“Carbon will be the world’s biggest commodity market, and it could become the world’s biggest market over all,” Louis Redshaw, head of environmental markets at Barclays Capital, told the New York Times in July 2007.

In the same article, Chris Leeds, then-head of emissions trading at Merrill Lynch, said that, carbon could become “one of the fasting-growing markets ever, with volumes comparable to credit derivatives inside of a decade.” Four years later, things have changed somewhat. Reuters recently described carbon as the world’s worst performing commodity. And even the World Bank acknowledges that carbon markets “now face major challenges”.

This might just be a blip for carbon markets. California’s emissions trading scheme, which is planned to start in 2013, could boost carbon trading. The World Bank employs about 200 staff to work full time on carbon markets, according to Andrew Steer, the Bank’s special envoy for climate change. The International Finance Corporation’s Climate Business Group has a US$200 million Post-2012 Carbon Facility, that will buy carbon credits generated after 2012 and forward purchase Certified Emission Reductions produced from 2013 to 2020 from IFC financed projects. Meanwhile, the UN Environment Programme’s Finance Initiative is working with financiers to promote carbon trading – particular for REDD.

If carbon is, at some point in the future, to become the “world’s biggest commodity market”, it is worth asking who will benefit from this recently created commodity.

Last week, a team of Reuters journalists produced profiles of 16 commodity traders, that between them have revenues of US$1.1 trillion a year. These companies sell more than half of the world’s freely traded commodities. Just two of them, Vitol and Trafigura, sold more oil last year than the combined exports of Saudi Arabia and Venezuela.

Commodity trading is hugely profitable, not least because traders make money whether the price goes up or down. For them, the current economic crisis is an opportunity. And they can manipulate the markets of the commodities in which they are trading. Reuters explains:

For many commodities traders, the most profitable ploy has been the squeeze, which involves driving prices up or down by accumulating a dominant position.

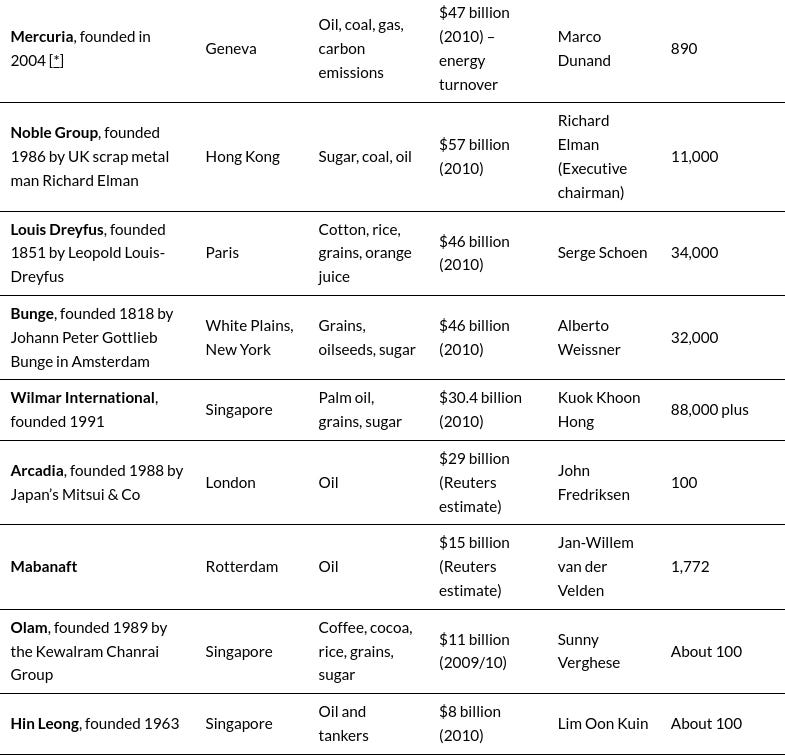

So who are these companies? The basic information about the world’s top 16 commodity traders, from the Reuters report is complied in a table below. Read the Reuters report for more information about these companies.

Almost all of the companies are involved in carbon trading. If carbon were to become the world’s biggest commodity, these companies would probably accumulate dominant positions in carbon. Some are involved in oil trading and carbon trading. Others are involved in large-scale forest destruction and carbon trading.The logic is simple. Oil trading is profitable. Clearing forest is profitable. Carbon trading is profitable. Win, win, win. For the traders, that is. For the climate, of course, it’s a disaster, because carbon trading does not reduce emissions.

Here is a thumbnail sketch of the top 16 commodity traders’ involvement in carbon trading. Feel free to add further information about these companies in the comments:

“Vitol has one of the largest and most diverse carbon project portfolios in the world and our involvement and expertise in carbon markets is global and comprehensive,” the company states on its website. In January 2011, Vitol announced that it had bought a 76.3% stake in Carbon Resource Management (CRM). CRM has a “portfolio of over 45 million tonnes and over 200 CDM projects currently being progressed”.

Glencore has said that it is not interested in carbon trading, apart from as a means of offsetting the emissions from its shipping activities. “We are a physical commodity trader so those [carbon] markets aren’t of interest to us,” a company spokesperson told Reuters. The company is involved in trading biofuels, and says that “biofuels will be increasingly important to Glencore as it attempts to address climate change concerns”.

Cargill has a fully-owned subsidiary called Green Hercules Trading Limited. The company has “an array of services, such as financial support to carbon reduction projects, at all stages.”

Koch Industries funds plays a major role in accelerating climate change through its oil trading. It also funds several climate denial think tanks and lobbies against any government action on climate change. At the same time, Greenpeace notes that Koch Supply and Trading, a Koch Industries subsidiary, has participated in carbon trading in the US.

ADM Investor Services is a subsidiary of ADM. In its monthly review of December 2010, it described carbon markets as “A golden opportunity in a commodity that is not gold” and predicted a 30 per cent price increase year on year. (The most recent monthly review from ADM Investor Services makes no mention of carbon markets.)

In August 2010, Gunvor and JP Morgan completed the first European Union 2020 over-the-counter European Union Allowance carbon contract. The over-the-counter trade, was part of a “complex structured deal involving trades with earlier delivery dates”, the brokerage company, Tradition, said in a statement.

Trafigura appears to have no involvement in carbon trading. However, the Trafigura Foundation has set up a biogas project in Yunnan, China which generates carbon credits.

Mercuria announced in 2009 that “Mercuria Energy is positioning itself to be one of the world’s top traders in carbon”. Last year, Mercuria Energy bought carbon offset project developer MGM International Group. Last week, Point Carbon reported that MGM International was involved in a project in Colombia where Ivan Cepeda Castro, a Colombian senator and leading human rights activist, accused the country’s largest cement manufacturer, Cementos Argos, of using illegally-seized land for a tree planting project to generate carbon credits. Mercuria sponsors IUCN to “strengthen capacity for economic approaches to biodiversity conservation in developing countries”.

“Noble is a major player in the expanding global market for emission reduction certificates or ‘carbon credits’ and one of world’s largest suppliers of registered CERs,” according to the company’s website. Last year, the Noble Group announced that it had bought a 52% stake in a 32,500 hectare oil palm plantation project in West Papua. The investment was heavily criticised by Papua Forest Eye under the headline, “Noble savages Papua’s forests“.

LDH Energy is the merchant energy platform of the Louis Dreyfus Group and Highbridge Capital Management, which is wholly owned by JPMorgan Chase. “LDH Energy has been active in emission credit markets since 2006. We operate across all emission markets with a specific focus on global carbon markets,” according to the company’s website.

“Bunge has been engaged in mitigating carbon emissions for several years through investments in Clean Development Mechanism (CDM) projects, participation in European cap and trade markets, and via the Bunge Emissions Group,” the company states on its website. The Bunge Guara biomass project aims to generate carbon credits by switching the fuel in one its fertilizer plants in Brazil from gas to firewood from eucalyptus plantations.

Wilmar International has cleared large areas of forest in Indonesia to make way for oil palm plantations. It also stands accused of human rights violations. While the emissions from this forest destruction are large, Wilmar is generating carbon credits through clean development mechanism projects by using biomass from waste products from its plantations to fuel its palm oil factories.

“Arcadia Energy Trading (AET) has taken a pre-emptive position in the Australian carbon market supplying Certified Emissions Reduction units (CERs) to Australian industry,” according to the company’s website.

“Mabanaft is expanding its current portfolio of trading activities into the carbon credit business,” according to a 2009 announcement on the company’s website.

Olam International, as well as trading in commodities, also owns forestry operations covering 2.3 million hectares in Africa. In December 2010, the company announced that it may enter the carbon market by building a biomass power plant. “The carbon potential is certainly something that we will be looking at seriously over the coming years,” Robert Hunink, Olam’s global head of wood products business announced.

As far as I’m aware, the sixteenth company in the Reuters report, Hin Leong, has not expressed any interest in carbon trading.

[*] Some of the information about Mercuria in this table comes from the company’s website, not the Reuters report.

Comments following the original post on REDD-Monitor.org are archived here: https://archive.ph/aE0ZR#selection-1797.4-1797.15