In April 2013, UK-based journalist Tony Levene wrote about a phone call he received from someone called Jacob. “Have you ever invested in commodities before?” Jacob asked. In his article, Levene commented, “This dodgy outfit flogged carbon credits, a fraud I’ve written about so often that I have lost count.”

The carbon credit fraud is simple: Companies buy near worthless voluntary carbon credits and sell them for a lot more than they are worth. “Investors” eventually realise that they paid far too much, that the value of voluntary carbon credits declines over time and that in any case no one wants to buy their carbon credits. By that time, the company has often disappeared.

Jacob worked for a company called ClearView Partnership Ltd. During the phone call Jacob managed to forget Levene’s name, and told him that “due to the Data Protection Act”, he could only send him a company brochure if Levene first became a client of ClearView Partnership. Jacob also needed Levene’s date of birth. As Levene points out this is “total nonsense”. Then Jacob forgot about the Data Protection Act and said he would send the brochure anyway.

A week later, no brochure arrived, but Levene received another phone call from ClearView Partnership, this time from someone calling himself Fraser. ClearView Partnership is “a major company and a leading company”, Fraser said. Impressive, for a company that was only registered in June 2012.

When Levene kept asking questions about the company, Fraser handed over to a senior broker called Vince. Levene continued asking questions. Before slamming down the phone, Vince told Levene he was so rude and a waste of his valuable time that he would punish him by depriving him of this investment opportunity. “The worst scammers I’ve ever encountered!” Levene commented.

Levene tells a funny story, but doesn’t provide much information about the company – not even the company’s name (which is perhaps not surprising as he was threatened by lawyers after writing about another company, Tullett Brown, which was subsequently ordered into liquidation in the public interest.)

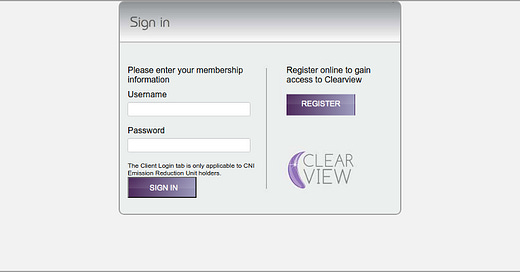

ClearView Partnership’s website was only registered in December 2012, six months after the company started. It is password protected. REDD-Monitor registered on the website, and received a message, “A member of ClearView Partnership will be in touch shortly to provide your login credentials.” I’m looking forward to hearing from them.

The company’s registered address is 90 Brixton Hill, London (see photograph, above). Google maps reveals that the address is actually a firm of accountants. The company was set up by two directors: David Pierce (who retired his position after three months) and Ashley Hunte.

The company was listed on Carbon Neutral Investments’ website as one of the “companies that CNI provides clearing and settlement services for”. (Carbon Neutral Investments is now called Opus Capital Ltd and the clearing and settlement services were taken over by a company called Gemmax Solutions Ltd. Neither Opus Capital’s nor Gemmax Solutions’ website is currently available.)

There’s an interesting discussion between several people who have been contacted out of the blue by ClearView Partnership’s sales team, on tellows.com. Winston from ClearView Partnership told one person that the company’s address was in Canary Wharf, a far cry from Brixton Hill. Someone else described the call from ClearView Partnership as a,

Very aggressive hard sell. All talking about green credits and how my investment will make 30 plus percent.

Another described a “pratt called Jamie” from ClearView Partnership, who “called and started being a fool on the phone”.

“Mike” went for a job interview with ClearView Partnership. “Seems dodgy,” he writes.

It’s run by a 25 year old guy called Chris Chapman who handed me a script which is just the boiler-plate way of getting people to invest. Who ever calls you up doesn’t know anything. At the end of the script, before you get to talking about what your selling, you hand over to a senior broker. I literally have no idea what it is they’re selling.

After the interview, he called Financial Conduct Authority whistleblower line to report the company. That ClearView Partnership managed to convince an interviewee to report them is quite an achievement!

If you bought voluntary carbon credits from ClearView Partnership, REDD-Monitor would be very interested to hear about your experience with the company, in the comments below. If you believe you are the victim of fraud at the hands of this (or any other) company selling voluntary carbon credits as an investment, you should contact Action Fraud, either via their website or by ringing them up on 0300 123 2040:

Comments following the original post on REDD-Monitor.org are archived here: https://archive.ph/Y5Bgm#selection-815.4-815.15