The unravelling of Aspiration and the arrest of Ibrahim AlHusseini. “Clean rich is the new filthy rich”

An investor allegedly lost more than US$150 million. “AlHusseini personally received more than $12 million in ill-gotten gains,” according to court documents.

Aspiration Partners, Inc. claims to offer a “climate-friendly banking alternative that’s good for your wallet and the planet”. Four years ago, the company planned a stock launch with an expected valuation of US$2.3 billion. The company raised almost US$600 million from investors, including Steve Ballmer, Orlando Bloom, Leonardo DiCaprio, Robert Downey Jr., Cindy Crawford, and Jeffrey Skoll.

The Canadian rapper Drake partnered with Aspiration. Drake invested in Aspiration, and used Aspiration’s tree planting programme to offset his carbon footprint. In a statement, Drake said,

“It’s exciting to partner with a company that’s found an easy way to offer everyone the ability to reduce their carbon footprint. Aspiration’s innovative approach to combating climate change is really inspiring and I hope together we can help to motivate and create awareness.”

The company’s slogan, “Clean rich is the new filthy rich,” featured on billboards and buildings in Los Angeles and New York.

But in July 2024, Bloomberg reported that “Aspiration is struggling to stay afloat and faces an investigation by US authorities, including the Department of Justice and the Securities and Exchange Commission.”

Aspiration Partners, Inc. was incorporated in the tax haven of Delaware on 18 July 2013. Its co-founders are Joe Sanberg and Andrei Cherny.

Sanberg worked on Wall Street before investing in start-ups. Cherny worked for Bill Clinton, Al Gore, John Kerry, and Barack Obama. He ran for congress in Arizona, but lost the Democratic primary.

Aspiration claimed that more than five million people had “signed up as Aspiration members”. In fact the company had five million registered emails of which less than 600,000 actually had accounts with Aspiration.

Tree planting and carbon credits

Aspiration also exaggerated the number of trees planted. In August 2021, Cherny claimed that 35 million trees had been planted. But this included trees that had not yet been planted. By February 2023, the company claimed to have planted more than 101 million trees.

But Eden Reforestation Projects, which had partnered with Aspiration, is “pursuing Aspiration for millions of dollars in expenses that Eden says it incurred”, Bloomberg writes. While Aspiration charged its clients US$1 per tree, Eden Reforestation charged Aspiration just 10 to 20 cents per tree, according to Bloomberg’s sources.

Aspiration also sold carbon credits. In 2021, sales of carbon credits raised US$56 million in revenue, almost double what the company got from digital banking. In 2022, Aspiration partnered with the International Finance Corporation’s Carbon Opportunities Fund. The IFC describes the Fund as “a global investment platform that will raise private capital for an innovative model to source, tokenize and sell high-quality, verified carbon credits”.

IFC explains Aspiration’s role: “As one of the anchor investors, Aspiration will advise on the selection of carbon credits projects and Fund investments.”

Presumably there were a few blushes inside the IFC when Bloomberg reported in January 2024 that,

Investigators from the Justice Department and Commodity Futures Trading Commission are looking into whether Aspiration misled customers about the quality of carbon offsets it was selling, according to people familiar with the matter.

In January 2024, REDD-Monitor took a look at some of the projects that Aspiration had bought carbon credits from, which include the Northern Kenya Improved Grasslands project in Kenya, and the Mai Ndombe REDD project in the Democratic Republic of Congo.

Aspiration relaunched its carbon business as Catona. In February 2024, one month after the Bloomberg investigation, Microsoft signed a deal with Catona to buy 350,000 carbon credits from the Lake Victoria Watershed Carbon project, an agroforestry project in Kenya run by Trees for the Future.

Dubious deals

In July 2024, Bloomberg reported that, “the explosive growth in Aspiration’s new business was driven in part by dubious deals that inflated the company’s revenue”. Bloomberg’s investigation included interviews with 28 former employees and several of Aspiration’s corporation customers, as well as a review of internal company documents.

Bloomberg reported that,

In its pursuit of a public listing, Aspiration told investors it had signed deals with nearly three dozen business customers. While a few were household names — including the Los Angeles Clippers basketball team and consulting giant Deloitte — most were never disclosed. Many of these deals baffled the Aspiration insiders who had access to the information, and Cherny said in a statement that there were parts of some agreements he didn’t know about.

Bloomberg uncovered the following deals:

Young Israel, an orthodox synagogue in Beverley Hills, that signed a letter of intent to pay US$25,000 per month to Aspiration for its tree-planting projects.

The Hidden Light Institute, a non-profit that produces documentaries about Israeli figures and events, agreed to pay US$300,000 per month to Aspiration for tree planting. That adds up to almost 10 times Hidden Light’s 2021 revenue.

A company called 539 N. Alta Vista LLC, apparently named after a house in Los Angeles, agreed to pay US$50,000 per month.

ETZ Partners LLC was formed within days of its deal with Aspiration by another LLC registered anonymously in Delaware. ETZ Partners agreed to a multimillion-dollar tree planting deal.

No one from any of these companies responded to Bloomberg’s questions.

A Colombian actor, footballers, and a model

A Colombian actor and several retired footballers from Colombia were also involved. Two of them signed agreements with Apogee Pacific LLC, a company controlled by Joe Sanberg.

Elizabeth Loaiza is a Colombian model. Bloomberg reports that in February 2021, she signed a letter of intent (in English) which stated that her non-profit foundation would pay Aspiration US$50,000 per month. She could then claim to have planted 50,000 trees. A second document, signed on the same day, was an “advisory contract” with Apogee Pacific. Under this contract, Loaiza would receive US$55,000 per month for “marketing and branding services”.

When she asked Sanberg about these payments he told her not to worry and that he would be paying her.

Juan Pablo Llano, a Colombian actor, told Bloomberg a similar story. Neither Loaiza nor Llano made any payments to Aspiration and they received no money from Apogee Pacific.

Cherny told Bloomberg he knew nothing about side deals with Apogee Pacific. Sanberg and his lawyer did not reply to Bloomberg’s questions.

Several former Aspiration managers told Bloomberg they knew nothing about these side deals with Apogee Pacific.

Day 12 Partners

A company called Day 12 Partners was also involved, Bloomberg writes. The company was incorporated on 14 August 2012 in Delaware. In one case more than US$3 million arrived from two of Aspiration’s customers through Day 12. At one point the company was registered to Sanberg — Bloomberg reports that his was the only name listed in two Day 12 records filed in California in 2013 and 2016.

After the Day 12 payments were discovered, Aspiration hired a law firm, Baker Hostetler, to conduct an investigation, which found “no evidence of wrongdoing”, a company spokesman told Bloomberg.

Bloomberg reports that, “Sanberg told the company he wasn’t involved in the payments and had long ago cut ties with Day 12, according to internal company documents.”

KPMG, Aspiration’s auditor resigned without signing off on Aspiration’s 2021 financial reports.

Bloomberg writes that,

It’s not clear exactly how Aspiration counted revenue from each specific deal, but it wasn’t contingent on it receiving money from clients. In an accounting technique used by many companies, Aspiration claimed revenue when it fulfilled its portion of an agreement (such as paying for tree planting), rather than when it received payment from customers, according to filings with the SEC. Because Aspiration paid large sums for tree planting, this allowed it to claim substantial revenues even as customer payments fell far behind.

By July 2024, Aspiration had laid off most of its 400 employees. The company faced more than half-a-dozen lawsuits over unpaid bills. Most of the corporate customers are no longer active clients.

Ibrahim AlHusseini arrested

In early October 2024, Ibrahim AlHusseini, an ex-board member and investor in Aspiration, was arrested, accused of securities fraud. He was jailed until 13 November 2024 when he was released on US$3 million bail.

On 8 October 2024, Richard Higgins, a Special Agent with the FBI, filed a criminal complaint with the Central District of California Court. AlHusseini is accused of providing falsified financial statements to two investor funds which inflated AlHusseini’s personal wealth by tens of millions of dollars.

As a result of the alleged fraud, one of the investors lost more than US$150 million. And, according to the criminal complaint, “AlHusseini personally received more than $12 million in ill-gotten gains.”

AlHusseini was brought up in Saudi Arabia. His parents are Palestinian refugees. In the early 1990s he moved to the US to study at the University of Washington. He has started and sold several companies, was an early investor in Tesla, Bloom Energy, Aspiration, and Uber. He claims to have raised half-a-billion dollars in “impact-focused capital”.

AlHusseini is the founder and managing partner of an investment firm called FullCycle. The company was incorporated in the tax haven of Delaware on 11 July 2013.

In a March 2021 interview with AlHusseini, Jonathan Foley, Executive Director of Project Drawdown, describes him as follows:

“Ibrahim is a really noted investor in the climate space, and he’s thought really hard about how we have to deploy capital in order to solve some of our biggest climate problems.”

In addition to Aspiration, AlHusseini has been a board member of Rainforest Action Network, The Culture Project, and The Global Partnership for Women and Girls.

AlHusseini was also on the board of Code Pink, the women’s peace organisation. CodePink’s founder, Jodie Evans, contributed to AlHusseini’s bail. AlHusseini, however, is no longer listed as a board member on CodePink’s website.

AlHusseini was deemed a flight risk. As part of his bail conditions, he had to hand in his Saudi Arabia and US passports, and his gun. And he has to wear a GPS ankle monitor.

The US far right website, The Daily Wire, is the only publication so far that has reported on the allegations against AlHusseini. (Predictably enough, The Daily Wire makes the most out of AlHusseini’s support for left wing politics and activists.)

The US$145 million loan and the put option

The criminal complaint explains how in March 2020, Aspiration’s founder, Joe Sanberg, took out a US$55 million loan from an unnamed investor fund. Sanberg pledged 10,302,837 shares in Aspiration as collateral.

However, Aspiration was not publicly traded and the criminal complaint states that “there was not a liquid market to sell [Aspiration] stock”. So the investor fund bought a put option from AlHusseini and two of his companies. A put option is a contract that gives the owner the right to sell a security at a set price before a certain date.

The criminal complaint describes the put option as “a form of financial guarantee” on the US$55 million loan that Sanberg received from the investor fund. Under the contract, if Sanberg defaulted on the loan, AlHusseini would have to hand over US$55 million to the investor fund in return for the 10.3 million Aspiration shares.

AlHusseini was required to have sufficient assets to pay up in case Sanberg defaulted on the loan payments. AlHusseini and his two companies needed to have a total net worth of US$137.5 million and a liquid net worth of US$68.75 million.

AlHusseini is alleged to have “made untrue statements” about his personal wealth, and provided “falsified account statements for brokerage accounts” in his name.

According to the criminal complaint, in early March 2020, AlHusseini claimed that on 31 December 2019 he held more than US$86 million in securities. In fact, his accounts held only US$4,390.10.

The investor fund then agreed to the loan with the shares as collateral and the put option as a guarantee. The criminal complaint alleges that the investor fund sent US$2 million to one of AlHusseini’s companies and Sandberg sent US$5 million to a bank account in Saudi Arabia in the name of a relative of AlHusseini’s.

In November 2021, Sanberg refinanced the loan against his 10.3 million Aspiration shares. Under the refinanced loan, an investment firm called Clover Private Credit Opportunities Origination lent US$145 million to an LLC controlled by Sanberg.

The refinanced loan included a new put option from AlHusseini. If Sanberg defaulted on the US$145 million loan, AlHusseini had to pay US$65 million to Clover.

For the refinanced deal, AlHusseini allegedly claimed to Clover that on 30 September 2021 he held more than U$199 million in securities with his broker. In fact, his accounts held just US$2,693.63.

AlHusseini is alleged to have received about US$6.3 million for guaranteeing Sanberg’s repayment of the loan.

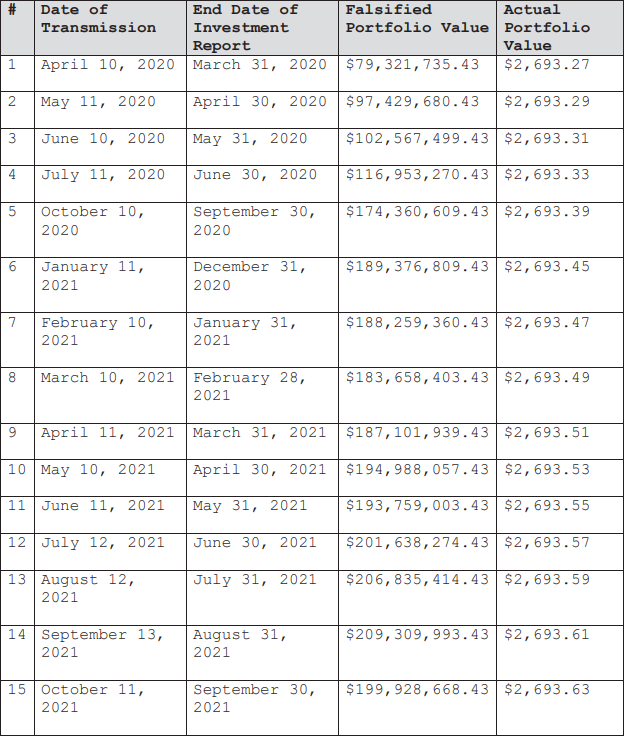

Between April 2020 and February 2023, AlHusseini allegedly submitted falsified brokerage statements at least 24 times. The criminal complaint provides a list:

Here’s the timeline, after the refinanced loan had been agreed with Clover — based on the criminal complaint and other lawsuits:

31 October 2022: Sanberg failed to make a loan payment.

December 2022: Clover and AlHusseini agreed to increase the put option to US$75 million.

December 2022: AlHusseini sold property worth US$5.1 million, according to a lawsuit filed in Los Angeles’ Beverly Hills Courthouse.

March 2023: AlHusseini made a US$300 million loan to a company in Saudi Arabia, according to the Los Angeles lawsuit.

17 April 2023: Clover sent AlHusseini a foreclosure notice for Sanberg’s default on the loan.

27 June 2023: Clover exercised the put option, requiring AlHusseini to pay Clover US$75 million for the 10.3 million shares in Aspiration.

12 July 2023: Clover sent AlHusseini a notice of failure to pay and a demand for payment.

14 July 2023: Clover filed a legal case against AlHusseini, the Husseini Group, Inc, and the Husseini Group, LLC, in New York state court to enforce the terms of the put option.

11 September 2023: The New York state court ruled that AlHusseini had to pay Clover more than US$75 million, including interest on the loan.

October 2023: AlHusseini transferred ownership of his US$3.7 million house in Venice, California to his brother Faisal AlHusseini.

November 2023: the court entered a judgement against AlHusseini for US$78 million. AlHusseini fired his legal counsel, changed his address in court documents to Lebanon, and according to the criminal complaint, “will not provide a means for [Clover] to serve AlHusseini with process in connection with the ongoing civil litigation”.

The Daily Wire reports that Clover filed a motion to hold AlHusseini in contempt of court. While AlHusseini did not pay Clover, he donated what The Daily Wire describes as “huge sums to politicians, particularly ‘the squad’ of far-left Democrats”.

The Daily Wire states that AlHusseini donated more than US$300,000 to Democrats, without giving a time period for this sum. It does, however, list a series of donations between February and May 2024. These add up to US$11,300.

AlHussein’s donations to the Democrats are, of course, a tiny fraction of the US$260 million that Elon Musk poured into Donald Trump’s election campaign.

Meanwhile, Sanberg has counter-sued Clover. Sanberg’s legal filing does not criticise AlHusseini, according to The Daily Wire.

At some point after the article was published, The Daily Wire made a series of changes, none of which are acknowledged. (Here’s an archive of the article on 7 January 2024, and here’s what it looks like on 13 January 2024.) In the latest version, this sentence has been added: “AlHusseini’s lawyer, Jessica Nall, told The Daily Wire that he has not been charged with a crime.”

Amazing reporting and investigation.

Well, given all that, this means AlHusseini is qualified to run for President! This is how the world of new-wealth works - don't bother picking up any of the shells, there is no pea under any of them, you've been fooled. And such is the financial trickery behind so many carbon schemes.