Living Investments UK and Hyperion Management are boiler room scams that offered investments in teak plantations in Costa Rica. But will the UK authorities take any action?

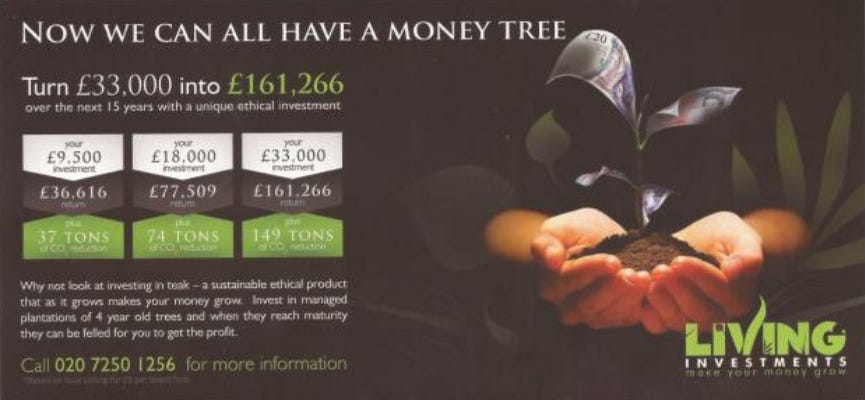

A company called Living Investments UK offered investments in teak plantations in Costa Rica. A 2011 flyer claimed to be able to “Turn £33,000 into £161,266 over the next 15 years with a unique ethical investment.” In addition, the investment would result in a reduction of 149 tons of CO2, according to Living Investments UK.

Investors were told that they “lease plots of forest for the time it takes the trees to mature”. On its website, the company stated that,

From the outset, clients own the trees, which are always at least three years old to avoid the numerous complications that often occur when growing seedlings. When the trees are thinned at year 11 (after 8 years of ownership) or felled, revenue is generated.

“A big fat no-no”

Here’s how financial journalist Holly Thomas describes Living Investments UK and its investment scheme:

The company, run by one individual named Nick Durrant, isn’t regulated by the Financial Conduct Authority (FCA). The website, which is full of typos, encourages investors to transfer their pensions into a Self-invested personal pension (Sipp) so they can invest their retirement savings into this unregulated and illiquid scheme — a big fat no-no. We placed numerous calls to Living Investments, which were answered by a call-answering service and none were ever returned.

In 2010, Gregory Monks paid about £12,000 to Living Investments UK, after seeing a flyer in New Statesman magazine. In a comment on REDD-Monitor, he describes his experience:

As an investor I apparently own sub leases in two plots of timber in Costa Rica. I am supposed to be responsible for their annual maintenance, and the company is supposed to arrange for a local forestry company to invoice me and keep me informed of my investment. After about a year of being subjected to high pressure sales calls trying to get me to buy more plots, I have only ever received invoices from one company for one year, at a cost of just under £500. If I do not maintain the plots of course I apparently lose the right to any returns from the harvest. The service is so appalling that I am now reluctant to throw any more good money after bad, and have asked for a refund of my original investment.

Title Trustees International

The deeds for the plots of land, according to Living Investments UK were held in trust by Title Trustees International, a company that was dissolved in July 2016. Title Trustees International was part of a network of companies around Highpoint Trustees (which was previously called Citadel Trustees). Title Trustees International shared the same address (5 Priory Court, Tuscam Way, Camberly, Surrey, GU15 3YX) as Citadel Trustees and many of the same directors.

In September 2021, REDD-Monitor summarised some of the scam investments that Citadel/Highpoint Trustees had been involved with. Citadel/Highpoint Trustees is under investigation by the Financial Services Compensation Scheme:

When Gregory Monks complained to Title Trustees International, they passed him back to Nick Durrant and Living Investments UK. Durrant did not pick up the phone when Monks rang him.

Living Investments UK: “Unprofessional, unreliable and unscrupulous”

Other victims of Living Investments UK left comments on REDD-Monitor. Alan G. handed over more than £30,000 to Living Investments UK. He describes the problems he’s faced with Living Investments UK:

In the last nine years I have paid over £30,000 to this firm in investments, administration fees and maintenance fees – with no due returns from thinnings, no returns at maturity, no response to any letters or phone calls.

He sums up his frustration with the company as follows, “Living Investments UK appears at best to be unprofessional, unreliable and unscrupulous.”

In January 2022, someone calling themselves “Hot Cold Chameleons” left a comment saying that her father, who had been “hoodwinked into the same scam” had died in March 2021. He was the victim of several other boiler room scams as well.

Because Action Fraud had failed to take any action on Living Investments UK, the family complained to the Financial Ombudsman Service about her father’s bank, HSBC. They argued that the bank should have protected him from handing over “huge amounts” of money to boiler room fraudsters. That was in January 2021. A year later her father’s case had still not been allocated to an investigator.

More disgruntled investors with Living Investments UK discuss their experience with the company here. The question for these people and all of the victims of this investment scam is whether the UK authorities will take any action. So far, Action Fraud has not passed Allan G.’s complaints to the police to investigate. Other victims have had a similar response (or lack of one) from Action Fraud.

Living Investments UK: Red flags

Living Investments UK’s investment scheme raises a series of red flags. This section is not an attempt to appear wise after the event, but to help readers spot and avoid future scams.

Living Investments UK cold called potential investors to tell them about “an ethical investment opportunity in a teak plantation project in Costa Rica”. Any unsolicited call is always a huge red flag. The Financial Conduct Authority warns that all unexpected calls, emails and text messages should be treated with caution. “Don’t assume they’re genuine,” the FSC warns, “even if the person seems to know some basic information about you.” The safest option is to put down the phone. (There’s a more colourful, but slightly better, version of this advice later on in this post.)

In January 2019, the UK finally put in place a ban on cold-calling about pensions. While welcome, the ban doesn’t go far enough. A ban on all cold-calling would have been better.

A search on Open Corporates reveals no registration details for a company called “Living Investments UK”. And a search for “Living Investments” gives many possible matches, but nothing conclusive. On its website, Living Investments UK gave the following address: 14 Grenville Street, London EC1N 8SB. I’m sure its pure coincidence that that’s the registered address of a company called IGL Labs UK Ltd, which was part of a diamonds investment scam involving Citadel Trustees.

Living Investments UK is not listed on the UK’s Financial Services Register. The FCA recommends that, “If you’re buying a financial product such as a loan, insurance, investment or pension, only deal with a FCA-authorised firm – check the FS Register to see if the firm is registered.”

The website (livinginvestmentsuk.com) was registered in September 2009. So when Gregory Monks and others handed over his money to Living Investments in 2010, the website was only a few months old. The company had appeared only recently and there was no way of investigating its record of previous investments, let alone its record in managing teak plantations – in Costa Rica, or anywhere else. To make matters worse, the website was registered anonymously.

Living Investments UK claimed that an investment of £33,000 would return £161,266 in 15 years. The company claimed that its investments would “Remove the volatility of stock markets and property”. If these promises seem to good to be true, it’s because they are too good to be true. At best, this is an extremely high risk investment. Far more likely is that it is a Ponzi scheme. As investigative reporter David Marchant of Offshore Alert points out, “Any investment scheme with a performance chart that is essentially a diagonal line trending upwards with little or no meaningful variation over many months is a Ponzi scheme and, as such, doomed to failure.”

Here’s how the US Securities and Exchange Comission defines a Ponzi scheme:

A Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors. Ponzi scheme organizers often solicit new investors by promising to invest funds in opportunities claimed to generate high returns with little or no risk. In many Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier-stage investors to create the false appearance that investors are profiting from a legitimate business.

In the case of Living Investments UK however, the investors commenting on REDD-Monitor and elsewhere received no payments whatsoever.

In June 2013, Vernon Martin wrote about Living Investments UK on his blog International Appraiser. Martin had received an email from Steve James of Living Investments UK, threatening to sue him for libel because of a comment following another of his blogposts about investments in teak plantations in Costa Rica. Martin questioned Living Investments UK’s calculations for the growth rate of teak trees, and how much money the company anticipated selling the timber for.

He also found a couple of interesting comments (at qfak.com – the comments no longer exist, and I’ve edited them slightly to correct the spelling and grammar):

Question: “I keep getting calls from someone at Living Investments UK. They apparently have a teak plantation in Costa Rica and they asked me to invest £25,000. I personally think it is a scam, but I’m not sure. Has anyone else had any experience with them? I don’t like how persistent they are. They were definitely using boiler room tactics.”

Answer: “Smithmeister, I think I remember you, I started with you for the training week thing. I stayed a little bit longer than you, I have a less sensitive bull**-o-meter and I stayed for 8 days. It is the most ridiculous company I have had the pleasure of working for. They have a virtual office at 14 Grenville Street, but it is simply a decoy for all their letters to go there. They actually operate from 6-8 St. John Street EC1 in Farringdon.

“No they are not regulated by the FSA and companies like this make me sick because they don’t know the impact they have on peoples lives. They don’t deal with any fund managers or pension managers. They get all the prospects from an investors list with mainly elderly pensioners and harass them for money. It’s not even a limited company, its sole proprietor is some guy who no one knows. If someone calls from Living Investments UK, tell them to stick the phone up their arses.”

And Martin found a job advertisement for Living Investments UK:

Company Living Investments UK

Job location London (United Kingdom)

Contract type Permanent

Closes on April 19, 2013

Basic Comm 55K-85,000 City based private client brokerage is interviewing for the above positions for an immediate start. We are looking for individuals who are proven in introducing investments to private clients and IFA’s. If you have an extensive and highly successful experience of dealing with building client portfolio’s within a broker style environment we will be interested in hearing from you. You need to be driven and money motivated and with a strong professional work ethic and furthermore you need to be articulate and able to think on your feet. Our top earner earns over 130,000 p.a.

“They have the appearance of being a telemarketing boiler room operation,” Martin notes. “Is this legal in the UK?” he asks. “Probably,” he replies.

Nick Durrant, the man behind Living Investments UK is the sole director of a company called Hyperion Management (London) Limited. The company shares its telephone number with Living Investments UK (0207 250 1256). In a disclaimer on its website, Hyperion Management states that the company “is not regulated by the Financial Services Authority and does not offer any advice about any regulated or unregulated investments, either on this website or elsewhere”.

But elsewhere on the same website Hyperion Management is “offering clients the opportunity to invest in 3-4 years old teak trees and 9-10 years old trees”. Hopefully the disclaimer will be enough to persuade potential investors not to have anything whatsoever to do with Hyperion Management.