The claim that “Carbon credits could generate US$82 billion” per year in Africa is based on a made in the USA fairy tale

Claver Gatete, Executive Secretary of the UN Economic Commission for Africa, keeps telling us that Africa could earn US$82 billion a year from carbon offsets. Where does this figure come from?

Claver Gatete is the Executive Secretary of the UN Economic Commission for Africa. He was appointed in October 2023. Gatete is an economist. From 2011 to 2013, he was Governor of the National Bank of Rwanda. Following that, he was Minister of Finance and Economic Planning then Minister of Infrastructure.

Before taking up his new job with the UN Economic Commission for Africa, Gatete was Ambassador and Permanent Representative of Rwanda to the UN in New York. Clearly then, he is no dummy.

But on 3 December 2023, which was “Africa Day” at COP28, Gatete said the following:

“There is a great potential in developing the African carbon market, carbon credit market, to unlock additional green financing for Africa. Africa’s research shows that at US$120 per ton carbon, nature based carbon credits could generate US$82 billion on the annual basis, which is about one-and-a-half times the amount of money that we get in terms of the official development aid.”

This is an extraordinary statement. It’s as if Gatete is unaware of the concerns of the massive land grab that is taking place in several African countries at the hands of a company called Blue Carbon LLC, based in the petrostate of United Arab Emirates.

“Green colonialism”

Nigerian climate activist Nnimmo Bassey recently described this process as “green colonialism”. In an interview with Democracy Now, Bassey calls offsets a “false solution”.

“These are things that allow polluters to keep on polluting without cutting emissions at source,” he says.

Gatete’s comments about sales of carbon offsets from Africa completely ignore the recent media, academic, and NGO investigations into problems with REDD projects and carbon markets in Africa and elsewhere.

And it’s almost as if Gatete has no idea what the current price of carbon offsets from nature-based solutions actually is — or that it has fallen dramatically since January 2022:

Today’s price is just below US$1.

In an interview with CNBC Africa, Gatete, if anything, made matters worse. “We need to have a fair game in terms of the carbon credit,” he said.

“Right now, in some of the countries, and from own estimation, the real price would be US$120 per tonne of carbon. But in many of the African countries it goes even below US$10 or it goes up to not exceeding US$50.”

Gatete repeats his claim that at a price of US$120 per tonne of carbon, Africa could get US$82 billion per year from sales of carbon offsets. Gatete calls US$120 “the actual market price”.

CNBC Africa’s journalist, Fifi Peters, notes that agreeing a price of US$120 will require “difficult conversations” involving “all stakeholders at the table”. She asks Gatete how the UN Economic Commission for Africa proposes that “such an equilibrium can potentially be reached such that all stakeholders walk away happy”.

Gatete’s answer reveals little, apart from his complete failure to grasp the current price of nature-based carbon offsets:

“So, we are helping African countries at least on the carbon credit framework, and we want to make sure that we create the guidelines under which can head up the countries ready to do that.

“But at the same time we want to start trading. Today I was, we just attended the one, the launch for, on the Rwanda stand, where we are starting together with Singapore and Sweden, they are starting a carbon trading market, whereby you bring the carbon, trade to stock exchange, provide the whole entire governance framework that is required, and also the capacity that helps the countries.

“So in that case then you can trade it on the international market. And by trading it on the international market then you get real value for that kind of product. That’s what you want to do so that we can start with some of the regions in East Africa, Southern Africa, Central, North, and West. So that we can develop that kind of capacity where they can be able to trade their carbon but get a fair price.

“Every carbon on any continent is same carbon. Why should there be a difference? Because the market is one. Yeah.”

The carbon deal between Singapore and Rwanda allows Singapore to buy carbon credits generated in Rwanda. Singapore has a carbon tax that is currently set at US$3.75/mtCO₂e. Next year it will increase to US$18.75/mtCO₂e.

Companies liable to pay the tax can buy carbon credits to cover up to 5% of their emissions. But they will not pay more than US$18.75 per carbon credit, because otherwise it would be cheaper to just pay the carbon tax.

In September 2022, Bloomberg New Energy Finance published a useful overview of carbon markets. It skips over the problems with carbon markets, but Gatete would do well to read it, at least for a basic understanding of the differences between compliance markets (like the European Trading System, where carbon is currently trading at just below US$70 per tonne of carbon) and the voluntary carbon markets.

BloombergNEF writes that,

In a scenario where only removal offsets are permitted, BNEF estimates demand for offsets could grow 40-fold between now and 2050, to 5.2 billion tons of CO₂ equivalent, which is equal to 10% of global emissions today. Prices could reach $120 per ton in 2050.

The word “could” in that last sentence is crucially important. As is the year: 2050.

Nature-based carbon credits in Africa

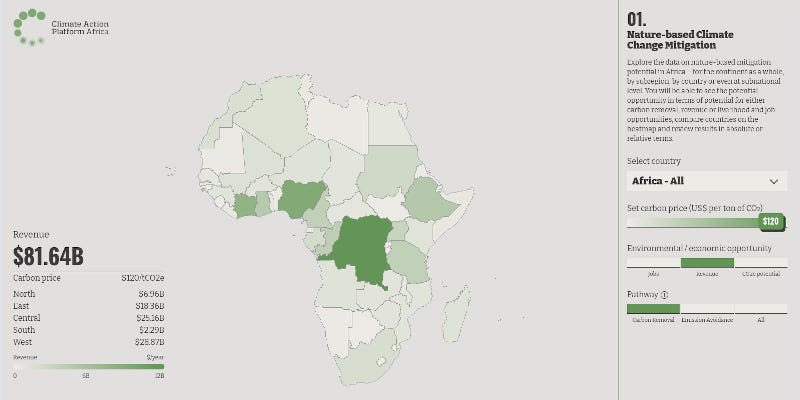

Gatete’s source for the US$120 price for nature-based carbon credits is a website created in 2021 by the Climate Action Platform Africa, Earthrise Media, and Dalberg Research, with support from the UN Economic Commission for Africa. Funding came from the Carnegie Climate Governance Initiative.

The website identifies “nature-based carbon dioxide removal opportunities in Africa”. Before looking at the assumptions behind the website, let’s take a quick look at the actors behind this project:

Climate Action Platform Africa was set up in 2021 by James Irungu Mwangi and Carlijn Nouwen. Mwangi was executive director of Dalberg Group for eight years until February 2023. In total, he worked for 20 years at Dalberg. Mwangi started Dalberg’s first office in Africa. Before that, he was at McKinsey. Nouwen also previously worked at Dahlberg and McKinsey.

The Climate Action Platform Africa promotes a “new climate-smart model of economic growth and inclusive livelihoods”.

The Dalberg Group consists of six consulting firms promoting neoliberalism worldwide. Dalberg Advisers, for example, works “collaboratively across the public, private and philanthropic sector to fuel inclusive growth and help clients achieve their goals”.

Earthrise Media describes itself as “a creative agency for the environment - building digital experiences to enable action on climate change and conservation”.

It is part of Earth Genome which works on climate and conservation issues using satellite data and machine learning. Its funders include The Rockefeller Foundation, ClimateWorks Foundation, Bezos Earth Fund, and the Gordon and Betty Moore Foundation.

Earth Genome’s board of directors consists of Peter Kareiva, former chief scientist at The Nature Conservancy, Craig McCaw, who made his fortune in the cellular phone industry and was on the board of The Nature Conservancy for 12 years until February 2022, and Susan Mac Cormac, a corporate lawyer who has represented the Gates Foundation, The Nature Conservancy, Omidyar Network, Goldman Sachs, and Generation Investment Management.

US$82 billion per year

Climate Action Platform Africa’s website has a sliding scale to set the price of carbon. It starts at US$10 per ton of CO₂ and increases in US$10 increments up to US$120.

It is not based on the actual price that a nature-based project might be able to receive for the carbon offsets the project generates.

So here’s how Claver Gatete comes up with his figure of US$82 billion per year - just crank the price up as far as it will go and hope no one notices:

However, if we adjust the price per carbon offset to US$10 (which is more than 10 times the current price), the African continent would receive less than US$1 billion per year:

It gets worse, believe it or not. Climate Action Platform Africa’s data is heavily based on a 2017 paper titled “Natural Climate Solutions”. More than one-third of the paper’s authors worked for The Nature Conservancy.

The paper puts forward the myth that more than one-third of climate mitigation can be provided by natural climate solutions. The authors assume that selling carbon offsets from natural climate solutions is the same as mitigating emissions from fossil fuels.

As climate scientist Glen Peters points out, “We need to protect forests, but they are not a fossil offset!”

More than three-quarters of the proposed natural climate solutions in the 2017 paper come from reforestation, reduced deforestation and changes in forest management.

Reforestation is by far the largest “natural climate solution”. But the authors of the 2017 paper admit that the mitigation potential is anywhere between 2.7 and 17.9 PgCO₂e y⁻¹. This massive range is not reflected in Climate Action Platform Africa’s figures.

The reality is that the figure of US$82 billion for Africa from sales of carbon offsets is based on a fairy tale. It is a dangerous distraction from the need to leave fossil fuels in the ground. Even worse, it provides legitimacy to continued extraction of fossil fuels by the biggest polluters on the planet.

Chris, The info you have gathered about who is behind these platforms - a sort of neoliberal conservation-finance complex - is revealing. Thanks!

LoL. Not only does Gatete clearly have no idea about carbon markets, he also makes the inexcusable mistake of treating Africa like it's one country. 'Africa' will not receive payments from carbon offset projects: specific African governments (or more likely, shady private operators, as at present) will. As with colonial production of commodities, they will compete with each for market share and lowest price. That, as well as the current massive over-production of credits which almost no-one wants any more, will ensure credit prices long remain at rock bottom, and probably below production price.