Celestial Green Ventures is an Irish carbon trading company, registered in November 2010. In 2011, the company claimed to have carbon rights to 20 million hectares of Brazil’s rainforest. The company aimed to become the “leading global supplier of REDD carbon credits in the Voluntary Carbon Market”.

In June 2011, Celestial Green Ventures forward sold one million carbon credits to Industry RE, a London-based company. A boiler room operation called Emerald Knight scammed retail investors into buying the carbon credits as investments.

Two years later, the High Court ordered Industry RE into liquidation.

Meanwhile, Brazil’s National Indian Foundation, FUNAI, declared that the carbon contracts Celestial Green Ventures had drawn up with Brazil’s indigenous peoples were “not valid”.

Reuters reported in December 2012 that a federal attorney in Rondonia had filed a lawsuit to cancel a contract signed by Celestial Green Ventures LLC and the Awo Xo Hwara Indigenous community. The Irish Times reported shortly afterwards that Celestial Green Ventures was “suspending agreements it has with indigenous tribes in the Amazon forest following legal moves by the Brazilian authorities”.

In 2011, Celestial Green Ventures listed on the Frankfurt stock exchange. In its prospectus, the company looked forward to generating more than US$600 million profits the next five years from sales of carbon offsets to companies. Celestial Green Ventures’ share price plummeted, and by 2013 it was delisted.

In 2012, Celestial Green Ventures listed 16 REDD projects on its website:

Today, Celestial Green Ventures’ website lists only one project: Trocano Araretama REDD+ Conservation Project. The project covers 1.3 million hectares, with 107 communities living in the project area.

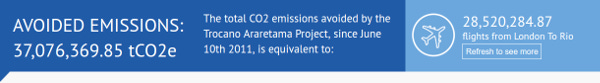

Despite the difficulties it has run into in the past few years, Celestial Green Ventures hasn’t lost its optimism. The company claims that more than 37 million tonnes of carbon dioxide emissions have been avoided by the Trocano Araretama project since 2011. Here’s a counter from the company’s website:

Unfortunately, the Trocana Araretama project website seems to have disappeared.

Tax troubles

In 2012, Celestial Green Ventures reported a €1 million loss. The following year, a €1.6 million pre-tax profit. Earlier this month, Michael Gladney, Collector General at the Revenue Commissioners (Ireland’s taxman), submitted a petition to the High Court to have Celestial Green Ventures wound up. The petition is due to be heard on 4 April 2016.

In May 2015, the Irish Times reported that a note in Celestial Green Ventures’ accounts stated that the company “is in dispute with an unidentified former customer, now in liquidation, concerning the return of a deposit of €1.9 million”. Celestial Green Ventures stated that, “The company has rejected this claim, has taken legal advice, and is of the view that no provision is necessary.”

Natural Capital Credits

Celestial Green Ventures’ voluntary carbon credits are not certified by the Verified Carbon Standard or the Climate, Community and Biodiversity Standard. Instead, the company sells “natural capital credits”, certified by the Natural Forest Standard. Here’s how the Natural Forest Standard explains what natural capital credits are:

Natural Capital Credits are unique to the Natural Forest Standard as the resulting certificates generated from successfully validated and verified NFS projects. As a result of this, NCCs inherently exhibit carbon, social and biodiversity features that together equate to a Natural Capital Credit.

Natural Forest Standard

The Trocano Araretama REDD project is the only project to have been verified and validated under the Natural Forest Standard. The Natural Forest Standard was developed in 2011 by Ecosystem Certification Organisation and Ecometrica. The Natural Forest Standard Registry is administered by Ecosystem Certification Organisation.

Ecosystem Certification Organisation was registered in the UK in June 2011. Victoria Kelly, a relative of Ciaran Kelly, is director of Ecosystem Certification Organisation. She’s also a director of the Natural Forest Standard. And Ciaran Kelly was a shareholder in the Natural Forest Standard, until March 2015, when he transferred his shares to Victoria Kelly.

The Natural Forest Standard’s office is in East Sussex (Third Floor, Map House, 34-36 St Leonards Road, Eastbourne, East Sussex, BN21 3UT):

Ecosystem Certification Organisation and the Natural Forest Standard shared the same address until recently.

If you look very closely at the windows on the third floor of Map House, you’ll see the logo of an accounting firm called MDJ Services Limited. Until 31 December 2015, David Jenkins of MDJ Services Ltd, was director of both Natural Forest Standard and Ecosystem Certification Organisation. Jenkins is still listed as Finance Director, on Ecosystem Certification Organisation’s “Governance Board” and on the Natural Forest Standards’ Governance and Secretariat.

Here is Ecosystem Certification Organisation’s flash new office in Polegate, East Sussex (Unit A6, Chaucer Business Park, Dittons Road, Polegate, East Sussex, England, BN26 6QH – an address it shares with MDJ Services Ltd and several other companies):

Natural Capital Wealth

A company called Natural Capital Wealth is currently marketing Celestial Green Ventures’ Natural Capital Credits. Here’s a company brochure, aimed at companies, encouraging them to buy Natural Capital Credits.

Natural Capital Wealth was registered in Ireland in November 2012. John Russell-Murphy is a director of the company. The website was registered in November 2012 in Murphy’s name, with an address for Natural Capital Wealth in Eastbourne, East Sussex.

One of Murphy’s other companies is Grosvenor Park Intelligent Investments, also from Eastbourne, East Sussex. For about four months in 2011, the company was registered as an appointed representative of Stonebridge Mortgage Solutions Ltd with the Financial Conduct Authority. Since then, Grosvenor Park Intelligent Investments has not been registered with the FCA.

According to a July 2012 article in the Financial Times, Grosvenor Park Intelligent Investments was offering a three-year investment scheme paying a “fixed return” of 145%.

Murphy told the Financial Times that his company was buying repossessed houses from banks in Detroit to refurbish them and sell them at a profit:

“Mortgage costs are only about 25 per cent of rental values in Detroit, so people are desperate to get back on the housing ladder. The firm has done 400 properties so far and is looking at a further 10,000 over the next three years.”

Of course, this all sounded too good to be true. And a couple of years later, The Guardian was reporting on foreign investors being scammed into buying property in Detroit. Reuters joined in at the end of 2015.

Grosvenor Park Intelligent Investments also offered investments in bamboo, warehouse storage pods and luxury Caribbean resorts.

In October 2012, Grosvenor Park Intelligent Investments ran an interview with Ciaran Kelly on its website. The company asked, “Could you tell us about investing in the voluntary carbon market?” Kelly answered that due diligence is important and added,

“They are a good investment and have been for a long time, and investor confidence is ever-increasing, at the premium end of the market. REDD+ credits for example have shown price increase year on year, and have seen the popularity in these projects increase, predominantly due to the additional features which are inherent to them, such as Conservation, Biodiversity Protection and Socio-economic Investment. Many investors are increasingly searching for a unique, financially viable and environmentally sustainable alternative, which is what CGV has identified, and is now providing to the market; in the form of NCCs developed under a REDD+ methodology.”

As many retail investors who were scammed into buying carbon credits found out the hard way, this is extremely misleading advice. Carbon credits are a wasting asset, not an investment. The value of a carbon credit falls over time. In any case, there is no secondary market for voluntary carbon credits.

Comments following the original post on REDD-Monitor.org are archived here: https://archive.ph/EHn7q#selection-1027.4-1027.14