China Carbon Neutral Development Group has issued 500 million “Carbon Coins”

Blockchain-based tokens backed by 500,000 carbon credits on Verra’s registry.

A company called Global Carbon Asset Management Co., Limited. has issued 500 million “Carbon Coins”. The company is a wholly owned subsidiary of China Carbon Neutral Development Group Limited. The Carbon Coins are backed by 500,000 carbon credits on Verra’s registry.

The Carbon Coins are blockchain-based tokenised carbon credits. Global Carbon Asset Management is managing the Carbon Coins on DigiFT, a digital asset trading platform in Singapore.

Let’s start with a look at each of the companies involved.

China Carbon Neutral Development Group

China Carbon Neutral Development Group is a Hong Kong-listed investment holding company.1

On its website, the company states that it “is a company listed on the main board of the Hong Kong Stock Exchange, under the supervision of the China Forestry Ecological Development Promotion Association”. We’ll come back to China Forestry Ecological Development Promotion Association later.

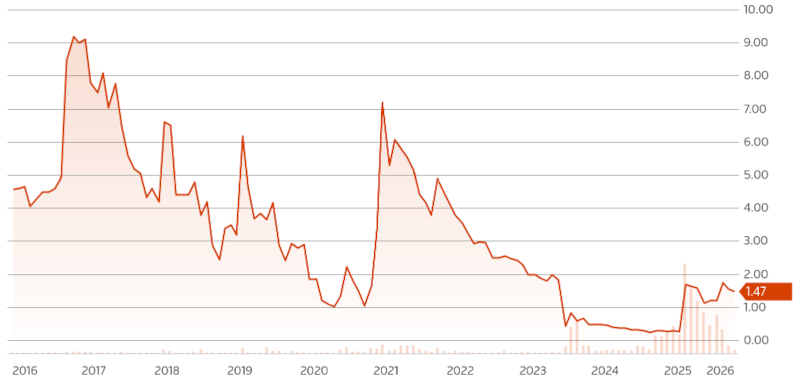

Since March 2021, the company’s share price has fallen. It has recovered slightly since May 2025. The share price is currently at 1.47 HKD (about US$0.19):

China Carbon Neutral Development Group is yet another company involved in carbon markets that was incorporated in a tax haven. In this case, the tax and secrecy haven of the Cayman Islands.

Global Carbon Asset Management Co., Limited

The company was incorporated on 11 November 2025. Its business registration number is 79128912. It’s a wholly owned subsidiary of China Carbon Neutral Development Group. It appears to have been set up specifically to manage the Carbon Coin initiative — which was launched on 29 December 2025.

China Forestry Ecological Development Promotion Association

The Association’s website explains that,

The China Forestry Ecological Development Promotion Association is a national first-level social organization approved by the State Council, registered with the Ministry of Civil Affairs, and under the supervision of the National Forestry and Grassland Administration.

And according to its Articles of Association,

The purpose of this Association is to adhere to Xi Jinping’s socialist thought with Chinese characteristics in the new era, practice Xi Jinping’s ecological civilisation ideology, advocate ecological civilisation, promote ecological construction, spread ecological culture, and promote the harmonious development of man and nature.

One of China Carbon Neutral Development Group’s alternate directors, Chen Lui, was previously Head of the Publicity Department of the China Forestry Ecological Development Promotion Association.

The China Forestry Ecological Development Promotion Association is a Communist Party of China Association that promotes socialist thought and ecological civilisation. It is also keeping a close eye on the distinctly capitalist Hong Kong-based company, China Carbon Neutral Development Group.

DigiFT

DigiFT Tech (Singapore) Pte. Ltd. describes itself as a “next-generation exchange for tokenized real-world assets”. Its licensed by the Monetary Authority of Singapore. Here’s how Henry Zhang, the founder and CEO of DigiFT, explains what his company does:

“DigiFT is a marketplace for real-world asset tokens and based on the DeFI technology. We are also licensed. We are the first one and so far the only one got a licence in a the DeFi marketplace by the Monetary Authority of Singapore. So basically DigiFT, we call ourself a generation three open exchange.”

DeFi is short for decentralised finance. It is a blockchain-based technology that uses cryptocurrencies to allow people to carry out financial transactions without needing a bank.

Banks are also getting in the game. UBS is Switzerland’s largest banking institution and the world’s largest private bank. In November 2025, UBS announced “the world’s first successful completion of an in-production, end-to-end tokenized fund workflow leveraging the Chainlink Digital Transfer Agent (DTA) technical standard”. DigiFT functioned as the on-chain fund distributor.

Fangda Partners

A company called Fangda Partners provided legal services “covering transaction structuring, drafting and negotiating transaction documents, and coordinating signing and closing”. Fangda Partners is one of China’s largest law firms and is headquartered in Shanghai.

The Carbon Coin initiative

On its website, China Carbon Neutral Development Group explains that it is,

An innovative carbon asset management and trading platform built on the Polygon public blockchain. Dedicated to addressing the challenges of transparency, liquidity, and compliance in the global carbon market through blockchain technology.

There are several articles about the Carbon Coin launch, which appear to be based on a press release from China Carbon Neutral Development Group or Global Carbon Asset Management.

One of these describes Carbon Coin as,

the world’s first compliance-issued carbon coin based on an internationally recognized carbon standard and the first VCS-backed token on a regulated overseas on-chain exchange . . .

It is far from clear what “compliance-issued” means in this context. In another article, Carbon Coin is described as “the world’s first compliant carbon coin based on international authoritative carbon standards”. But there are no internationally agreed carbon standards on tokenisation of carbon credits. And China Carbon Neutral Development Group does not state which carbon standards it is supposedly complying with.

VCS-backed token

This is not the first time that carbon credits on Verra’s registry have been tokenised. Between October 2021 and May 2022, about 22 million carbon credits were tokenised by a company called Toucan.

On 25 May 2022, Verra stopped the tokenisation of retired carbon credits on its registry.

Verra then held a consultation on the tokenisation of carbon credits on its registry. In January 2023, Verra published a 170-page summary of the comments received. In June 2023, REDD-Monitor predicted that, “At some point, Verra will no doubt start allowing the carbon credits on its registry to be tokenised once again.”

There is no information publicly available about which projects the 500,000 tokenised carbon credits came from, except that they are on Verra’s registry.

So far, Verra has not responded to the news of the Carbon Coin. REDD-Monitor has sent some questions to Verra, including which projects generated these 500,000 carbon credits. I’ve also asked about how it’s possible to generate 500 million Carbon Coins from just 500,000 carbon credits. I look forward to posting Verra’s response in due course.

UPDATE — 3 February 2026: Verra’s response is posted in full here:

In 2022, following Toucan’s tokenisation of Verra’s carbon credits, Robin Rix, then-Verra’s chief legal, policy and markets officer, called it, “Mind frying”:

“Carbon credits themselves are abstract intangible things based on counterfactuals of things that you can’t actually see – emissions. And then crypto is another layer of abstraction on top of that.”

A better way of putting it is “a scam on top of a scam”:

An investment holding company is a company that holds and manages investments in other companies. It doesn’t produce anything. The holding company buys enough shares in other companies to control those companies. The holding company can then set goals, appoint board members, and oversee major financial decisions. One of the best known investment holding companies is Berkshire Hathaway Inc.

"I’ve also asked about how it’s possible to generate 500 million Carbon Coins from just 500,000 carbon credits"

That's very simple: instead of selling tonnes you sell kilos then you have 1000 kilos instead of 1 tonne. This is called fractionalization and mny registries already allow for this. There are several use cases for which this is needed, like automated offsetting transations where a % of a purchase goes to buying and retiring credits. Or think or Carbon Removals where one credit is priced above $150. We may went to retail kilos of it and not entire tonnes, especially for smaller transaction in B2C context.

If a credit never enters a national registry, it’s already a virtual asset.

If you tokenize it, it becomes a virtual double-helix.

No extra carbon is removed — only the story gets thicker.