Rabobank’s tree planting project in Côte d’Ivoire overestimates carbon credits by 600%. Microsoft is one of the buyers of these credits

No provable additionality. And double counting.

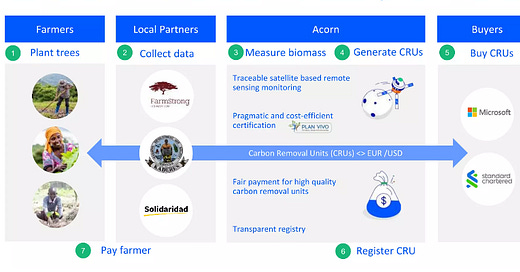

Rabobank is a Dutch multinational bank and financial services company. Since 2020, Rabobank has been selling carbon credits through a programme called “Project Acorn”, that generates carbon offsets by encouraging cocoa farmers to plant trees on their land.

Acorn’s website states that,

This is being realised through a different form of agriculture that stores carbon as biomass. This storage and trading of the carbon gives farmers access to the growing marketplace of carbon emissions and allows them to develop a new income source.

The companies buying these carbon credits include Microsoft, Standard Chartered, Lavazza, and Bain and Company.

Microsoft was Acorn’s first customer. On Acorn’s website, Jelmer van Mortel, Innovation Manager Markets at Acorn, explains that,

“We work closely with Microsoft. We have built a platform on their technology. On that platform we register the biomass measurements. With that we can calculate the stored carbon. The data is owned by the farmer who — in the future — can hopefully make this data available to other parties for a fee.”

In a 2021 promotional video, Eveline Van Wezel, Digital Advisor at Microsoft, says that,

“Rabobank asked us to provide a view on how they can use technology to make agroforestry more scalable. For Microsoft it’s very special to be part of this project, actually to be the first launching customer because it helps us to purchase carbon removal units that have a positive societal impact on under served communities.”

In 2020, Microsoft announced that the company would be “carbon negative” by 2030. But Microsoft also works hand-in-glove with the fossil fuel industry. These deals with Big Polluters remain in place, while Microsoft buys carbon offsets to give the impression of addressing the climate crisis.

A new investigative report by Ties Gijzel and Ties Joosten for Follow the Money, reveals that Rabobank could be massively overestimating the number of carbon credits generated by its project in Côte d’Ivoire. Gijzel and Joosten reveal that Rabobank cannot prove that the project is additional.

And in 2023, the Côte d’Ivoire government wrote to Rabobank asking the bank to stop selling carbon credits from the project because Côte d’Ivoire has already sold credits from part of Rabobank’s project area to the World Bank’s Forest Carbon Partnership Facility.

Over-estimating carbon credits — by 600%

Under Rabobank’s project in Côte d’Ivoire, which is called FarmStrong Foundation - Côte d’Ivoire, farmers are provided with timber and fruit trees for planting between cocoa crops. FarmStrong Foundation is a Swiss organisation founded in 2016 and runs the project in Côte d’Ivoire.

Since 2021, according to Acorn’s registry, the project has generated 122,457 carbon credits, which Acorn refers to as carbon removal units (CRUs). The project covers a total of 50,942 hectares.

More than one-third of the carbon credits that Rabobank has sold so far came from the Côte d’Ivoire project. Rabobank sells the credits for €35 according to Rabobank’s “Buy credits” web-page. (The web-page has now been removed, but an archived copy is available here.)

Rabobank uses satellite imagery to determine how many trees have been planted. From this information, according to Acorn, the amount of carbon stored in the trees can be calculated.

Using satellite imagery is much cheaper than actually checking what’s happening in the project area. Rabobank argues that this allows more money from carbon credit sales to be given to farmers.

But in June 2022, a Danish consulting firm called Preferred by Nature carried out an audit under Plan Vivo’s certification system. Preferred by Nature found that the satellite image data generated more than more than 600% more carbon credits than Preferred by Nature’s estimates:

. . . Preferred by Nature concludes that there is enough evidence to confirm that ADD CRUs [Acorn Design Document carbon removal units] overestimate current GHG [greenhouse gas] removals. ADD CRUs are more than 6 times (600%) higher that Preferred by Nature estimates . . .

Follow the Money reports that,

The report advised Rabobank and Acorn to have the credits externally verified “to ensure they have been calculated correctly”.

Rabobank has yet to act on that advice, according to its own website. The bank told Follow the Money that its internal calculation models have since been adjusted.

No provable additionality

Since 1960, more than 80% of the rainforest in Côte d’Ivoire has been destroyed. Cocoa farming is one of the major drivers of deforestation in the country, along with coffee and rubber plantations. Côte d’Ivoire is the world’s leading producer of cocoa.

There are many tree-planting projects in Côte d’Ivoire.

The FarmStrong Foundation is not the only organisation that is working in the region to encourage tree-planting. No third party has verified that Rabobank’s project has specifically led to the planting of additional trees.

The World Cocoa Foundation is an alliance of 90 cocoa companies, including Cargill, Ferrero, Hershey, Mars, Nestlé, and Starbucks. It has a 2022 to 2025 Action Plan under its Cocoa and Forests Initiative for Côte d’Ivoire. One of the regions targeted for tree planting under the plan is “almost identical to Rabobank’s project area”, Gijzel and Joosten write.

While there is no doubt that new trees have been planted in the Ivory Coast, it is impossible to know for sure how many of these are because of Rabobank’s carbon credits.

Rabobank told Follow the Money there was little or no overlap with other reforestation projects. Participating farmers had signed agreements stating that they are “not being paid by other carbon programmes,” the bank said.

Double counting

On 23 November 2023, Konan Jacques, the Côte d’Ivoire environment minister, wrote to Rabobank asking the bank “to suspend your carbon credit valuation activities in the Nawa Region, which is part of the intervention zone of the Emissions Reduction Project (PRE) implemented by my ministerial department.”

The letter explains that reduced emissions from the PRE zone are governed by Decree No. 2021-674 dated 3 November 2021. The Decree states that carbon credits from the PRE zone are the property of the Côte d’Ivoire government, and that the government will transfer them to the Carbon Fund of the World Bank’s Forest Carbon Partnership Facility, as part of a purchase contract signed with the World Bank on 30 October 2020.

The letter points out that “double counting . . . could damage the reputation of the country”. The risk of double counting “exists for the credits you could have issued from the date of signature of the PRE agreements”.

Rabobank had received warnings about double counting before this letter. Preferred by Nature warned about the risk of double counting in its 2022 auditing report. However, there is no mention of the Forest Carbon Partnership Facility in the report.

In 2023, Rabobank sold 34,989 carbon credits to Microsoft for about €1 million. Rabobank has now suspended the sale of carbon credits from its project in Côte d’Ivoire.

A former Rabobank employee told Follow the Money that Acorn’s management had failed to intervene several times, despite being warned about problems with the Côte d’Ivoire project, adding that Acorn has been under “enormous pressure” from upper management for some time.

“They have to show that the project can also yield revenue. The negative impact on the project’s integrity is not important. It’s all about upscaling, upscaling, upscaling.”