Carbon credit conman Paul Seakens jailed for 13 years. Luke Ryan jailed for six years

A £36 million carbon credits investment scam

Paul Seakens and Luke Ryan have been jailed for their role in a £36 million carbon credits investment scam. Seakens and Ryan were directors of a company called Enviro Associates. REDD-Monitor first wrote about Enviro Associates in November 2012 after BBC Inside Out secretly filmed Ryan making misleading claims about how much money could be made from investing in carbon credits.

Seakens was convicted of three counts of money laundering and one count of fraudulent trading. He was sentenced to 13 years in jail, and disqualified as a director for 12 years. Ryan was convicted of one count of fraudulent trading. He was sentenced to six years in jail and disqualified as a director for eight years.

(Seakens had already been disqualified as a director for 13 years in July 2018, for “conduct while acting for Enviro Associates”. Ryan was banned as a director in July 2010 for his role in a company called Simply Trading Group.)

In November 2012, the BBC filmed Ryan saying that there was “serious money” to be made from investing in carbon credits. Ryan claimed that,

“In the next four to five years the market could go from anywhere from 100 to 500%.

“So you could be buying at £5.50 now, but in a year’s time it could be [worth] £10, £11, £12, £13.”

The BBC filmed Ryan explaining that the money from the sales of carbon credits “would be held in accounts protected by the FSA [Financial Services Authority which since April 2013 was superseded by the Financial Conduct Authority]”.

And on its website, Enviro Associates stated that,

Enviro Associates is a partner of Carbon Clearing.

It’s all encompassing systems [sic], powered and administered by Carbon Neutral Investments Limited, an FSA regulated firm, are at the forefront of the VCS VER Market.

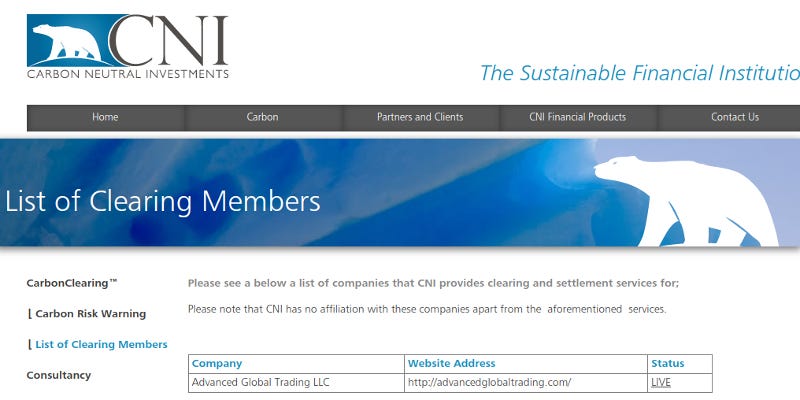

CNI’s clearning members

Paul Seakens was also a director of Carbon Neutral Investments. The company’s list of clearing members included many scam companies in addition to Enviro Associates that subsequently appeared on REDD-Monitor. Here are some of the scams:

Paul Seakens: “a man completely without credibility”

Carbon Neutral Investments bought the carbon credits very cheaply. The boiler rooms sold them at a mark-up of more than 1,000% in some cases. The victims’ money went to the bank accounts of three companies controlled by Seakens: CNI, Tocan, and Opus. These companies took a commission then paid the money back to the boiler rooms.

Back in 2012, REDD-Monitor asked Seakens about the “clearing and settlement services” that CNI provided:

REDD-Monitor: I understand that CNI provides clearing and settlement services for companies selling over the counter carbon credits. Please explain what these services involve and why such a service is necessary.

Paul Seakens: The services involve CNI in providing settlement and custody services for firms engaged in buying and selling on the spot carbon market. This involves us in acting as a settlement agent for members of our clearing systems by settling the cash element of the transactions and holding the credits in nominee for both parties. Why is any service necessary? There was a demand for the service and we had the capability to fulfil the demand.

In a press release about Seakens’ and Ryan’s sentences, the Crown Prosecution Service states that:

CPS specialist fraud prosecutors said this clearing mechanism was simply a money laundering device. The clearing companies were created, in part, in order to give these VER transactions an air of legitimacy so that customers would think that their payments were being made to a safe Financial Conduct Authority regulated third party and in part because the VER brokers would not have been able to operate without such a mechanism.

In other words, in his response to REDD-Monitor, Seakens was doing what he did best: lying. Daily Echo Journalist Tom Orde reports the judge, Sally Cahill QC, as saying to Seakens,

“In my judgement now, you are a man completely without credibility. Not a single word that comes from you can be trusted.

“Whilst your victims had little exposure to you, and clearly trusted what they were told by the brokers, in the cold light of the evidence, in this case, your dishonesty was laid bare and what you failed to appreciate is that for anyone hearing your repeated lies, half-truths, distortions of the truth and your complete contempt for the truth, and as the jury in this case did, there was only one possible conclusion and that is that you were right at the centre of this fraud, one of the masterminds behind it, and one of the recipients of benefits from it.”

An obvious question for the Financial Conduct Authority about all this is why was Carbon Neutral Investments ever included on the Financial Services Registry? And why was Opus Capital Limited (as Carbon Neutral Investments was renamed in April 2013) still registered with the FCA until March 2017? Especially considering the fact that the Financial Conduct Authority had put out a warning about Carbon Neutral Investments four years earlier.

Thorn Medical

In October 2014, a healthcare company called Thorn Medical hired Opus Capital as “Corporate Advisor”. When REDD-Monitor wrote about Thorn Medical in March 2016, Opus Capital was still listed on Thorn Medical’s website as Corporate Advisor.

Shortly after REDD-Monitor’s post, Opus Capital was replaced on Thorn Medical’s website by Ernst & Young Global Limited.

Thorn Medical was supposed to list on the London Stock Exchange in 2016. That did not happen.

Then the company was bought out by Teknisity Inc. Teknisity was supposed to list on the New York Stock Exchange in 2017. That didn’t happen either.

Thorn Medical was dissolved in May 2020.

Meanwhile another company linked to Thorn Medical called Radley Ventures Nominees started selling shares in Med Cell Plc, a UK registered company linked to a stem cell research company run by a Scientologist in the Bahamas.

GXG Markets Exchange

One of the services that Opus Capital offered was to help companies list on GXG Markets Exchange. The Danish financial regulator, Finanstilsynet, closed down GXG Markets in August 2015 following a series of investigations by Richard Smith posted on Naked Capitalism. Writing in FT Alphaville, Paul Murphy described GXG as,

welcoming all passing carbon fraudsters, rare earth mystics and boiler room operators to use its cheap and largely rule-free platform.

A few, legitimate companies also listed, attracted by the low cost and rapid admission service. But GXG was first and foremost a gift for scamsters.

Incidentally, Smith’s posts on Naked Capitalism about Carbon Neutral Investments are a great read and well worth revisiting:

London Capital & Finance

Seakens was involved in a company called Prime Resort Development, that as Jim Armitage reports in the Evening Standard received £70 million from the collapsed mini-bond investment firm London Capital & Finance.

On 31 October 2018, London Capital & Finance agreed a loan to Prime Resort Development. Seakens signed the documents registered with Companies House for another loan received by Prime Resort Development:

Armitage reports that Seakens was Prime Resort Development’s book-keeper. Another key player at Prime Resort Development was Terrence Mitchell. In December 2018, Mitchell was sentenced to two years in jail for his role in a company called Anglo Wealth Limited.

London Capital & Finance collapsed in 2019, after raising £236 million from retail investors.

Comments following the original post on REDD-Monitor.org are archived here: https://archive.ph/VxGsG#selection-731.4-731.14