“Flowcarbon is a scam,” says Cory Doctorow about WeWork co-founder Adam Neumann’s new carbon offset and blockchain company

Adam Neumann, co-founder of WeWork, a company that crashed spectacularly in 2019, has raised US$70 million for his new company Flowcarbon. As Cory Doctorow points out, “Flowcarbon is a scam that is also a platform for scams – scams that roast the planet and bankrupt desperate retail investors.”

Flowcarbon is yet another startup that’s going to put offsets onto the blockchain, while making the delusional claim that this will somehow help address the climate crisis.

With Flowcarbon though it’s a bit different. The company is being called out as a scam before it launches its token to the public. Vox writes that it “sounds like a scam within a scam”. Techcrunch asks “Does WeWork’s Adam Neumann really deserve his second chance?” And Cory Doctorow writes that, “Flowcarbon is a scam.”

Here are some of the red flags that Neumann’s new company raises.

Offsets are a dangerous distraction

Flowcarbon exists to put carbon offsets onto the blockchain and make tokens available for sale to the public. It does nothing whatsoever to fix the problems with carbon offsets – the most serious of which is that they are a gigantic distraction from the need for structural economic and societal changes that involve leaving fossil fuels in the ground.

In a press release, Dana Gibber, Flowcarbon’s CEO, reveals that she’s never really looked into any of the problems with the voluntary carbon market:

There are powerful economic incentives to destroy and degrade critical natural landscapes around the world, but the voluntary carbon market is a brilliant financial mechanism that creates a counterbalancing incentive to reforest, revitalize and protect nature.

The problem with carbon offsets is not just that they may not actually be causing any reduction in carbon going into the atmosphere. The problem with offsets is that they allow Big Polluters to continue burning fossil fuels. Which is, of course, precisely how the oil industry is using offsets.

To make matters worse, it is impossible to verify whether an offset actually leads to a reduction in emissions, because offsets are based on a counterfactual story about what would have happened in the absence of the project that generated the offsets. Offsets are a completely fictional commodity.

Offsets have been generated from forests that would never have been logged, or forests that were attacked by illegal diamond, sapphire, from gold mining operations, and from community forests that were cleared by the Cambodian military.

Flowcarbon is buying low, selling high

Flowcarbon raised US$32 million in venture capital, and US$38 million from private pre-sales of its tokens – which are called “Goddess Nature Tokens”, believe it or not. Funders of Flowcarbon include Andreessen Horowitz (a16z crypto), General Catalyst, Invesco Private Capital and Samsung Next.

The Celo Foundation is one of the buyers of Goddess Nature Tokens in the pre-sale. The blockchain company bought US$10 million of the tokens to “offset” its own emissions.

And in April 2022, a company called Fifth Wall Climate Tech handed over US$4 million for GNTs. According to a company video, the company bought 279,000 offsets. That works out at US$14,34 per GNT. In September 2021, Ecosystem Marketplace reported that the average price for offsets from forestry and land-use projects in 2021 was US$4.73. That’s a tidy mark-up.

Adam and Rebekah Neumann

Adam and Rebekah Neumann were behind the WeWork co-working space company. Why venture capital firms believe that Neumann’s new company is worth gambling on, is a bit of a riddle. After WeWork collapsed, The Guardian described Adam Neumann as,

the tall, long-haired, barefoot, meat-banning, weed-smoking, tequila-drinking, Kabbalah-studying, experimental school-opening Paltrow-cousin-in-law and founder and now deposed chief executive officer of the We Company.

WeWork leased office space, divided it up into smaller chunks, then rented the desk space out month to month. The company raised a huge amount of funding.

Incidentally, Bar Works, Renwick Haddow’s co-working investment scam, was inspired by WeWork’s apparent early success.

One of Haddow’s scams before Bar Works (and there were many) was selling carbon offsets. Neumann is going the other way – from co-working to offsets.

There are books about WeWork’s collapse, a documentary on Hulu, and an eight part series on Apple TV. Bloomberg has a good overview about WeWork and how it collapsed:

My favourite part is when Neumann trademarked the brand “We” and sold it to his company for US$5.9 million. (WeWork managed to get the money back, after a public outcry.)

Neumann was forced out as chief executive of WeWork but he still managed to walk away with more than a billion dollars from the company. WeWork sacked 2,400 people after Neumann left. By November 2019, that figure had risen to nearly 6,000.

Justin Guay of The Sunrise Project nails it with this tweet:

Flowcarbon is registered in a tax haven

Flowcarbon’s “Lite paper” states that the company is “Headquartered in NY”, but the company was registered in the tax haven of Delaware, on 8 July 2021. Registering a company in a tax haven is not illegal. But registering a company in a tax haven is a way of avoiding paying tax, and therefore increasing profits. It’s also a way of avoiding scrutiny. Given the Neumanns’ history with WeWork, where the flaws were exposed only when the company released documents as part of its initial public offering in August 2019, any level of secrecy has to be a red flag.

Flowcarbon is ridiculously complex

“Complexity is a fraudster’s best friend,” Cory Doctorow writes. And anything involving carbon offsets and the blockchain is complex.

Here’s how Robert Rix, Verra’s chief legal, policy and markets officer, describes what’s happening under the Flowcarbon business model:

“It’s mind frying. Carbon credits themselves are abstract intangible things based on counterfactuals of things that you can’t actually see – emissions. And then crypto is another layer of abstraction on top of that.”

(I know. I used that quotation in a post two days ago. And I know that Rix wasn’t specifically talking about Flowcarbon. But Rix’s description perfectly describes what Flowcarbon is doing.)

Flowcarbon’s offsets are not retired

Flowcarbon’s carbon offsets are not retired before they are put on the blockchain. Flowcarbon argues that this means that the offsets “retain full off-chain value and can be used as an offset”.

In its press release, Flowcarbon explains that its mission is to,

drive billions of dollars directly to projects that reduce or remove carbon from the atmosphere by creating the first open protocol for tokenizing live, certified carbon credits from projects around the globe.

Flowcarbon’s lite paper explains that,

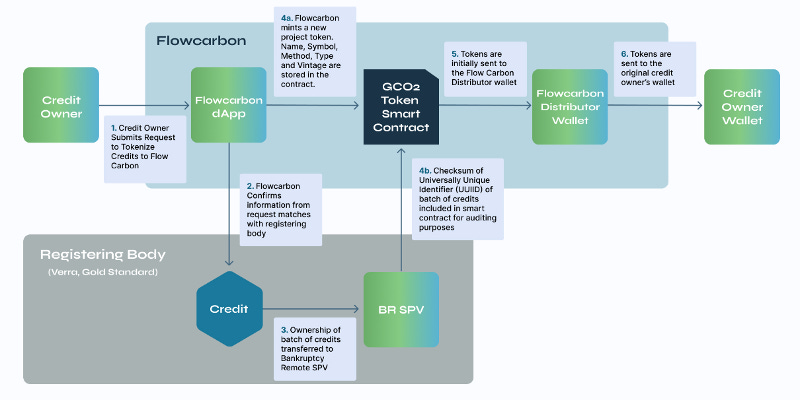

Each off-chain carbon credit will be tokenized into GCO2 tokens that are unique to each project and vintage year from which credits are sourced. GCO2s are then added to a bundle with other GCO2s that have similar characteristics, and the fungible GNT token is minted from the bundle.

Here’s Flowcarbon’s diagram showing the “minting” of the offsets onto the blockchain:

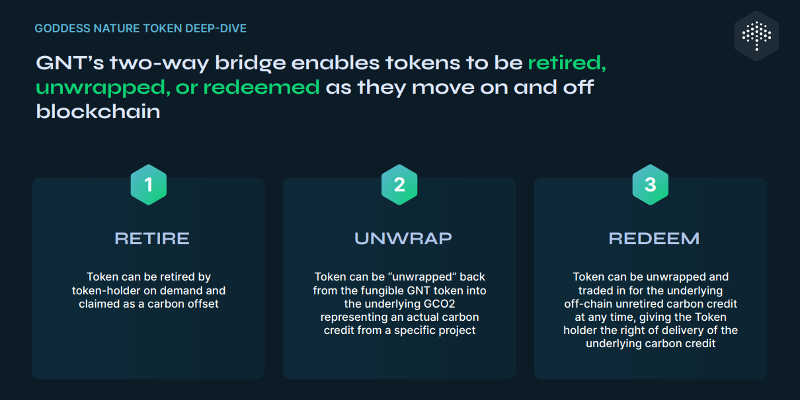

And here are two slides from Flowcarbon’s “lite paper” giving “deep dives” into the Goddess Nature Token and the Token Architecture:

If that isn’t enough to set off alarm bells about complexity being a scammer’s best friend, I just don’t know what is. It’s anyone’s guess whether Verra will allow live offsets to be tokenised, particularly since Verra announced last week that it is prohibiting tokenisation of retired offsets.

Flowcarbon is a scam

In June 2022, Flowcarbon will offer its speculative crypto “Goddess Nature Tokens” to the public.

Buyers of GNTs can hold them and hope that the price goes up or use them as offsets. Doctorow writes that, “Neumann’s new venture, Flowcarbon, will only be profitable if naive, retail investors also buy into it.”

And Doctorow points out,

Their pitch to you, the person hoping to retire without freezing or starving to death, is that you should buy the Goddess Tokens now. Get on the waiting list, and hold Goddess Tokens against the day that they shoot up in value as Adam Neumann — the $47b failure who nevertheless walked away with $480m of his investors’ money — leads the company to glory.