile, the government should increase enforcement of forest protection laws and revise land-use regulations to discourage rather than encourage deforestation.

But he told Inside Climate News that the claim that Bolivia could reduce deforestation by 100 million tons of CO₂ was “not credible”. He added that, “it is complex to think about selling carbon now. During the last few years a number of companies of dubious provenance have appeared that have approached indigenous territories to ‘sell them smoke’.”

Laconic has not provided any details of its deal with Bolivia. If Bolivia successfully prevented deforestation, that could result in increased deforestation in neighbouring countries. Gilmour acknowledged this risk to Inside Climate News. He said it would need to be addressed in the design of the programme.

Laconic’s plan to sell sovereign carbon securities and stash the money in the Cayman Islands means that Laconic has the option of not paying Bolivia if deforestation does not decrease. But if fires wiped out vast areas of Bolivia’s forests after the five-year Laconic programme, the carbon offsets would be worthless. And Laconic has no mechanism to address this problem.

The Bolivian Platform Against Climate Change is a network of more than 50 civil society organisations in Bolivia. Cristian Flores of the Platform told Inside Climate News that the Laconic deal will neither stop the fires nor address the economic crisis in Bolivia.

Flores calls the deal a false solution. He said that,

“A false solution is precisely for Bolivia to continue being complicit in receiving money through carbon markets from companies, industries and countries that continue to generate greenhouse gas emissions at the expense of our forests.”

Background in prisons and security firms! PERFECT for fortress-conservation! And electric fences to keep those peasants from returning!

The Magic of US$25T absorbing 500B tons of CO2? How, with a 3D printer? Has the CO2 level gone down from the US$3B "credits" in 2023? No prob, we're going to stop measuring it.

Why wait to 2030 to stop deforestation? Why not now? Intact rain forests draw weather to them, via VOC emissions, etc., and albido differential.

Contradictory claims - reduce deforestation AND double timber production?

And this is a five-year plan?

And this bank Entoro Capital, says: “There’s approximately $30 billion worth of paper that’s going to be issued in the next year and a half that we know of.” That's fiat money, that is fractional-reserve banking, what physical assets back it up, or is it simply a debt-obligation?