The crypto carbon cowboys: Letscoin and Bluegrace Energy Bolivia

Also featuring Banyan Investment Bank, Quantum Metal, Mbombo Investment Group, Nexus Global One, BGCarbon Bank, NIBank, Maximance 2030, DevvStream, and FICO.

On 1 January 2025, a crypto company called Letscoin “secured an irrevocable carbon credit purchase agreement” for 3 billion carbon credits from Bluegrace Energy Bolivia S.R.L.

That’s an awful lot of carbon credits.

It is. The press release describes it as “staggering”.

How much did that cost?

29,999,999,950 Letscoins. According to a press release from Letscoin, that is. The press release, dated 15 January 2025, announces that the transaction had been completed on 10 January 2025.

But the same press release also states that,

Mr. Jean Bilala, Executive Chairman of Letscoin, stated that he is ready to proceed to the final step of the conversion of LTSC vs USDT. The contractual obligation and settlement of this placement will be done in parallel with the confirmation of the global carbon credit offset buyers.

Which suggests that the transaction may not actually be completed.

This going to be one of those shaggy dog stories, isn’t it?

It is. And the shaggy dog has a particular fondness for rabbit holes.

Oh good. Let’s start with Letscoin, then.

According to the FAQ page on the company’s website,

Letscoin (LTSC) is a fiat-backed stablecoin and complementary currency built on blockchain technology, designed to foster local and global economic growth.

What’s a stablecoin?

A stablecoin is a type of cryptocurrency that has its value tied to that of a precious metal such as gold, a commodity like oil, or a currency — the most popular being the US dollar. Fiat-backed stablecoins are supposed to maintain a reserve of the currency as collateral.

Because the value is tied to a comparatively stable currency (unlike Bitcoin, the price of which is volatile), the value of stablecoins is, well, stable.

How much reserve currency does Letscoin need?

The total number of Letscoin is limited to 50 billion tokens. So US$50 billion should do it.

However, Letscoin seems to be little confused about exactly what the reserve consists of.

The company’s “White Paper” states that,

Letscoin (LTSC) is backed by fiat currency reserves, ensuring that each token maintains a stable value and can be redeemed for its fiat equivalent.

Letscoin operates under a custodial stablecoin arrangement, where reserve assets are held securely and transparently.

Meanwhile, a corporate presentation explains that Letscoin is “backed by a basket of commodities, ensuring its stability and reliability in the volatile cryptocurrency market”.

The presentation states that “depending on the amount of LTSC valued at $1 we want to put available, we need to purchase the equivalent value of the other coin” — the other coin being USDT, USDC, and/or MATIC.

I know that USDT is Tether. But what are the others?

USDC is USD Coin. It’s a stablecoin created by Circle, which is a payments technology company.

MATIC Network (which offered plasma sidechains) was founded in Mumbai in 2017. In February 2021, the project changed its name to Polygon. Polygon decided to keep MATIC as its cryptocurrency. Polygon provides a framework for blockchain projects to build on Ethereum, without scalability issues.

Do I need to know what any of this means?

Probably not, in the grand scheme of things. It may be worth noting that MATIC is currently worth US$0.30. And Ethereum is a decentralized blockchain with smart contract functionality.

Can we return to Letscoin, then?

The Letscoin presentation states that, “LetsCoin is a digital complementary currency backed by a Medium Term Note Powered by Letscoin Blockchain Bank and Cloud GPT24”.

I wish we’d stayed with Polygon. Are you deliberately trying to confuse me?

No, but I suspect Letscoin just might be. A medium-term note is basically an IOU under which the borrower receives payments from a lender, possibly involving an interest rate, with a set date on which the entire loan has to be repaid.

So, Letscoin is backed by a loan? That will have to be repaid?

That does appear to be what Letscoin is saying in its presentation. But whether that’s actually what’s going on is not at all clear.

In a May 2024 video, Thana Balan, the co-founder of Letscoin, tells us that Letscoin is, “The first ever coin in the world which is being backed up by gold, 100% value gold.”

In the same video, Jean Bilala, Letscoin’s CEO, says,

“So what we have done, we have put hard as a cash to the tune of $50 billion to back the coin. And not only that, we are running with our partners Banyan Investment Bank and Quantum Metal, we are running the gold programme. So in the other way, we are the first gold backed coin.”

We’ll get round to Banyan Investment Bank and Quantum Metal later on.

So Letscoin’s reserve may consist of dollars, crypto coins, a loan, gold, or perhaps fresh air.

Let’s just say that the reserve assets are not held quite as transparently as the company claims.

Incidentally, here’s how the price of Letscoin has been going — it’s currently worth 0.458 USDT, and it’s not exactly stable (click on the image to go to P2B Exchange):

What is Letscoin Blockchain Bank?

Letscoin Blockchain Bank’s website has disappeared. However, an archived copy of the website dated 3 September 2024 states that,

“The future of blockchain in the banking industry has already arrived, and Letscoin stands at the forefront, offering cutting-edge online blockchain banking solutions.”

That’s funny coming from a website that no longer exists. What’s Cloud GPT24?

I have no clue. The most recent version of Chat GPT is GPT4o. There is a company called CloudGPT LLC, that was incorporated in Texas on 9 February 2024. I could find no connection between Letscoin and CloudGPT.

What’s a complementary currency?

Complementary currencies are supposed to work along with fiat currencies. They are not intended to become the main currency in an economy. Instead they are set up for specific social, environmental, or political reasons.

I suppose the fact that Letscoin isn’t planning on replacing the US dollar, is slightly reassuring.

Or any other currency, for that matter.

So where are we going next?

Bolivia. Letscoin “secured” its 3 billion carbon credits from a company called Bluegrace Energy Bolivia S.R.L.

According to Bluegrace Energy Bolivia’s website, “Since mid-2022, 16% of Bolivian forests have been protected by Bluegrace Energy Bolivia.”

Bluegrace Energy Bolivia doesn’t appear on OpenCorporates, so we can’t confirm when, where, or by whom the company was incorporated.

From 27 December 2023, Bluegrace Energy Bolivia was a participant in the UN Global Compact. Until it was delisted, that is.

Uh oh. Why was the company delisted?

The UN Global Compact’s website doesn’t give any details, but states that the reason for delisting was, “Other reason related to Integrity.”

That’s a red flag.

Yes. And it’s far from the only one.

Bluegrace Energy Bolivia’s website includes the logos of an impressive number of “partnerships”:

Oddly enough though, Letscoin is nowhere to be seen. In fact, there is no mention of Letscoin anywhere on Bluegrace Energy Bolivia’s website.

Here are a few recent press releases from Bluegrace Energy Bolivia in reverse chronological order:

4 December 2024: Bluegrace Energy Bolivia announced a partnership with Mbombo Investment Group and Nexus Global One. BGCarbon Bank is also involved. BGCarbon Bank is “dedicated to carbon credits trading and sustainable forest management, aiming to revolutionize forest capital monetization in the Democratic Republic of Congo. NIBank, which is a based in Antigua and Barbuda, is also involved. Julio José Montenegro, CEO of BlueGrace Energy Bolivia said he was looking forward to welcoming DRC’s Minister of Environment to Canada “to formalize this collaboration”.

14 November 2024: Bluegrace Energy Bolivia announced a partnership with NIBank to “facilitate SDG Bonds sales related to forestry and natural capital assets”. The company has bought an ownership stake in Compañía Minera Arco de Oro SAC in Peru. “The Arco de Oro Mining Project will feature innovative green technologies funded by Green Certificate Bonds issued by BGE.” And Bluegrace Energy Bolivia has bought a stake in vegan food manufacturer Frigorificos Kobefoods in Peru.

19 August 2024: Bluegrace Energy Bolivia announced that, together with the Congolese Environment Agency, it will begin “working sessions” with Mbombo Investment Group (a Kinshasa-based investment firm) and Maximance 2030 (a London-based investment firm) to secure certification for 80 million hectares of Congolese forests and to launch a Carbon Credit Investment Bank.

19 December 2023: Bluegrace Energy Bolivia announced a US$2 billion project equity, backed by Maximance 2030 Ltd. “Aligned with the UN's environmental conservation and sustainable energy requirements, BlueGrace Energy Bolivia is spearheading an extraordinary project to conserve 20.5 million acres of the Amazon Rainforest in Bolivia.”

21 September 2023: Bluegrace Energy Bolivia is aiming to preserve 8.3 million hectares of Amazon Rainforest in Bolivia, together with DevvStream Holdings Inc. and FICO (Foreign Investment Company). The press release refers to something called the Infinite Forest Carbon methodology.

Do we know any more about the forest projects in the Democratic Republic of Congo and Bolivia?

There doesn’t seem to be much information available about the 80 million hectare project in the Democratic Republic of Congo — apart from Bluegrace Energy Bolivia’s press releases.

Although it does look like Quantum Commodity Intelligence regurgitated the 19 August 2024 press release about the Democratic Republic of Congo.

Whoopsie! What about Mbombo Investment Group, Nexus Global One, BGCarbon Bank, NIBank, the Arco de Oro Mining Project, Frigorificos Kobefoods, Maximance 2030, Devvstream, FICO, or the Infinite Forest Carbon methodology?

I think I’ll save those rabbit holes for another day, if you don’t mind.

Except for FICO and the Infinite Forest Carbon methodology which appeared in a January 2024 article by Glòria Pallarès on Mongabay. Pallarès found that Indigenous communities in Peru, Bolivia, and Panama had handed over economic rights to 9.5 million hectares of forests.

The deals cover 788,000 hectares of Indigenous Kakataibo and Matsés territories in Peru, 8.3 million hectares of Chiquitano and Guaraní land in eastern Bolivia, and 438,000 hectares of Emberá-Wounaan territory in Panama.

Sorry to interrupt, but didn’t a carbon cowboy try to persuade the Matsés Indigenous People to hand over their forests more than a decade ago?

David Nilsson was an Australian who claimed to have 3 million hectares of forest in Peru under a 200 year contract. A carbon contract would run for 25 years, after which the forest could be logged and replaced with oil palm plantations.

REDD-Monitor first wrote about Nilsson in May 2011. Just over one year later, he appeared on a 60 Minutes Australia programme, titled, appropriately enough, “The Carbon Cowboy”.

Right. Back to today’s carbon cowboys.

The Inter-Ethnic Association for the Development of the Peruvian Rainforest (AIDESEP) told Mongabay that the contracts with the communities in Peru (which were signed with an iffy looking company called Get Life) were quite similar to the agreements signed with Nilsson. “This company follows the same line of abusive contracts and evidently this is a violation of Indigenous rights,” AIDESEP told Mongabay.

The Infinite Forest Carbon methodology was developed by FICO. Pallarès reports that she found “no public information regarding IFC’s scientific and technical details, nor any track record of the methodology being used”.

The IFC methodology states that,

The Infinite Forest Carbon (IFC) methodology is officially endorsed for scientific calculations (stored carbon) by the International Center for Leadership Training (CIFAL) Argentina of the United Nations Institute for Research and Training (UNITAR).

FICO also claims that the IFC methodology was approved by the UNFCCC. Pallarès writes that communities and organisations told her that it was the claims of UN endorsement that sold the idea to Indigenous communities.

UNITAR is at training arm of the UN system. There are 33 associated training centres called CIFAL (Centro Internacional de Formación para Autoridades y Líderes in Spanish). UNITAR’s website includes a warning that states:

Scammers may misuse the names and logos of the United Nations, UNITAR, or the CIFAL Global Network to commit fraud. . . .

Please be informed that CIFAL Argentina has officially ceased operations as of 30 September 2023.

Pallarès contacted the UN organisations. She writes that they told her that “they did not know about, or support, the IFC methodology or the financial schemes in question”.

Yet the UN names and logos are still used on the IFC methodology.

Who is behind Bluegrace Energy Bolivia?

Julio Montenegro, the company CEO, is a US citizen.

Montenegro is also director of a company called Bluegrace Energy Ltd that was incorporated in the UK on 17 May 2021. In addition to its offices in London, the company claimed to have offices in seven other countries.

The company’s website has disappeared, but an archived copy states that,

Bluegrace Energy is one of the nine divisions of Bluegrace Holdings, a private equity firm and holdings company active in a very large assortment of business endeavors.

Bluegrace Holdings claims to be “one of the main technological development consultancies in the world”. It also claims to have a “multinational presence” and lists more than 30 cities — apparently suggesting that it has offices there.

The chairman of Bluegrace Holdings, Richard Granier, lives on the Costa del Sol, Spain where he enjoys scuba diving, playing golf, and driving sports cars.

According to its most recent accounts (up to 31 May 2023), Bluegrace Energy has £100 in assets. And according to its most recent accounts (up to 31 January 2024), a company called Bluegrace Holding Ltd, which is incorporated in the UK, has £100 in assets and in 2023, the average number of employees, including directors, was zero.

Hmmm. Back to Bluegrace Energy Bolivia.

Pallarès reports that in 2022, Bluegrace Energy Bolivia signed agreements with the following Indigenous organisations: Organización Indígena Chiquitana (OIC); Capitanía del Bajo Isoso (CBI); Confederación de Pueblos Indígenas de Bolivia (CIDOB); and Coordinadora de Pueblos Étnicos de Santa Cruz (CPESC).

The agreement with CPESC states that the communities must not disclose any economic, financial, or technical information. And they have to get permission from Bluegrace Energy Boliva even to discuss the deal.

Roberto Vides Almonacid, director of the NGO Foundation for the Conservation of the Chiquitano Forest in Bolivia, told Mongabay that he’d never heard of Bluegrace Energy Bolivia’s plans for the forests.

Do we know anything about the 3 billion Bolivian carbon credits?

Only what Letscoin tells us in its press release: “The carbon offsets produced by Bluegrace Energy Bolivia CDM are aligned with Chapter 6 of the Paris Agreement 2015 and are fully verified.”

Predictably enough, Letscoin doesn’t tell us which organisation verified the carbon credits.

Who on earth will buy these carbon credits?

Who knows? Letscoin’s press release tells us that,

Letscoin confirmed they have commitment under NCNDA from major airlines, oil and gas extraction operations, shipping, banking and other related companies actively participating in a voluntary and responsible carbon offset program. Globally, Letscoin (LTSC) has confirmed that over 300 major companies have enrolled.

Wait, NCNDA?

A non-circumvention non-disclosure agreement is a legal document drawn up between companies that wish to enter into a business deal. It protects the identity of the companies involved.

Ah, of course.

According to Letscoin, then, 300 companies have signed up, but neither Letscoin nor the companies can say who they actually are.

In its most recent press release, dated 15 January 2025, Thana Balan, the co-founder of Letscoin tells us “the business is comprised of users that require carbon offsets”.

No shit, Sherlock.

Has Letscoin named any of the companies that might be interested in buying these mysterious carbon credits?

Only Pantheon Resources PLC.

Who?

Just one example is Pantheon Resources PLC. Vice President of Operations & Engineering, Michael Duncan who shares a few words about his Pantheon's support of Letscoin.

Letscoin has posted two videos on Google Drive. One video is from June 2021 and consists of Michael Duncan describing operations at the Talitha A well in Alaska. He makes no mention of Letscoin.

The second video is filmed on a mobile phone. In it, Michael Duncan says the following:

Hello, this is Michael Duncan, CEO of Duncan Resources. We are pursuing a project for hundreds of millions of barrels of oil production. I’m excited about our relationship with Letscoin, the digital stable currency versus USDT and its ability to handle any future carbon credit offset programme requirements. I wish to express my gratitude to Dr. Thana the founder and trustee of Letscoin for giving us the opportunity to participate in this huge carbon credit preservation programme and offset mechanism. Thank you.

Note that Duncan says that he is CEO of Duncan Resources and does not mention Pantheon Resources. There appears to be little publicly available information about Duncan Resources.

That’s odd, isn’t it?

Yes. Letscoin says that 300 companies are interested in buying the non-existent carbon offsets. Yet the one company that Letscoin is prepared to mention as being interested, Duncan Resources, appears to be somewhat non-existent itself.

So who’s behind Letscoin?

On 26 November 2024, Letscoin held an event in Jakarta, marking the opening of Letscoin’s new office in Jakarta:

Those on the right are “a select group of prominent entrepreneurs in Indonesia”. All seven of them. On the left are Letscoin’s Hannes van Niekerk, chief commercial officer, and Jean Bilala, chief executive officer.

The company’s website doesn’t mention any of the people behind the organisation. However, the website tells us that Letscoin is listed on the P2B Exchange. And on its page about Letscoin, the P2B website lists the following people: Jean Bilala, CEO; Hannes van Niekerk, CCO; Dr. Thana Balan, International Investment Partner; Joel Anansambi, CIO; and Anselm Lopez, CISO.

Bizarrely, none of these people mention their involvement in Letscoin on their LinkedIn profiles.

OpenCorporates lists four companies with the name Letscoin in them:

Letscoin Limited, incorporated in Hong Kong on 3 May 2018;

Letscoin Organization LLC, incorporated in the tax haven of Delaware on 16 August 2018;

Letscoin Organization Inc, incorporated in Ohio on 24 October 2018; and

Letscoin mark is a combination of a room sign with a ($) sign in front and a (c) sign at the back…, incorporated in Ohio on 24 October 2018.

Can you handle one more story about Letscoin?

Having come this far, why not?

In May 2024, a company called Banyan Investment Banking and Hedge Fund announced the launch of Letscoin in Kenya. Various websites in Kenya reported that Letscoin has “secured financial backing from Germany’s Deutsche Bank”.

Needless to say, there is no confirmation of this financial backing from Deutsche Bank.

It turns out that Thana Balan, the co-founder of Letscoin, also works for Banyan Investment. The Kenya news website Tuko also mentions that the Banyan Group of companies’ chairman is Jean Bilala, the CEO of Letscoin.

Balan told Tuko that,

“We will introduce our AI technology to review the deposits of Kenya’s carbon credits. We believe that this will transform the economic opportunities for farmers and other stakeholders in the larger economy.”

Tuko reports that Quantum Metal Bullion Pty Ltd will “pilot the project to develop a carbon credit initiative program”.

As part of the deal, Banyan Investment announced a US$100 million funding agreement with Quantum Metal Bullion to support their African gold trading activities. And Banyan will serve as a custodian bank, holding 2.5 tonnes of gold on behalf of Quantum Metal Bullion, the beneficial owner.

A company called Banyan Investment Banking & Hedge Fund Statutory Trust was incorporated in Connecticut on 14 September 2022.1 But Banyan Investment’s internet presence appears to be limited to its Instagram account. The company’s website has disappeared. But if you’re really curious, here’s an archived copy.

Speaking at the launch of Letscoin in Kenya, Thana Balan said,

“Banyan Investment Bank is releasing what we call that currency. So Banyan Investment Bank is giving complimentary currency worth of $100 million to Quantum metal to handle the current situations of Quantum Metal members. The situation is not bad actually it is a misunderstanding of what the system error is happening. OK?”

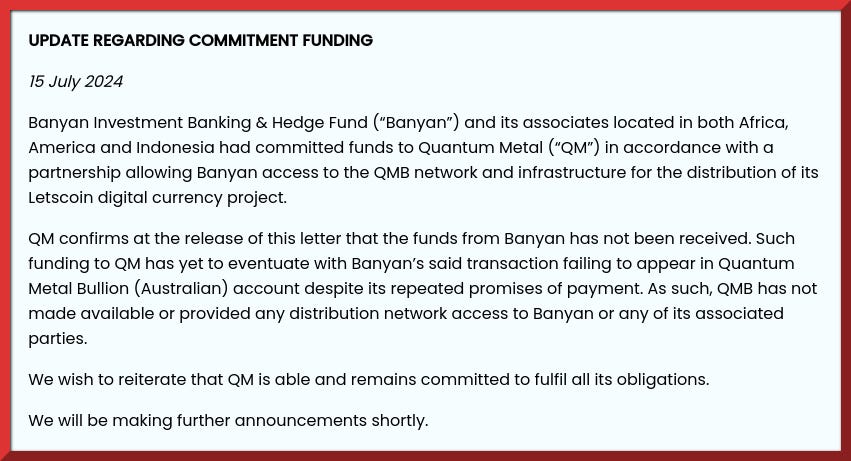

Balan’s promises of US$100 million worth of Letscoin came to nothing though. Quantum Metal Bullion is a subsidiary of Quantum Metal Exchange, and the latter’s website displays the following notice:

Here’s the launch, in Kenya:

From the left, that’s Lim Khong Soon (Quantum Metal), Thana Balan (Banyan Investment and Letscoin), Rubi William Moss (Rubi Foundation Africa), and Jean Bilala (Banyan Group and Letscoin).

You want me to ask about Rubi William Moss, don’t you?

Yes! She’s the President and founder of the Rubi Foundation Africa, which was incorporated in July 2014 in the tax haven of the Bahamas. Banyan Investment said it will commit US$1 billion to the Rubi Foundation Africa.

In June 2024, Kenyan media reported that Moss is accused of running up a debt of about US$11,500 at a hotel in Nairobi. She also faces another court case involving 5,000 bales of flour, worth about US$75,000, that she allegedly acquired without payment.

You couldn’t make this up. I can’t take much more, but I have to ask about Lim Khong Soon and Quantum Metal.

There are various Quantum Metal companies, including two incorporated in the UK in July 2021, and one called Quantum Metal Inc., which was incorporated in the tax haven of the Seychelles in July 2015.

Quantum Metal offers a gold investment platform. The company pays “consultants” a commission for recruiting new investors. There are several levels of consultants, with increasing commissions the higher the level. It looks a lot like a multi-level marketing scheme.

Lim Khong Soon’s own version of the Quantum Metal story is available here. And there are several lively discussions about Quantum Metal on Reddit. The words “Ponzi” and “scam” appear fairly often.

In January 2024, Bank Negara Malaysia, the country’s central bank, released a press release to clarify that, contrary to claims on social media, Quantum Metal’s products and business activities are not registered, approved, or licensed by the Bank.

In March 2024, the Securities Commission Malaysia issued a a cease and desist order to Lim Khong Soon because he was offering shares in Quantum Metal Exchange Inc. to the Malaysian public in contravention of Malaysian securities laws.

And in July 2024, Quantum Metal launched a “gold-backed blockchain token”.

Quantum Metal also runs something called the Quantum Metal Corporate University, which is “initiated and founded to achieve systematic human capital development”.

It’s address is Level 18, 40 Bank Street, London. That’s the same address as the two Quantum Metal UK companies. Here it is with Level 18 highlighted:

It’s an unusual address for a university, but there are several companies offering virtual offices at this address.

Quantum Metals has a video of the university — presumably to reassure potential students that it really does exist:

For just US$68 you can register for the (online) G.O.L.D. Education Programme.

I wouldn’t.

Me neither.

CORRECTION — 17 February 2025: This post previously stated that Banyan was incorporated in The Netherlands.

I think my favorite bit here is the Quantum Metal Corporate University video. Presumably it came from somebody giving a prompt to a video-creating AI along the lines of: "Create the most implausible possible 3-minute promotional movie for a nonexistent university containing no facts whatsoever." ... But the real question is, is anybody making money here, and if so how and off whom?

That is an incredibly detailed report! I had never heard of blue shame either. Above sentence: "I think I’ll save those rabbit holes for another day, if you don’t mind." I have holes like that all over my backyard, probably mole-holes, and I have the feeling that, down there in the dirt, they are all connected! And sure, all dirt contains a tiny percentage of gold.