Sustain:Green’s biodegradable credit card, Nike’s “Air” shoes, and the carbon credits that no one wants to buy

“Credit cards that help the planet.” That’s the sales pitch from a company called Sustain:Green. With the company’s new biodegradable credit card you can “Fight climate change”, “Fund rainforest preservation”, and “Reduce your carbon footprint”.

Doesn’t it sound great? The company’s sales pitch says nothing awkward about reducing consumption. Nothing awkward about reducing your emissions. And nothing awkward about holding corporations or government to account, or campaigning to keep fossil fuels in the ground.

The first time you use the card, you earn 5,000 pounds of offsets. After that, Sustain:Green buys two pounds of carbon offsets for every dollar spent using the card.

That works out at one carbon credit for every US$1,000 spent using the credit card. (Assuming US tons, with 2,000 pounds to a ton.)

How much is a carbon credit worth?

Predictably enough, Ecosystem Marketplace likes Sustain:Green’s credit card. In an article last month about the launch of the credit card, Ecosystem Marketplace repeats Sustain:Green’s sales pitch:

If carbon offsets were purchased separately by consumers through the SustainGreen offset store, an equivalent amount of carbon offsets would cost the consumer $136 based on the $15 per tonne price offsets sell for in the online store.

Sustain:Green’s website doesn’t say where the projects are that generate its US$15 carbon credits, but US$15 per credit is pretty expensive. In 2013, the average price of voluntary carbon credits was US$4.90, according to Ecosystem Marketplace’s State of the Voluntary Carbon Markets 2014.

We do know where the carbon credits come from that are linked with Sustain:Green’s credit card: sports equipment multinational Nike. From 1971, the company had used the gas sulphur hexafluoride (SF6) in the air soles of its shoes. The problem with that is that SF6 has a global warming potential of 22,200 times that of carbon dioxide.

Nike found out about the problem in 1992, from an article in a German environmental magazine about SF6. Nike’s initial reaction was to do nothing. Nike’s SF6 production peaked five years later, when it was equivalent to the emissions from about one million cars.

But Nike had started tracking its SF6 usage and emissions and by 2006 (only 14 years after it found out about the problem), Nike had replaced the SF6 in its shoes with nitrogen. In the process, Nike had managed to generate 7,984,006 carbon credits. The credits were registered on the American Carbon Registry, a project of Winrock International.

But finding a buyer for Nike’s millions of carbon credits proved tricky. Here’s Ecosystem Marketplace’s Steve Zwick, writing about Nike and SF6 in 2011:

Although the reduction – and the cost of achieving it – was substantial, industrial credits like those from SF6 are in oversupply.

In an attempt to encourage buyers, Nike announced it would donate all the money from the sale of the SF6 carbon credits to forestry projects in Brazil. For this, Nike used something called “Mata no Peito”, which describes itself as “a coalition initiative to support local organizations and communities to protect and replant forests throughout Brazil”.

On its website, Mata no Peito explains that you can buy carbon credits directly via Hub Culture or Global Giving. On its website, Global Giving is selling Nike’s carbon credits at US$5 each.

Mata no Peito has this announcement on its website:

But this deal happened in 2011. Ecosystem Marketplace’s Steve Zwick reported on it back then under the headline: “How Nike Turned Unsold Industrial Credits Into a Forest Bonanza”.

The US$40,000 “bonanza”

On 14 April 2015, Mary Grady, the Director of Business Development for American Carbon Registry, wrote an update about Mata no Peito on Global Giving’s website. Grady explains that,

To date, individual and corporate Mata no Peito partners have collectively raised $40,000 and removed 19.5 million pounds of CO₂ from the atmosphere via retirement of carbon credits to offset their carbon footprints – equivalent to taking 1,825 cars off the road for a year.

The Mata no Peito website was registered in August 2010. By October 2012, it had raised US$35,000. It’s been stuck on US$40,000 for more than one year. Nike’s global revenue in 2014 was US$27.8 billion.

After more than four years, Mata no Peito has sold less than 10,000 carbon credits. In her April 2015 update, Grady adds that she is looking forward to announcing the first Mata no Peito project in the coming months.

Who is behind Sustain:Green?

Sustain:Green’s CEO is Arthur Newman. Ecosystem Marketplace describes him as follows:

Arthur Newman previously worked on Wall Street and focused on the cap-and-trade market in the United States and the use of carbon offsets to offset carbon footprints as a former partner for Carbon Capital Advisors. He cites this experience working with large organizations in the carbon market as inspiration for the development of the credit card.

Actually, according to his LinkedIn profile, the Wall Street part of Newman’s career was between 1994 and 2001, when he worked for Gerard Klauer Mattison, then Schroders, then ABN AMRO. His focus was internet and new media companies. I’m guessing that the bursting of the dot-com bubble didn’t help his career too much.

Since 2002, Newman’s been the owner of his family’s firm, The Sweet Tooth, which makes speciality chocolate. From 2003, Newman worked for a “a boutique investment bank” called Halpern Capital. (According to the latest documents filed with the Securities and Exchange Commission, at the end of 2012 Halpern Capital had assets of US$280,613 and liabilities of US$175,360. Not one of the bigger investment banks, then.)

Newman’s experience of carbon markets comes from his involvement in Carbon Capital Advisors, “an advisory firm focused on carbon offsets”, created in 2011.

According to Ecosystem Marketplace, Newman’s inspiration for the credit card came from working with large organisations in the carbon market. Which large organisations has Newman worked with at Carbon Capital Advisors?

The company’s website gives no clues. According to the company’s Form ADV, filed with the Securities and Exchange Commission on 17 April 2015, Carbon Capital Advisors had no clients in the past fiscal year.

Carbon Capital Advisors has an account on the Climate Action Reserve. The company is the account holder for a large number of carbon credits on the Climate Action Reserve, the vast majority of which are accounts in the name of individuals.

Carbon Capital Advisors is account holder to the following four companies, none of which I would describe as large organisations (although two of them are pretty interesting):

ECO2.org (106,851 credits) – registered in Jersey in May 2013, and dissolved in October 2014.

J.R. Elvin Consultancy LTD (742 credits) – registered in the UK in January 2011. In March 2013 the company had £60,086 in the bank.

Windward Capital (500 credits) – registered in the UK in April 2012. Ordered into liquidation by the High Court in February 2015, for duping investors with false and misleading claims.

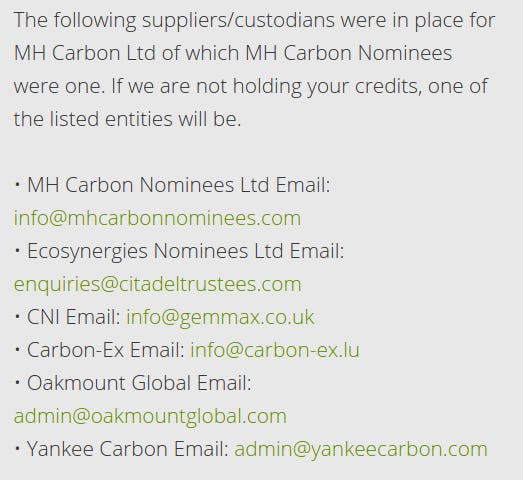

Tricon (67,960) – Tricon Ventures was registered in April 2013. In June 2013, “keith johnson” left a comment on REDD-Monitor explaining that “I have also had a call from Stein House trying to get me to invest in oil exploration company Africa New Energies Ltd.with shares @10p each the money has to be paid to Tricon Ventures (UK)Ltd.” Tricon’s website is still live, but according to OpenCorporates, the company’s director Cody Cain resigned in August 2014. Cain is also a director of a company called YC Ventures, which changed its name from Yankee Carbon in January 2013. Cody Cain registered the website yankeecarbon.com in June 2012. On 16 April 2015, a proposal to strike off the company was filed in the London Gazette. Yankee Carbon was one of the companies listed on the website of MH Carbon Nominees as suppliers/custodians for MH Carbon Ltd (one of the first boiler room carbon credit scams to appear on REDD-Monitor):

Full Disclosure: This post is part of a series of posts and interviews about REDD in Brazil, with funding from Heinrich-Böll-Stiftung e.V. Click here for all of REDD-Monitor’s funding sources.