Naked Capitalism shines a spotlight on Carbon Neutral Investments

Part I of Richard Smith's series about CNI

Naked Capitalism is a blog set up by Yves Smith. She’s an expert on investment banking and the founder of Aurora Advisers, a New York-based management consulting firm. Carbon Neutral Investments is a company that, before it changed its name, provided services for a long list of companies that sold carbon credits as investments.

REDD-Monitor occasionally receives comments asking how someone with a training as an architect, an MSc in Forestry and 20 years experience as an environmentalist, can write about carbon credits as an investment. Here’s a typical comment along these lines (it also happens to be the most recent):

chris, who gives you the power to sit in Jakarta and blog non-sensical rubbish about a subject you no absolutely nothing about?

i doubt you have ever made an investment in your entire life, and probably do not no the difference between an IPO and a CFD.

Perhaps surprisingly, this wasn’t signed by Nigel Molesworth. Nevertheless, I think the answer should come from him: “A chiz is a swiz or a swindle, as any fule kno.”

Richard Smith’s series of posts on Naked Capitalism about Carbon Neutral Investments is filed under “ridiculously obvious scams”. He’s on safe ground with that classification, at least since 29 March 2013, when the UK’s Financial Services Authority put out a warning against Carbon Neutral Investments. The Financial Conduct Authority (as the FSA is now called) subsequently updated the warning to include Gemmax Securities:

Smith’s series on Naked Capitalism about Carbon Neutral Investments is excellent and well worth reading in full, but here’s a handy guide to the first five posts:

28 October 2013: How Novice Eco-Warrior Michael Bloomberg Ended up Looking as if he Endorses Carbon Credit Scams

Michael Bloomberg, the mayor of New York, probably wouldn’t want to be associated with a carbon credit scam. But there he is on CNI (UK) Ltd’s website on the front cover of April’s issue of L’Uomo Vogue (the Italian version of men’s fashion magazine Vogue) over a presentation about Carbon Neutral Investments Limited from the same magazine. At the time, as Smith notes, Carbon Neutral Investments was offering its services to a large number of boiler room companies selling carbon credits as investments.

Embarrassing for Bloomberg certainly. Even more so for the editor L’Uomo Vogue. But it seems that L’Uomo Vogue has been taken in even further. According to L’Uomo Vogue‘s puff piece about Carbon Neutral Investments, the magazine bought REDD carbon credits from Carbon Neutral Investments, “although they are more expensive” than credits from hydropower dams or wind farms. L’Uomo Vogue chose REDD credits because of the benefits for “the environment and the community that they provide. We believe in responsible publishing.” Yeah, right.

29 October 2013: The Glam and The Scam: Sauber Formula 1 Team and its Partner, Carbon Neutral Investments, Limited

Smith takes a look at the relationship between Sauber Formula 1 Team and Carbon Neutral Investments, in particular how Sauber Formula 1 Team tracks the re-branding of Carbon Neutral Investments to CNI (UK) Ltd. In April 2013, Carbon Neutral Investments split into three companies: CNI (UK) Ltd., Gemmax Solutions, and Opus Capital. The FSA warning about Carbon Neutral Investments came just a few weeks before the split. Here’s Smith:

Possible motivation: Seakens has been having some uncomfortable exposure in the national press relating to two of CNI’s scammy related companies, Anglo-Capital and Carbon Green Capital. Hiding that little contretemps away from the likes of Sauber, (CNI’s partner list is long and lustrous, BTW, as we will see) might make a whole lot of sense, for CNI.

30 October 2013: FBI Raids, Lord Heseltine’s Haymarket Media Group, Financial Regulator “Crackdowns”, “What Car” Magazine . . . and Carbon Neutral Investments Limited

What Car is published by Haymarket Publishing, which was founded by UK Conservative politician Michael Heseltine. In September 2011, Carbon Neutral Investments put out a press release announcing that “AGT Investments has re-branded, becoming Carbon Neutral Investments (CNI)”. The press release explains how CNI offset What Car‘s Green Awards in 2011, and it includes a quotation from Thomas Knifton, then-CNI co-chairman.

Smith takes a romp through Knifton’s history of involvement in one dodgy company after another. He also points out that another CNI partner James Brown’s claim to have a Diploma in Particle Physics from Oxford University is bogus, “because there is simply no such thing as a Diploma in Particle Physics from Oxford University”.

To sum up: two blokes, with two fake career resumés, an £80 million investment fraud (and an FBI raid as a side order), two boiler rooms shut down by the FSA. and a current scam warning from the FCA.

Great partner choice, “What Car” people! Great supervision, FCA!

31 October 2013: The Careless Organizers of Gumball 3000 are Hooked Up with Boiler Room Scam “Servicers” Carbon Neutral Investments (CNI)

Gumball is a motor rally on public roads. Smith isn’t a fan:

Perhaps sensing that this annual waste of rubber, petrol, environment and the occasional innocent bystander ought, in the long term, to attend to its image better than that, the Gumball 3000 has announced its intention to go “Carbon Neutral”, eventually.

And guess who is Gumball’s carbon offsetting partner? Step forward CNI, or the company formerly known as Carbon Neutral Investments.

1 November 2013: Carbon Neutral Investments’ Trail of Disaster: How Carbon Credit Con Artists use Google Adwords to Work the Recovery Scam

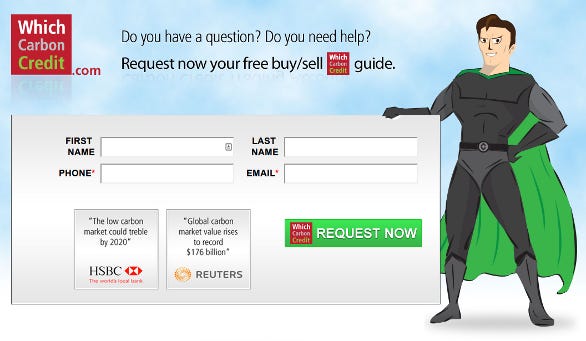

Smith turns his attention to the next stage of the carbon credits as investments scam: the Recovery Room. A website called whichcarboncredit.com is using Google’s Adwords to advertise their services for people searching for many of the company names for which Gemmax Solutions (another company formerly known as Carbon Neutral Investments) offers “clearing and settlement services”.

On their web site it appears that all whichcarboncredit.com really want to do is collect the enquirer’s email address and telephone number. Top tip: don’t give it to them.

Here’s a screenshot, to save you wasting your time visiting it (and running the risk of inadvertently typing in your phone number):

The website whichcarboncredit.com was set up by Luke Ryan. He’s a director of Enviro Associates, and was caught by the BBC last year making misleading claims about how much could be made by investing in carbon credits. Paul Seakens, who was once the director of Carbon Neutral Investments and is currently the director of Gemmax Solutions, also used to be a director of Enviro Associates (until shortly after the company appeared on the BBC).