If you have been the victim of a scam, your name will be on a list to be cold called – and scammed – again. These “sucker lists” include names, addresses, phone number and background information about the person scammed. They are traded between boiler room operations, because scammers know that people who have been scammed are more than likely to fall for another scam.

This isn’t original research on my part (although there is plenty of evidence to back this statement up in the comments on REDD-Monitor). The statement is paraphrased from a leaflet produced by the US Federal Trade Commission. In 1998.

I know that this is not good news for people who have been scammed. And I know it’s easy for me point out that any phone call out of the blue will be a scam, because I’m not sitting on hundreds (or thousands) of near-worthless carbon credits that I’d really like to sell.

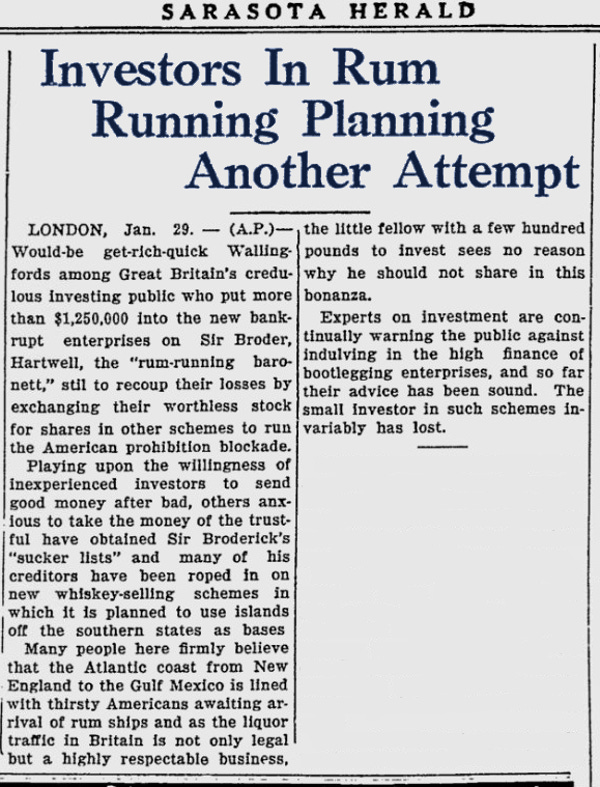

But sucker lists are an important part of the scammers’ operation, and have been around for a long time. In January 1924, the Associated Press reported on the investment schemes of Sir Broderick Cecil Denham Arkwright Hartwell, Baronet, who was otherwise known as the “rum-running baronet”.

In July 1923, Sir Broderick saw a business opportunity: smuggling booze into prohibition era USA. He raised the money for this operation by sending out a circular to 100,000 people, offering shares in his company and guaranteeing them a return of 20% within 60 days.

Sir Broderick received money from 10,000 people. The first four shipments got through and Sir Broderick’s subscribers were paid in full. But when the six and seventh shipments didn’t make it, Sir Broderick went bankrupt. More than US$1 million of investors’ money was lost.

The details of the 10,000 people who bought shares in Sir Broderick’s enterprise were entered into a sucker list, as the Associated Press reported:

“Playing upon the willingness of inexperienced investors to send good money after bad, others anxious to take the money of the trustful have obtained Sir Broderick’s ‘sucker lists’ and many of his creditors have been roped in on new whiskey-selling schemes…”

The following is the introduction to a more recent article about sucker lists. Written by Kate Palmer in the Telegraph, the article is about charity fund-raising, but she starts with a description of the importance of sucker lists to scammers:

If your object is to part people from their money there’s a rule of the trade you will quickly be taught: if you succeed in getting money out of someone once, it’s worth trying again, and again.

It’s the rule that underpins the relentless, pitiless “boiler room” selling of fake investments – often to vulnerable people.

And it’s the rule that gives rise to “suckers lists” – databases of the names and phone numbers of susceptible targets – which are traded for profit among legitimate and unscrupulous businesses alike.

When you’re scammed, the chances of you being scammed again increase, because you become more trusting. This may sound counter-intuitive, but here’s how clinical psychologist Dr Cecilia d’Felice described it to Moneywise:

“Our desire to trust people can be taken advantage of; if we’ve been the target of a scam, we may need to make ourselves feel better by trusting all the more, to reassure ourselves that the world is a good place.

“Sadly, we may then end up being fodder for the scammers once again.

“The very vulnerable may end up serially scammed because their ability to make these judgements, further confused by the desire for material gain, can lead to a gambler’s mentality that surely they’ll win through this time. That is why the scammers have these lists – they understand human nature.”

In the same interview, she adds,

“Remember, we’re being primed with a series of cues, Derren Brown-style, that lull us into trusting the scammers. They often offer a series of steps that appear to give good feedback – until they sting you with the real deal.

“This cognitive loading not only confuses your innate alarm system but also reassures you in the short term to continue, because it looks ‘real’. This is why even experienced people can fall victim to fraud.”

Comments on this post up to November 2016 are available here: https://archive.ph/LQ3JS#selection-367.1-367.12