Evertreen: Non-transparent tree planting and dodgy carbon offsets

I know, I know. All carbon offsets are dodgy.

A few weeks ago a REDD-Monitor reader got in touch to ask me about a company called Evertreen. He’d signed up with Evertreen “hoping to do some good”. He was impressed by the “big names in their website”.

Evertreen describes itself as “on a mission to transform the world, one tree at a time”. The company “connects companies and individuals to reforestation projects in several countries”. Via the company’s website, you can “Plant & offset from £1.5”.

Evertreen appears to be yet another tree planting company selling carbon offsets, in other words.

The company behind Evertreen is called CG Green Solutions Ltd and was incorporated in the UK in April 2020. The company was founded by Daniele Ciufo who previously worked for two years at Morgan Stanley. Luca Giordaniello became a director in March 2021.

The company’s registered office is in Brentford, London, in an office building shared with 685 companies.

Let’s see how many red flags Evertreen raises.

Two companies have significant control over CG Green Solutions: DCF Capital Ltd (since September 2024); and Synesthesia Colours S.L.U.

Daniele Cuifo is the only director of DCF Capital. The company’s registered office is the same as CG Green Solutions, in Brentford. The company has net assets of £100,432.

Synesthesia Colours is a Spanish company with only one shareholder (S.L.U. stands for “Sociedad de la responsabilidad limitada unipersonal”). There is no information about the company available on the OpenCorporates website. The company’s address in Barcelona appears to be a restaurant.

On its website, Evertreen lists “Our projects for a better world”. For example, there’s a project called “Indonesian Emerald Reforestation”. It’s illustrated on Evertreen’s website with a photograph of Mount Merapi, a volcano near Yogyakarta on the island of Java, a Hindu temple on the island of Bali, and Kelingking Beach on Nusa Penida, an island close to Bali. Clearly, none of these photographs has anything to do with the reforestation project.

Evertreen claims that the project is “bringing back Indonesia’s mangroves”. Evertreen also claims to be “replanting native trees such as teak and meranti”.

But no information is given about where the trees are planted or how large the project area is. There are no maps. Instead there are vague statements such as this:

Deforestation and land mismanagement have been major drivers of environmental degradation in Indonesia. Evertreen’s project addresses these issues by promoting sustainable land management practices and providing alternative livelihoods for local communities.

A search for “Indonesian Emerald Reforestation” gives four results, all of which are on Evertreen’s website.

Evertreen is selling carbon credits from Indonesia for £9.98:

Evertreen gives no information about which company certified the carbon project, or which carbon registry the carbon credits are listed on.

There are similarly vague descriptions of tree planting projects in Kenya, the Philippines, Ethiopia, Honduras, India, Brazil, Mozambique, Rwanda and several other countries.

Evertreen is selling carbon credits from tree planting in India for a whopping £33.30.

In March 2025, Chris Harris, who works with a Canadian company called Ground Truth Data, Inc., took a look at Evertreen’s tree planting claims. Harris looked at two of Evertreen’s projects: New Brunswick, Canada; and Madagascar.

Harris writes that,

Each of these projects provides some basic location data, but key details — such as species selection, survival rates, and mapped planting areas — remain unclear or incomplete.

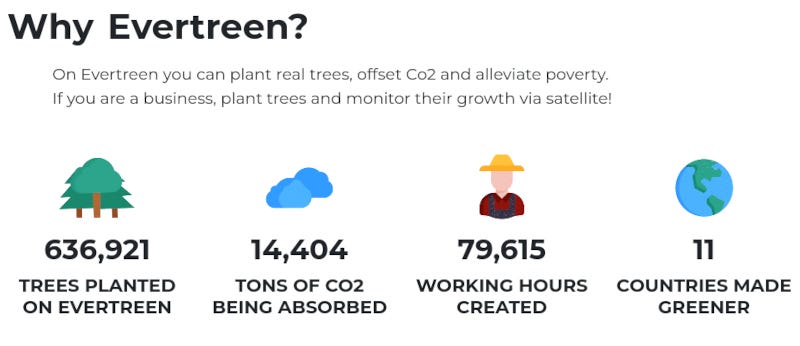

On its website, Evertreen claims to have planted 3,129,364 trees which have absorbed 3,025,356 tons of CO₂. That’s slightly less than 1 ton per tree.

Evertreen does not explain how it calculates the amount of CO₂ stored in each tree. The company’s website does include an article titled “How Much Carbon Does a Tree Capture?” This tells us that, “On average, a single mature tree can sequester about 48 pounds of CO₂ annually (U.S. Department of Agriculture, Forest Service).” There is no link to the source of this statement.

48 pounds is approximately 22 kilogrammes. That’s a lot less than 1 metric ton (1,000 kg). Even if all the trees were planted five years ago (which they weren’t) that would only bring the figure to 110 kg. And the trees that Evertreen is planting are not mature trees.

Evertreen points out in the next sentence that, “this number can vary based on species, age, and environmental conditions.”

In the same article, Evertreen states that “According to the U.S. Forest Service, mature trees can sequester anywhere from several hundred to over a thousand pounds of CO₂ per year, depending on their species and size.”

Anywhere between 22 kg and more than 450 kg, then.

To make matters worse, over the years Evertreen has changed how it calculates how much CO₂ is absorbed by its trees. Here’s a screenshot of an archived copy of Evertreen’s website from 23 May 2023:

In 2023, each of Evertreen’s trees absorbed 22 kg.

Evertreen offers a subscription deal for companies:

For £100 per month, Evertreen will plant 100 trees, which will absorb 61 tons of CO₂.

For £500 per month, Evertreen will plant 200 trees, which will absorb 180 tons of CO₂.

And for £1,000 per month, Evertreen will plant 600 trees, which will absorb 370 tons of CO₂.

It doesn’t take a mathematical genius to notice that these figures make no sense. Planting 200 trees should cost twice as much as planting 100 trees, not five times as much. And we might expect the amount of carbon absorbed to be twice as much, rather than almost three times as much.

Despite claiming to have planted more than 3.1 million trees, CG Green Solutions’ most recent (unaudited) Financial Statement up to 30 April 2025 states that the company owns plant and machinery worth only £2,135. The Financial Statement also states that the “Average number of employees, including directors, during the year was: 1.” While the company has £467,808 in the bank, the company’s net assets are only £8,627.

Evergreen does not explain exactly how it counts and monitors all its trees, except to state that it has a “powerful satellite monitoring tool”. The satellite data is provided by a US-based company called EOS Data Analytics, Inc.

Evertreen explains that the satellite data covers growth status, detects aging or stressed areas, identifies disease by analysing nitrogen concentration in leaves, assesses photosynthetic activity, and highlights regions with water stress.

But none of this satellite data is publicly available.

In its “General Terms & Conditions of Service,” Evertreen includes the following get out of jail free card:

All data and imagery are supplied “as is”. Evertreen disclaims all warranties (express or implied) as to accuracy, sufficiency, fitness for a particular purpose, merchantability, title, and noninfringement.

A quick look at some of the projects from which Evertreen sells carbon credits suggests that the company’s monitoring leaves a lot to be desired.

On its website, Evertreen has a map of “Active projects”. In some cases, clicking on the project leads to one of the vague descriptions of tree planting in an entire country (e.g. Mexico and Honduras).

Here are some of the Verra-certified projects that Evertreen lists as “Active projects”:

REDD+ Project Resguardo Indígena Unificado–Selva de Mataven, Colombia: This project covers an area of 1.15 million hectares. In a 2021 report, Carbon Market Watch argued that the project used an inflated baseline to estimate how many carbon credits could be issued. The reference area, which is used to illustrate what might happen in the absence of the REDD project, has far more well-connected roads, and is therefore more prone to deforestation, than the project area. The entire REDD project area is Indigenous Peoples’ territory, whereas only part of the reference area is Indigenous Peoples’ territory. Carbon Market Watch calculates that between 2013 and 2019 the project could have issued as many as 18.35 million inflated credits. The status of the project is currently listed on Verra’s registry as “Verification approval requested”.

Evergreen REDD+ Project, Brazil: In June 2024, Brazil’s Federal Police launched Operation Greenwashing aimed at a criminal organisation suspected of illegally grabbing public lands, producing fraudulent documents, selling illegal carbon credits, and illegal logging. One of the five people arrested was Ricardo Stoppe Junior. He was accused of running a massive illegal logging scheme. Shortly after Operation Greenwashing, Verra started a review of Evergreen REDD+ Project. The project is listed as “On hold” on Verra’s registry.

Rio Anapu-Pacaja REDD Carbon Credit Project, Brazil: In 2022, World Rainforest Movement published a report about REDD projects in Portel, in the state of Pará. The Intercept Brazil also published a detailed article on the projects. In July 2023, the Pará state Public Defender filed legal cases against the proponents of the REDD projects, including the Rio Anapu-Pacaja REDD project, for theft and unauthorised use of public lands. In 2023, the carbon credit rating company Renoster downgraded the Rio Anapu-Pacaja project to a score of “0.0” meaning that all the carbon credits issued from the project were hot air. In September 2023 Verra started a review of the Reio Anapu-Pacaja REDD project. The project is listed as “On hold” on Verra’s registry.

Madre de Dios Amazon REDD Project, Peru: This REDD project consists of logging operations overlapping with the territory of the Mashco Piro who are Indigenous People living in voluntary isolation. An investigation in 2021 by The Guardian and Greenpeace UK’s investigative journalism project, Unearthed, exposed the fake baseline used by the Madre de Dios project to exaggerate the amount of deforestation that supposedly would have happened in the absence of the project. Nevertheless, Evertreen appears unaware that this a logging operation and states that the project “unites multiple reforestation and restoration activities into one cohesive initiative”.

Kariba REDD+ Project, Zimbabwe: In October 2025, Verra completed an “in-depth review of the carbon accounting” of the Kariba REDD+ project. Verra concluded that it had issued the project developer, Carbon Green Investments, with 15.2 million fake carbon credits. Verra’s review followed a series of journalists investigated the project in 2023. The project is listed as “Withdrawn” on Verra’s Registry after Carbon Green Investments withdrew the project in June 2024. Evertreen is currently selling carbon credits from the Kariba project for £3.00 each.

Clients who pay Evertreen for tree planting and carbon credits receive a “Certificate of planted or protected tree”. Evertreen calls this “An official document that serves as proof of your contribution to reforestation and restoration. It includes tree details and conservation info.”

In reality, it is neither official, nor proof of anything much:

In its “General Terms & Conditions of Service,” Evertreen gives the game away:

Evertreen may source financing for Projects that are (a) internally monitored by the Company or (b) externally verified under recognised carbon standards (including but not limited to Verra, Gold Standard, and the Core CBL market). The mix of internally and externally verified Projects utilised for a given Client contribution is determined solely at Evertreen’s discretion.

So when clients pay for carbon credits from Evertreen, there is no way of knowing whether they will receive carbon credits certified by Verra, Gold Standard, or carbon credits that are “internally monitored” by Evertreen.

Clients won’t even know which country the carbon credit is going to from. While Evertreen’s clients can theoretically chose which country they want their carbon credits to come from, Evertreen writes that “Such choice is nonbinding.”

Evertreen reserves the absolute right, at any time and without prior notice, to reallocate all or part of the Client’s contribution to a Project in another jurisdiction, provided that the alternative Project delivers, in Evertreen’s reasonable judgement, environmental equivalence (same or higher estimated tCO₂e).

Reallocation for reasons of operational efficiency, seasonal constraints, phytosanitary risk, local regulatory change, or credit availability shall not entitle the Client to a refund, discount, or compensation.

In fact, Evertreen’s clients appear to have given away any chance of getting any money back — no matter what:

The Client irrevocably waives the right to refunds, chargebacks, or payment disputes once a transaction (initial or renewal) is processed.

https://registry.verra.org/app/projectDetail/VCS/4381?_gl=1*ri7zy*_gcl_au*MTM0OTUzMjAxMS4xNzUxMjQ4MTI2*_ga*ODg2MDUxMTAyLjE3MDE2ODI3NDM.*_ga_2VGK901B6P*czE3NTQ0NTMwNTQkbzM5MiRnMSR0MTc1NDQ1NTU3MiRqNjAkbDAkaDA.

https://registry.verra.org/mymodule/ProjectDoc/Project_ViewFile.asp?FileID=140073&IDKEY=niquwesdfmnk0iei23nnm435oiojnc909dsflk9809adlkmlkf0193160667

Systematic Non-Compliance and Fabrication

Additional evidence indicates that these projects were non-compliant not only at the level of Article 6 alignment, but also under Indonesia’s own mandatory national rules.

First, the projects never applied Indonesia’s legally required FREL/FEL (Forest Reference Emission Level / Forest Emission Level) in baseline construction. Instead, project-level baselines were created entirely outside the national framework, despite Indonesia having an officially submitted and approved FREL under the UNFCCC. This alone disqualifies the projects from being considered valid mitigation activities under Indonesian law and international REDD+ norms.

Second, FPIC procedures were demonstrably fabricated. Community representatives presented as independent consent providers were, in several cases, the same individuals holding positions as local forestry officials, creating an obvious conflict of interest and invalidating any claim of free, prior, and informed consent. These irregularities were not corrected or meaningfully investigated.

Third, despite these fundamental defects, VVB CTI failed to flag or investigate the violations and nonetheless issued VVB reports that were submitted to Verra for registration. This process collapsed only on 25 March 2024, when CTI was suspended following its involvement in a separate large-scale fraud case in China. As a result, the project was forced back into “under development” status—not due to substantive corrective action, but due to verifier incapacity.

Critically, this did not lead to remediation. On 30 October 2025, the same project was resubmitted for validation under the guise of an “update,” this time reclassified from REDD+ to ARR. Yet the core violations remained unchanged: FPIC irregularities persisted, national FREL/FEL were still not used, and the project was never properly registered within Indonesia’s national carbon system. The methodological relabeling functioned as a reset of paperwork, not as compliance.

Throughout this period, false representations were actively made to Taiwanese investors and partners. These included claims that the project had already been “registered,” that carbon credits were imminent, and that annual issuance would reach “one million tonnes.” In reality, what existed was at most a preliminary project code or listing, not legal registration, not authorization, and not any completed regulatory process under Indonesian law.

Moreover, Indonesian government documents were allegedly fabricated or misrepresented. At no point were there valid, legally issued Indonesian approvals demonstrating completion of required procedures, host-country authorization, or recognition under national regulations. No lawful basis existed for claiming offset eligibility or future credit issuance.

Taken together, these facts point to a broader structural failure. Verra’s system—despite memoranda of cooperation with Indonesia—has functioned as an enabling environment for misrepresentation, allowing non-compliant projects to circulate internationally, particularly in jurisdictions such as Taiwan where Article 6–aligned oversight is absent. The result is not climate finance, but systematic capital extraction under the appearance of climate action.

This is not an allegation based on disagreement over standards.

It is a documentation of repeated regulatory non-compliance, verifier failure, and factual misrepresentation, none of which were substantively corrected before continued attempts at monetization.

https://www.youtube.com/watch?v=LEt_EqOxQTA&t=32s

Misuse of the UNFCCC COP28 Platform

An additional and particularly serious concern is that some of these actors did not merely operate in regulatory gray zones, but actively leveraged the UNFCCC COP28 platform itself to launder credibility. By appearing in side events, fringe sessions, or loosely affiliated showcases around COP28, these projects wrapped themselves in the visual and institutional legitimacy of the UN climate process, despite lacking alignment with sovereign accounting requirements under Article 6.

This tactic exploits a well-known vulnerability in the COP ecosystem: while the UNFCCC sets the rules for intergovernmental accounting, the surrounding conference space allows a wide range of non-state actors to present narratives without formal validation. For unsophisticated investors or corporate audiences, the distinction between “being present at COP” and “being compliant with Paris Agreement accounting” is easily blurred. In these cases, COP visibility was used not to advance climate governance, but to manufacture perceived legitimacy for projects that could not meet host-country or Article 6 standards.

The issue here is not participation in COP per se, but representation. When projects that fail sovereign authorization or corresponding adjustment requirements present themselves under the symbolic umbrella of the UN climate process, the result is a form of institutional arbitrage. It allows legacy voluntary market narratives to survive longer than they should, precisely at a moment when sovereign systems are attempting to assert accounting discipline. This practice risks undermining trust not only in carbon markets, but in the broader multilateral climate framework.

In a sovereign carbon accounting era, COP participation cannot substitute for compliance. Visibility is not verification. Presence is not authorization. And association with the UNFCCC does not transform a non-accounted credit into a mitigation asset.